Noble's Marathon Revamp Nears Finish After Goldilocks Deal

This article by Krystal Chia and David Yong for Bloomberg may be of interest to subscribers. Here is a section:

The remaining equity in the new company is being split between senior creditors and management. Under the latest deal, senior creditors stand to receive 70 percent of the trader, while management’s share will be 10 percent.

In a separate statement, Noble Group said Pinpoint Asset Management Ltd. and Value Partners Ltd., holders of its perpetual securities, withdrew a lawsuit filed against the company on June 13. Perpetuals have been offered $25 million of new bonds in exchange for securities with a face value of $400 million. On Wednesday, the perpetuals rose 0.6 cent, the most in a week, to 7.8 cents.

“Obstacles to the completion of the restructuring are probably getting removed,” said Neel Gopalakrishnan, senior credit strategist at DBS Group Holdings Ltd. “But the key question is still whether, post restructuring, the company will be able to turn around operations for creditors to recover value.”

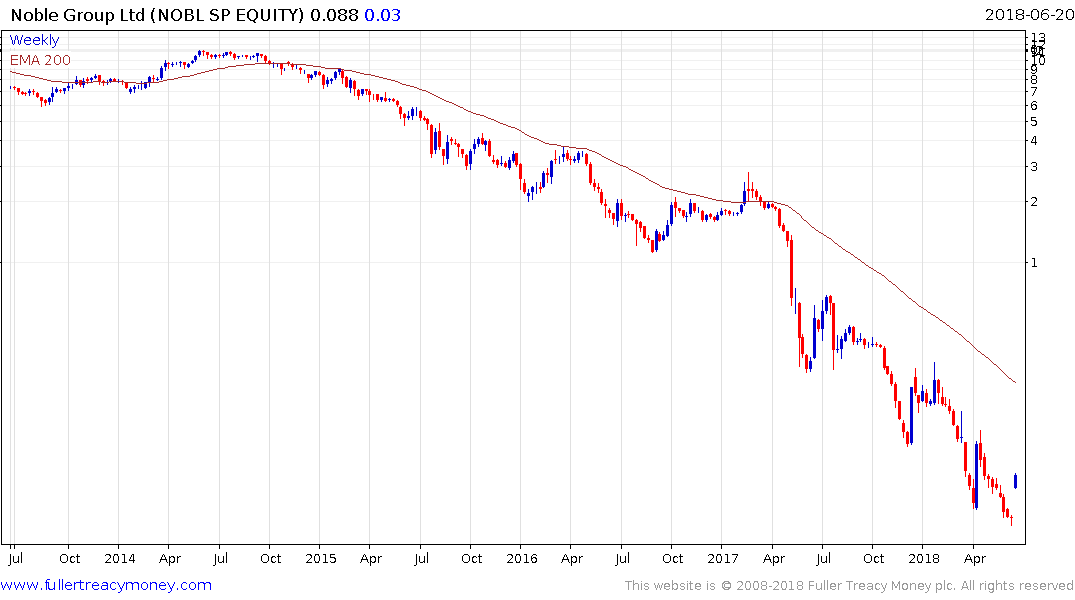

Noble Group suffered from bad commodity bets in the agriculture sector but also from the demise of coal which took a lot of people in the commodity business by surprise in terms of its ferocity. The share trended lower along with commodity prices from the 2011 peak but failed to sustain the rally that began in 2016 and it collapsed in 2017.

The biggest challenge for any trader is to avoid catastrophic failure when dealing on a leveraged basis. That is a lesson for all us.