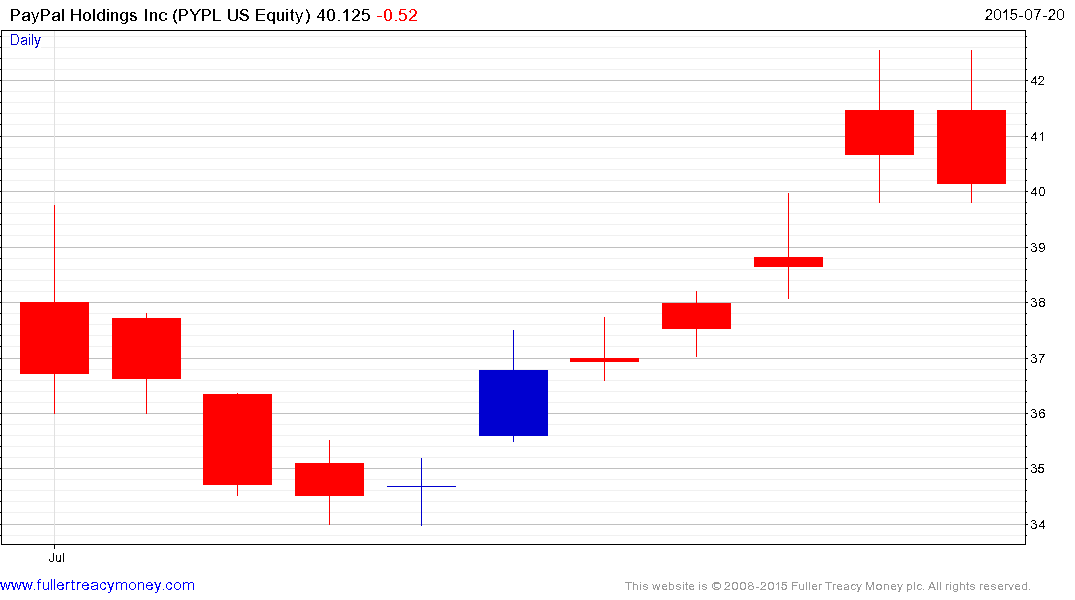

PayPal Shares Climb in Market Debut After Spinoff From EBay

This article by Spencer Soper for Bloomberg may be of interest to subscribers. Here is a section:

PayPal started trading Monday with a market capitalization of about $46.6 billion, data compiled by Bloomberg show. After the spinoff, EBay’s shrinks to roughly $34 billion. Investors are viewing PayPal as a new growth option, while EBay’s expansion decelerates amid increasing competition in e-commerce.

“Investors have been waiting to invest in PayPal for a long time, even before the split was announced,” said Gil Luria, analyst at Wedbush Securities in Los Angeles. “We’re finally at a point where you can only own PayPal with its market-leading position and growth rate.”

PayPal had 169 million users and processed 1.1 billion transactions in the second quarter, with transaction volume up 27 percent from a year earlier, the company said last week. The company’s value is in its growth rate as online shopping booms and people’s spending habits change.

EBay’s marketplace becomes a value investment, with 157 million buyers who spent $20.1 billion in the second quarter, down 2 percent from a year earlier due largely to currency exchange rates. Even with its slowdown tied to a data breach and changes to Google Inc.’s search engine last year, EBay is more profitable than PayPal.

PayPal’s IPO has been eagerly awaited since it represents Ebay’s primary growth trajectory. The types of services it offers such as moving money both domestically and internationally, paying people for services or for goods, and most important of all, its secure payment portal which means you do not have to input your credit card details into a host of sites are all attractive business lines .

Ebay continues to extend its breakout from the more than two-year trading range and a sustained move below $25 would be required to question medium-term scope for additional upside.

Rather than being compared to its parent PayPal has more in common with credit card companies like Visa and MasterCard. Visa found support three weeks ago in the region of the 200-day MA and a sustained move below $65.50 would be required to question the consistency of the medium-term uptrend.

MasterCard also remains in a reasonably consistent uptrend.

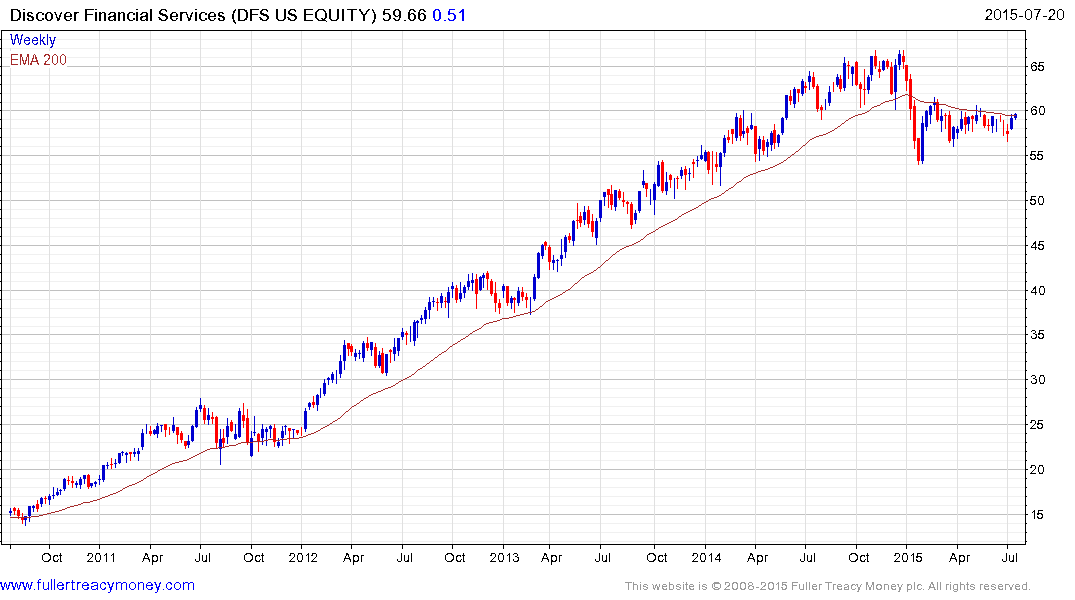

Discover Financial Services pulled back to break its medium-term progression of higher lows in January and has been ranging below the 200-day MA since. It is now retesting the $60 area and a clear downward dynamic would be required to signal supply dominance in this area.

.png)

American Express has also been trading below its 200-day MA since January and will need to sustain a move above it to signal a return to demand dominance beyond the short term.