Petrobras Revenue Hits Record as It Resists Cheap Fuel Calls

This article from Bloomberg may be of interest to subscribers. Here is a section:

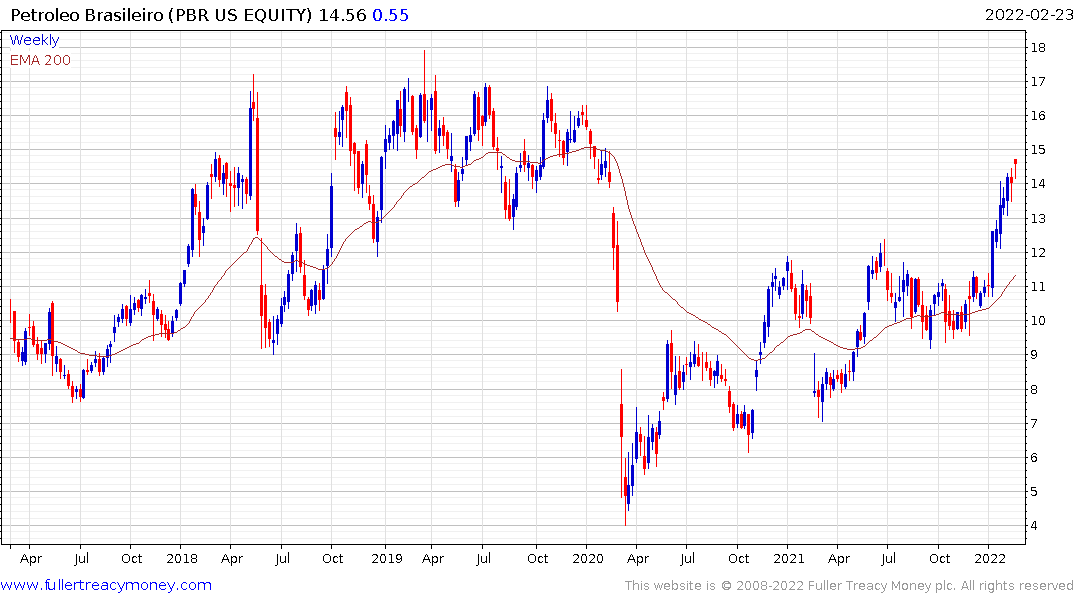

Political pressure for Petrobras to make fuel cheaper for Brazilians is mounting ahead of presidential elections in October, but the giant oil producer has instead focused on taking advantage of the windfall from crude’s rally to shore up its finances and reward investors.

Once the world’s most indebted oil producer, Petrobras last year managed to reduce its debt below $60 billion ahead of schedule, thanks also to the sale of refineries.

Meanwhile on the campaign trail, former president Luiz Inacio Lula da Silva is leading the polls and calling for fuel price relief and more investments in refining. This has put Bolsonaro on the defensive, though a recent rally in the local currency has helped mitigate the impact of higher international oil prices.

Under Lula’s Workers’ Party, Petrobras lost an estimated $40 billion during the 2012-2014 oil price boom because of policies to make gasoline and diesel cheaper. Since the party lost power in 2016, two pro-business administrations have transformed Petrobras into a leaner, more profitable outfit.

Cordial relations with much of the rest of the world favour Brazilian exports of raw commodities. That’s particularly true of its oil and iron-ore exports as geopolitical tensions with Russia are amplified.

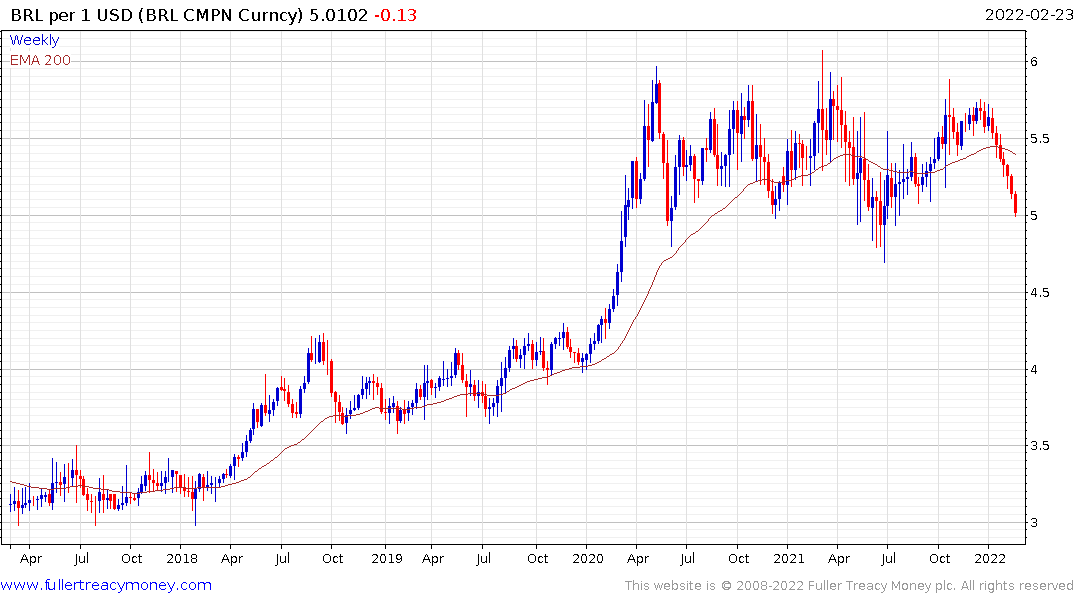

The Real eased back today from the region of the upper side of its base formation against the US Dollar.

The iBovespa Index eased back but in a less dynamic manner than global markets today. Having broken the seven-month downtrend, there is clear scope for the Index to post a higher reaction low.

Petrobras is currently pausing in the region of the pre-pandemic breakout level. Recovery potential can be given the benefit of the doubt provided it holds the $12 area.

Vale also eased back today as well but a sustained move below $16 would be required to question the consistency of the recovery.

Vale also eased back today as well but a sustained move below $16 would be required to question the consistency of the recovery.