Panama Canal to further reduce daily transits if drought continues

This article from Reuters may be of interest. Here is a section:

The head of the Panama Canal Authority, Ricaurte Vasquez, said the waterway would opt for reducing daily transits if needed, before planning any further cut to authorized vessel draft, which affects shippers the most.

Passage restrictions are not planned for this month. But in its budget for the fiscal year beginning October, the canal foresees a possible cut to 30-31 daily transits, he added.

The El Niño weather phenomenon "has been very severe this year. We have hot temperatures in the Pacific and the Atlantic simultaneously," Vasquez told journalists in a briefing. "We anticipate that in the upcoming months, in the absence of significant rain, we'll have to be prepared."

Many North American retirees decamp to central America for the winter because the period between January and May is the region’s dry season. That suggests if rains don’t arrive soon, we can anticipate a prolonged period of below normal traffic through the Panama Canal. The nascent El Nino is exacerbating the current drought conditions.

I don’t ever remember issues with water in the canal before the expansion was completed in 2007. That increased the size of the ships that can transit the canal, and increased overall traffic. The downside is more water is required and little thought appears to have been given to the additional stresses that would put on the available resources. There is a temptation to blame everything on climate change. Sometimes all it does is highlight poor planning. Addressing this issue will cost at least another $2 billion.

The Baltic Panamax Index (largest ships that can transit the canal) has bounced from the region of the 2023 lows. It is now testing the sequence of lower rally highs.

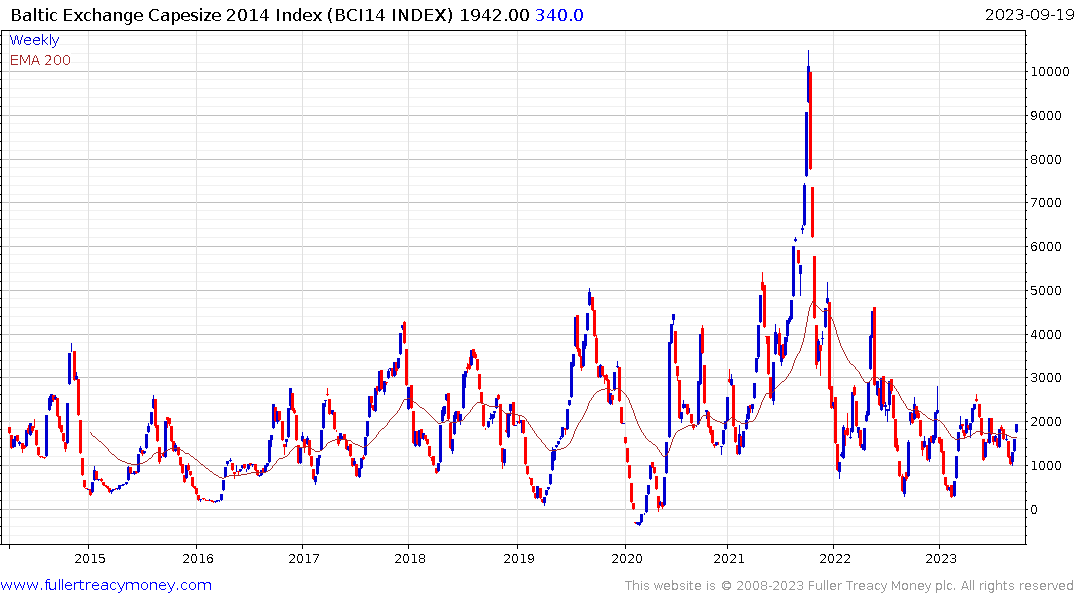

The Baltic Capesize Index is also firming. Those are the ships too large to transit the canal.

The Baltic Capesize Index is also firming. Those are the ships too large to transit the canal.

The reason I think this renewed strength in shipping indices is focused on more congestion is because the price of 40ft containers remains under pressure.

The reason I think this renewed strength in shipping indices is focused on more congestion is because the price of 40ft containers remains under pressure.

The reorientation of global trade flows is likely to increase demand for ships since distances travelled are likely to increase. The continued evolution of the global LNG market is also likely to increase demand for shipping. Together that should support the shipping sector in aggregate but perhaps not as much for the container sector.

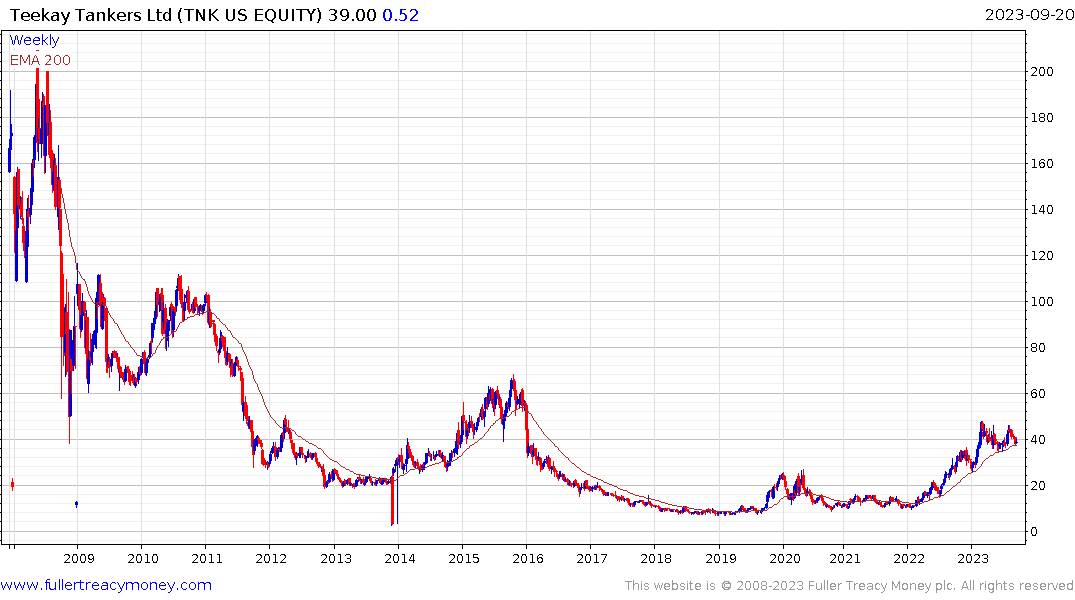

Teekay Tankers is currently steadying in the region of the trend mean.

Frontline is also firming as it consolidates in the region of the highs for the year. This range has first step above the base characteristics.