Perseus Maintains 2H Gold Production Forecast

This note from Bloomberg may be of interest. Here is a section:

Perseus reaffirmed its gold production forecast for the second half-year.

SECOND HALF FORECAST

Still sees gold production 230,000 to 260,000 oz

Still sees all-in sustaining costs/oz $1,000 to $1,200YEAR FORECAST|

Still sees gold production 498,370 to 528,370 oz

Still sees all-in sustaining costs/oz $1,000 to $1,100THIRD QUARTER RESULTS

Gold production 130,275 oz, -0.5% q/q

All-in sustaining costs/oz $971, -1.2% q/q

Gold sales volume 135,111 oz, -33% q/q

COMMENTARY AND CONTEXT

Perseus’s strong operating performance is forecast to continue in the June quarter with both gold production and cost guidance for 1H and FY expected to be achieved strong quarterly cashflows further strengthened Perseus’s financial position with available cash and bullion of $471 million, zero debt, net cash and bullion balance increased by $66 million at quarter end

Development activities continued at Meyas Sand Gold Project with confirmatory and sterilisation drilling, Front-End Engineering and Design and site preparation, ahead of a possible FID during 2H 2023

Organic growth activities including Mineral Resource drill outs and feasibility studies for MSGP and Yaouré’s CMA Underground Project progressed on schedule; Results due in Sept. qtr

The team at Perseus are betting Sudan’s welcome for foreign investment will persist despite the threat of internal conflict. That was driven by the desire to acquire a promising asset at a discounted price. It’s a challenge every miner faces. New supplies of key resources are most often now found in politically unstable parts of the world.

How miners look at governance is not the same as how investors look at it. A miner wants to know their claim will be respected and they hope royalty rates are set in stone once agreed. That prioritises a version of minority shareholder rights and downplays other considerations like a free press or independent judiciary. The uncomfortable reality is autocratic regimes tend to be stable and often enjoy the income from mining operations directly. That can lend more security than a democratic government which changes priorities at every election.

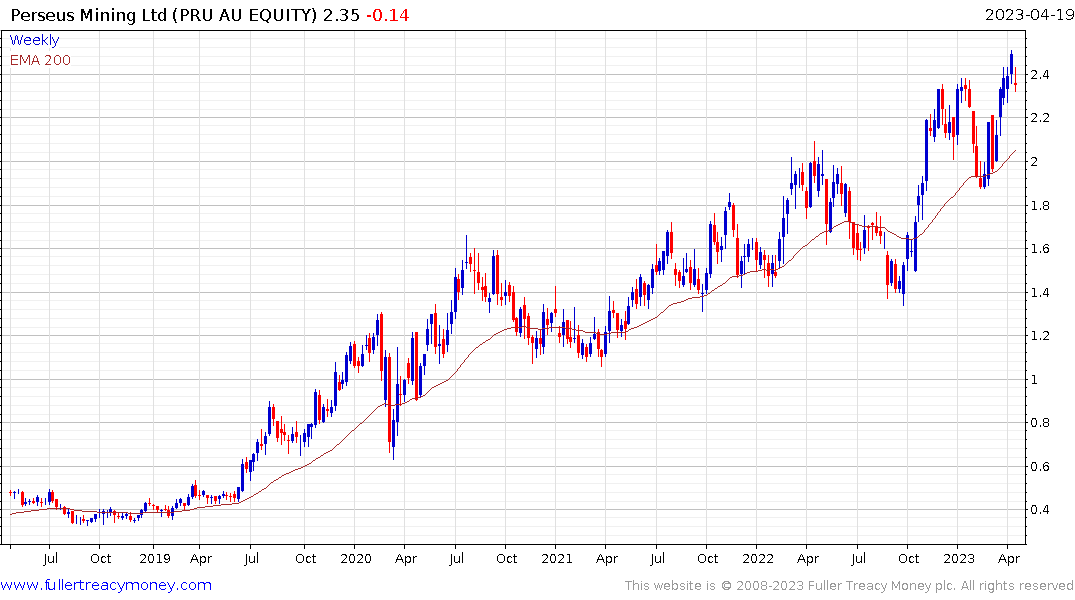

Perseus is building a mine in Sudan but production takes place in Ghana and Cote d’Ivoire. The share is currently unwinding a short-term overbought condition but remains in a consistent medium-term uptrend.

Perseus is building a mine in Sudan but production takes place in Ghana and Cote d’Ivoire. The share is currently unwinding a short-term overbought condition but remains in a consistent medium-term uptrend.

Gold in Australian Dollars continues to hold the breakout from a 3-year range as it consolidates in, what is so far, an orderly manner.

Gold in Australian Dollars continues to hold the breakout from a 3-year range as it consolidates in, what is so far, an orderly manner.