PacWest Reports Decline in Deposits, Western Alliance's Grow

This article from Bloomberg may be of interest to subscribers. Here is a section:

PacWest Bancorp reported a drop in deposits and Western Alliance Bancorp said its deposits grew, with investors continuing to scrutinize the levels amid tumult in the regional-banking industry.

Beverly Hills-based PacWest said in a regulatory filing Thursday that deposits fell 9.5% last week after Bloomberg News reported that the lender was in talks with potential investors. The bank didn’t specify its total deposit levels after the decline, but said it had total deposits of $28.2 billion as of March 31, and that it had immediately available liquidity of $15 billion as of May 10, exceeding uninsured deposits of $5.2 billion. Hours after the Bloomberg report last week, PacWest confirmed it was in talks with several potential investors.

An inverted yield forces banks to offer higher deposit rates because of competition from money markets funds. The current situation is somewhat different because many banks are sitting on big losses on their bond portfolios and are technically insolvent. Hoarding deposits is the only way they can ensure they keep their leverage ratios in check. That’s an expensive source of funding for banks when long-term rates are so low.

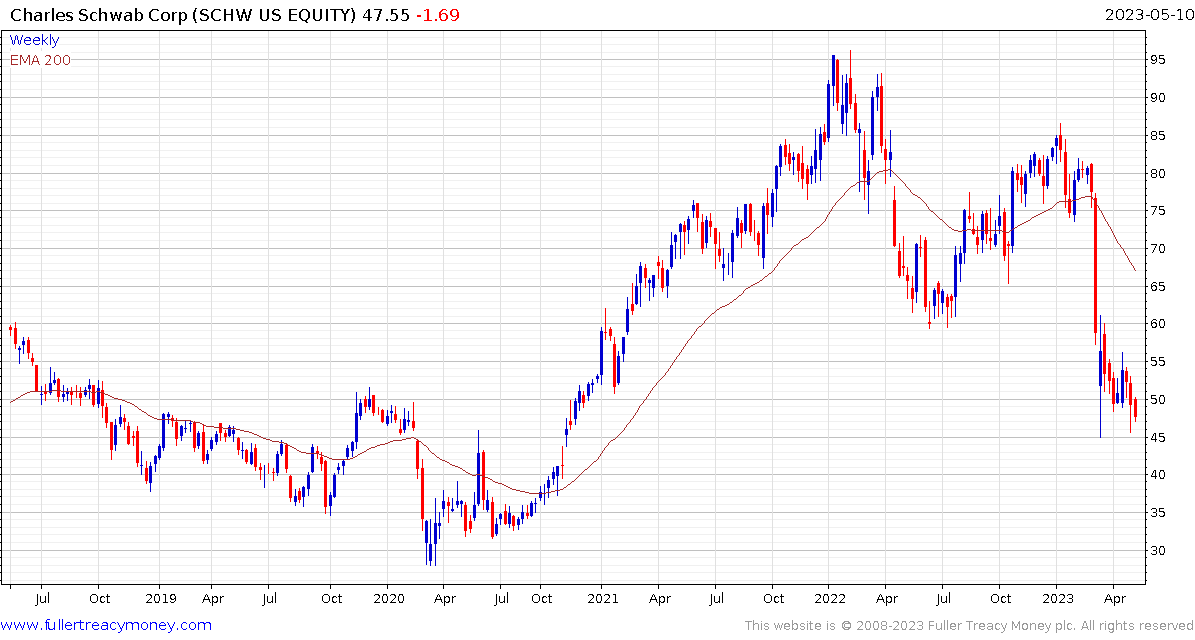

The fact Apple is now offering deposit rates on its Apple card of 4.15% means there are new powerful sources of competition for deposits. Interactive Brokers announced a rate of 4.58% yesterday on uninvested cash in client accounts. That’s attractive and is clearly aimed at forestalling the kind of risk of capital flight Charles Schwab is dealing with.

For consumers the choice is clear. Apple has more cash on its balance sheet than most governments, has no exposure to the commercial property sector and is reasonably unleveraged. What is less understood is the account is in fact held at Goldman Sachs, which is highly leveraged and holds massive exposure to commercial property via its asset management business.

For consumers the choice is clear. Apple has more cash on its balance sheet than most governments, has no exposure to the commercial property sector and is reasonably unleveraged. What is less understood is the account is in fact held at Goldman Sachs, which is highly leveraged and holds massive exposure to commercial property via its asset management business.

The underperformance of the US banking sector is a clear sign of tightening credit conditions in the wider economy. The sheer volume of cash in the system has sustained the inflated price of assets but the longer rates stay high for, the more likely it is that credit conditions will tighten to the point of failure in a systemic part of the market.

Back to top