Pepsi Says It's Facing the Same Trends That Are Battering Retail

This article by Janet Freund for Bloomberg may be of interest to subscribers. Here is a section:

Retail’s “shifting sands and macro headwinds will make near-term earnings beats challenging” for PepsiCo, Wells Fargo analyst Bonnie Herzog said in a note to clients. Still, PepsiCo gets a large proportion of revenue from snacks, which are easier to sell online than beverages, she said. That means the company is better positioned to adapt than some of its peers.

PepsiCo’s comments were similar to those made by Coca-Cola CEO James Quincey, who told Bloomberg in May that when shoppers skip trips to the local mall and shop online, they also forgo buying Coke at a vending machine or food court. Coca-Cola investors will be watching to see how that may hurt second-quarter results on July 26.

Nooyi’s remarks were “an acknowledgement to the intensifying competitive environment that will likely get more so with Amazon involved,” Bloomberg Intelligence analyst Ken Shea wrote in an email. Still, some consumer products companies will be more vulnerable than others to change, and PepsiCo’s “huge distribution reach and agility arguably make it less vulnerable” to changing shopper behavior than its peers, he said.

Amazon Prime Day was the firm’s highest grossing ever, with its discounted Echo speaker being the top seller yesterday. The company sells just about everything and is now offering try-before-you-buy on fashion, same day delivery and investigating how to sell pharmaceuticals and auto parts. It is logical that even companies which reside squarely in the consumer staples sector but also get part of their income from discretionary products would be affected by the demise of the shopping mall.

Amazon popped back above $1000 today and a downward dynamic, like those posted in June, will be required to check the advance on this occasion.

Pepsi makes more than 66% its net revenue from foods as opposed to beverages. The share bounced back impressively following its cautionary earnings announcement yesterday and a sustained move below the trend mean would be required to question medium-term scope for additional upside.

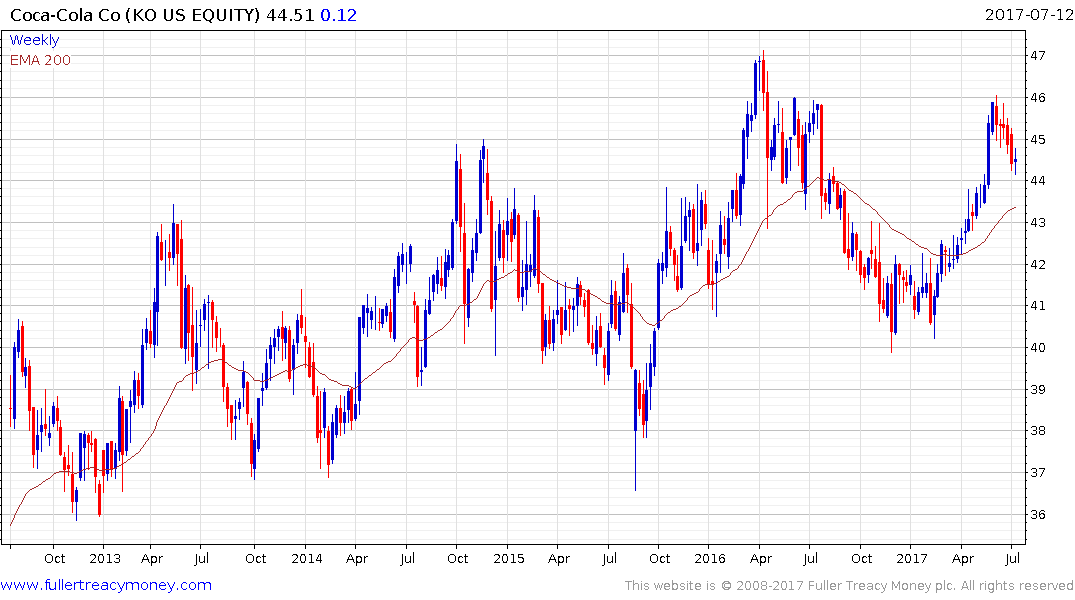

Coca Cola which is almost totally dependent on drinks for revenue has been largely rangebound since 2013; albeit with a mild upward bias.

I have noticed that shares like PepsiCo, Coca Cola Procter & Gamble, Johnson & Johnson, Nestle or maybe even Dividend Aristocrats generally, tend to bounce when the dividend yields tests 3.5%. That appears to be a level where yield oriented investors are willing to support companies with long histories of dividend increases.