O'Reilly Automotive plunges after sales miss and warning of 'weak consumer demand'

This article from Business Insider may be of interest to subscribers. Here it is in full:

O'Reilly Automotive plunged by as much as 16% in early trading on Wednesday after the company announced second-quarter sales results that were weaker than it had expected.

Sales at its auto-parts stores open for at least one year rose 1.7% in the second quarter, O'Reilly said in a release on Wednesday. That was improved from Q1 but weaker than its guidance of 3%-5% growth.

"We faced a more challenging sales environment than we expected for the remainder of the quarter," after April, O'Reilly CEO Greg Henslee said, "due to what we believe were continued headwinds from a second consecutive mild winter and overall weak consumer demand."

"The comparable store sales shortfall will also have a consequent impact on our operating profitability," Henslee added.

Car sales in the US slowed in the first half of this year following seven straight years of record-setting volumes. Although sales have softened, continued employment growth suggests that consumer purchases of the big-ticket items may remain healthy.

Auto sales in June rose at a seasonally adjusted annual rate of 16.51 million, Autodata said on Monday, down 13.2% year-on-year.

Automotive parts retailers are being squeezed both by declining auto sales and the rise of electric vehicles which do not need nearly as many parts to be replaced. That represents a secular headwind until they retool to offer the kinds of products drivers of cars less likely to breakdown require, like new batteries.

From the perspective of The Chart Seminar O’Reilly Automotive represents a wonderful teaching example. It posted one of the most impressively consistent uptrends from its 2008 lows but the large reaction at the end of 2015 represented a loss of consistency. It subsequently was able to regroup and move to a new high, but that move was not sustained and the decline that followed contributed to the rolling over characteristic.

We often see previously consistent trends lose that consistency at the penultimate high. The initial sharp drawdown cautions buyers that the imbalance between supply and demand that drove the advance could be changing. Meanwhile there are still enough new buyers coming into the market to drive the price a little higher but not enough to sustain the advance any longer. The massive reaction against the prevailing trend often gives way to a volatile ranging phase as some people argue nothing has changed and buy while others argue that the share has gone up a lot already and has stopped doing so and sell.

The longer the range continues the greater the possibility it will constitute a top. In this case the Typ-3 top (ranging, time and size) was completed with the move below $250 in May (Also see Comment of the Day on April 4th 2017) It is now accelerating lower.

AutoZone has been leading on the downside and extended its decline today.

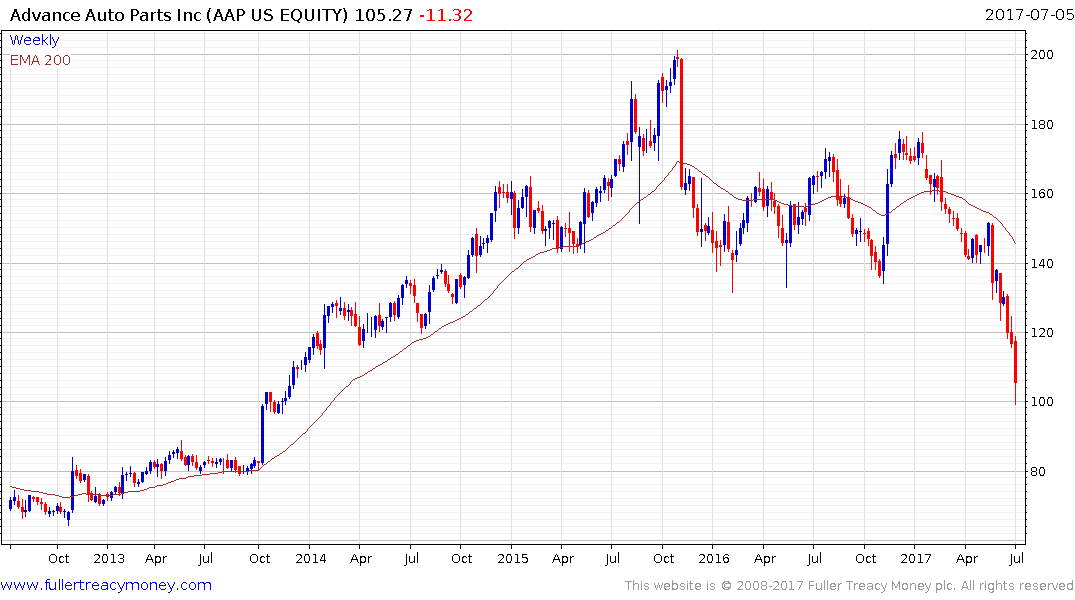

Advance Autoparts is going down even faster.

All three of these shares are exhibiting short-term oversold conditions so there is scope for some steadying but clear upward dynamics will be required to check momentum beyond a pause.

Genuine Parts is more diversified with about 50% of revenue from the automotive sector. However the share has similar Type-3 top formation development characteristics as these shares did a couple of months ago.