Oversold commodities

Commodities are about as unloved a sector as one could possibly imagine but there are at least some short-term indications that recent selling is giving way to bargain hunting.

The Continuous Commodity Index hit a medium-term peak near 700 in 2011 and dropped to test the 500 level within a year. It ranged above that level until late 2014 before breaking downwards. The Index found near-term support near 400 in March and bounced from that level again today. Potential for a reversionary rally back up towards the 200-day MA has improved but a sustained move above the trend mean will be required to signal more than a short-term return to demand dominance.

The Index’s 17 constituents are equally weighted but represent unequal weightings in the main commodity sectors. These are Energy (17.65%), Metals (23.53%), Softs (29.41%), Agriculture (29.41%). Softs and agriculture occupy almost 60% of the Index so while energy and metal prices are bouncing from oversold conditions the outlook for larger weighting are more important.

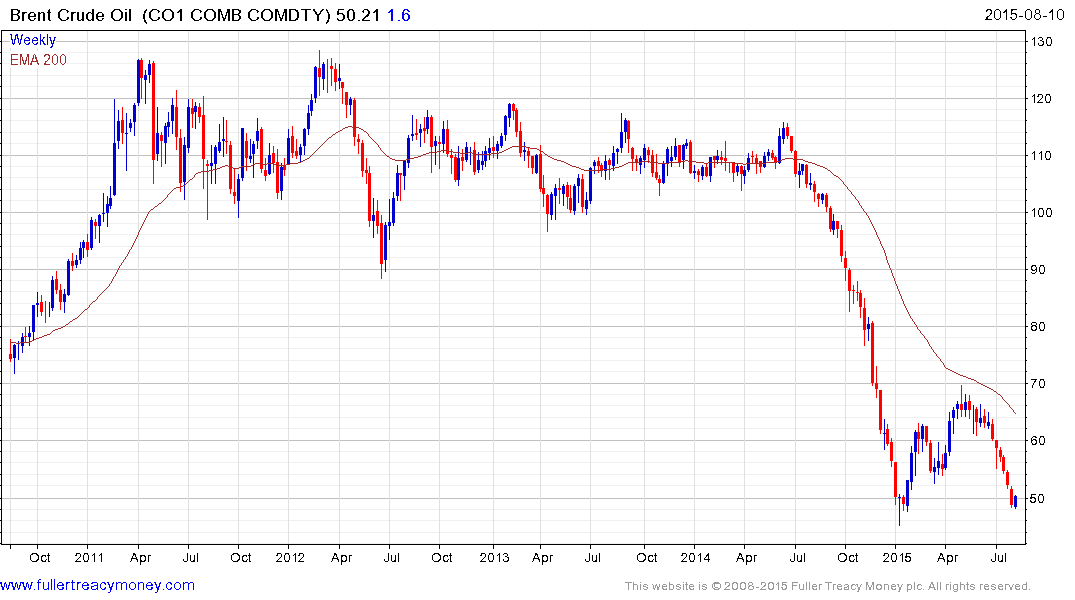

Oil prices are deeply oversold and found at least a temporary low today.

