Paul Tudor Jones on Jerome Powell

Thanks to a subscriber for this note which may be of interest.

The market has long relied on the assumption that in a crisis the Federal Reserve will wade in to the rescue by boosting money supply and helping to reflate asset prices. However, it is not until a crisis occurs that investors truly knew whether Greenspan, Bernanke or Yellen had their backs. Jerome Powell is a lawyer, rather than an economist by training, and has yet to be tested. Therefore, investors do not know how he will react in a time of market stress. That remains an uncertainty that is being priced into this market.

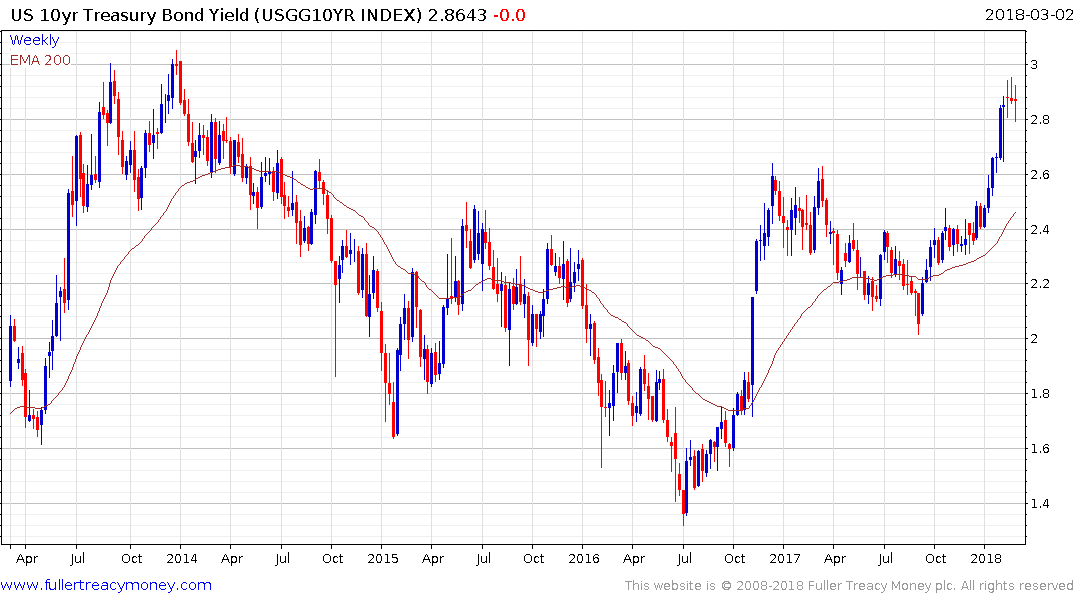

The markets most at risk are the Treasury and mortgage bond sectors since the Fed has been such a prolific buyer since 2009. The Fed’s policy of quantitative tightening against a background where supply is increasing is the primary factor behind the rise in bonds yields.