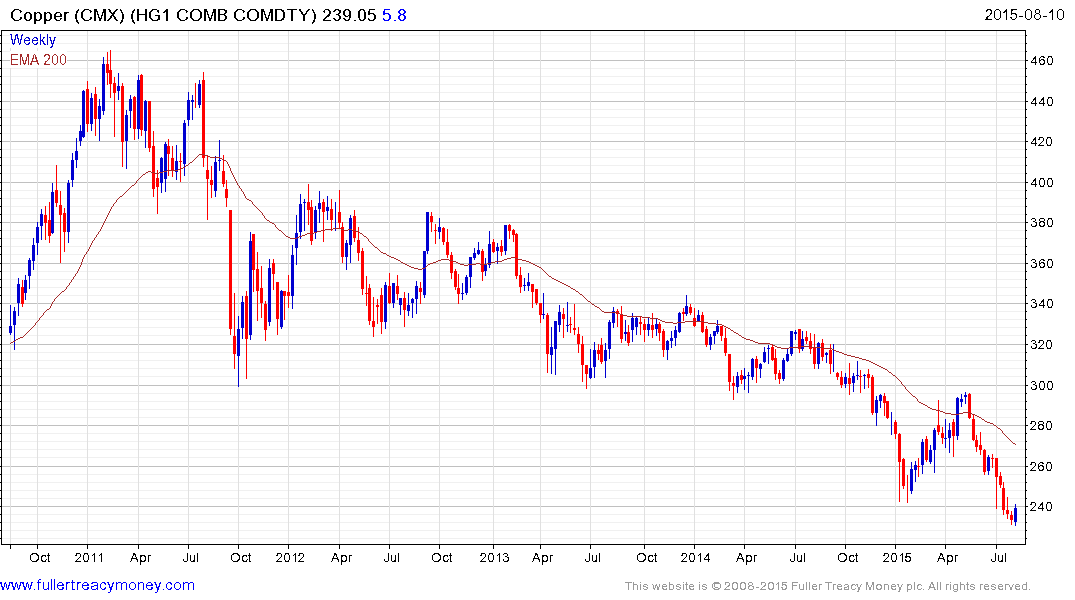

Copper prices deteriorated steadily from May, hit a new low on Friday and rallied today to signal a trough of at least near-term significance within what remains an orderly medium-term downtrend.

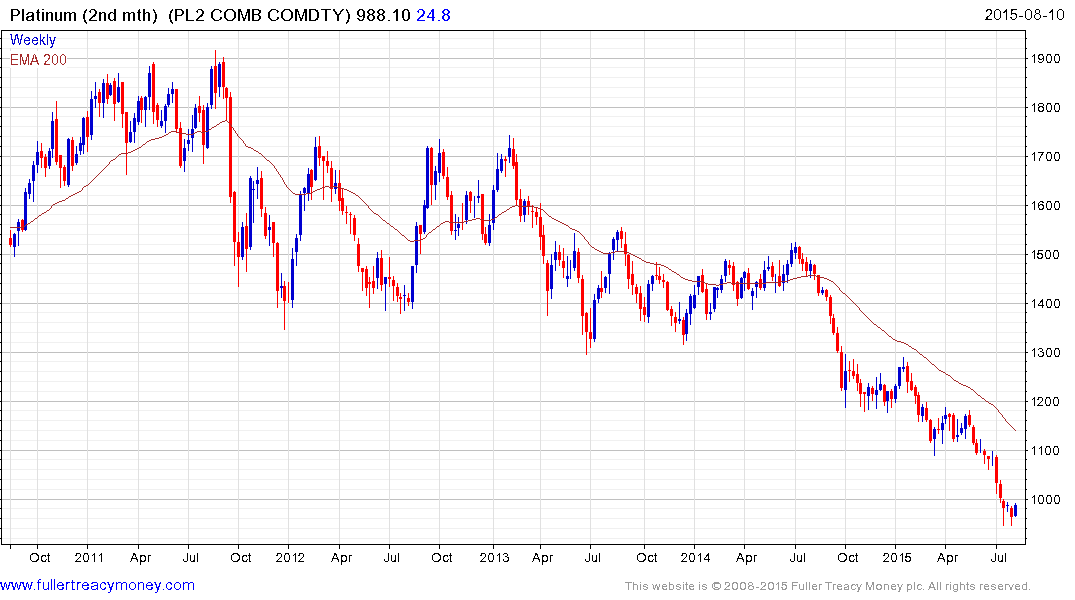

Platinum is deeply oversold following a steep yearlong deterioration. It found at least near-term support today to push back up to challenge the $1000 level. A clear downward dynamic would be required to question current scope for a reversionary rally.

Corn rallied to break the medium-term progression of lower rally highs in June and subsequently pulled back sharply to give up most of the advance. It found at least short-term support last week in the region of 375¢ and bounced today.

Soybeans are also bouncing having found at least near-term support.

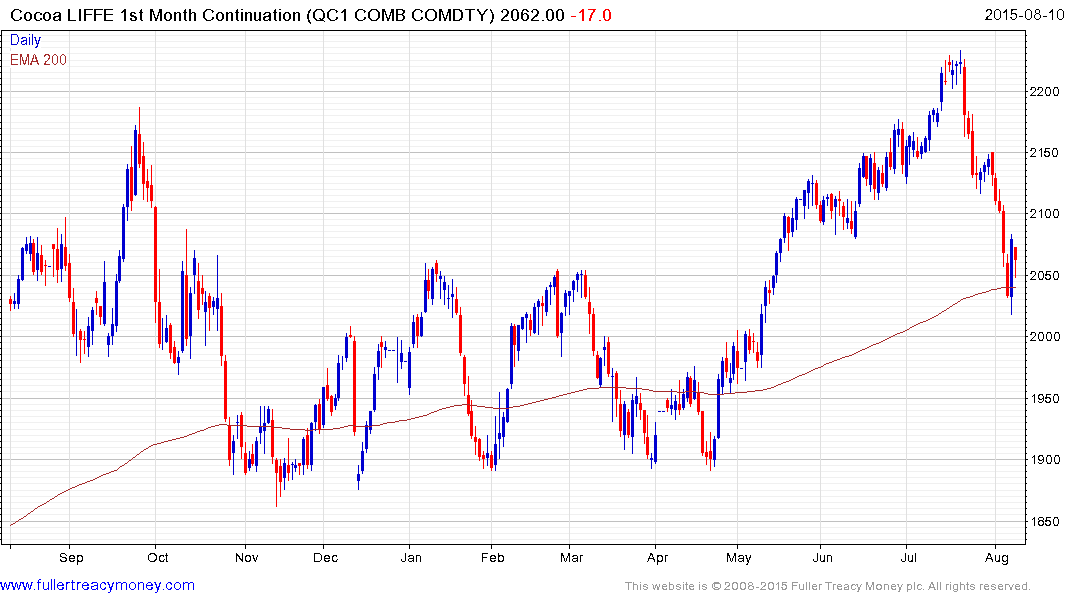

London listed Cocoa posted a large upside key day reversal on Friday following what has been a steep decline.

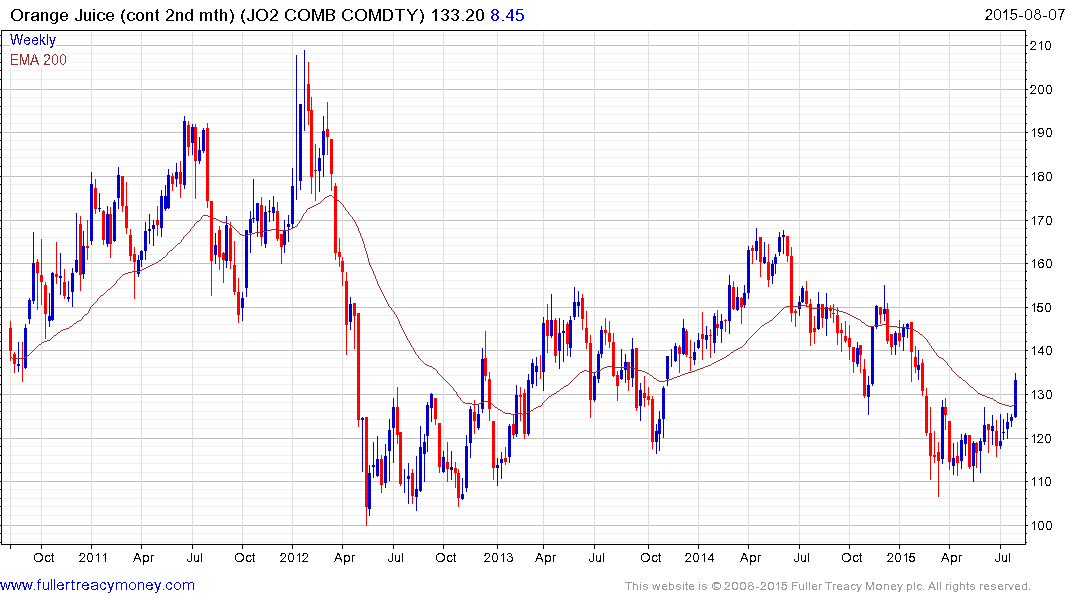

Orange Juice found support in the region of the 2012 low from March and rallied last week to push back above the 200-day MA for the first time in more than a year.

Arabica Coffee has lost momentum following a steep decline and has possible Type-2 bottoming characteristics.