Nickel Rallies Most in Five Years on Promise of Electric Cars

This article by Yuliya Fedorinova and Martin Ritchie for Bloomberg may be of interest to subscribers. Here it is in full:

The nickel market has caught fire, with prices posting the biggest two-day advance in five years.

Nickel rose as much as 6 percent to $13,030 a metric ton on the London Metal Exchange, the highest since June 2015. That added to Tuesday’s 5.3 percent gain after Trafigura Group Pte joined Glencore Plc in unveiling bullish usage forecasts. In Shanghai, prices climbed by the daily limit.

"Such breakthrough has been cooking long, backed by relative value and EVs," Richard Fu, head of Asia Pacific at Amalgamated Metal Trading Ltd., said by email.

Nickel sulphate, a key ingredient in lithium-ion batteries, will see demand increase by half to 3 million tons by 2030, Saad Rahim, chief economist at Trafigura, said in an interview. That echoes bullish views from miner and trader Glencore. Batteries are likely to use more nickel and less cobalt in future, Rahim said.

Nickel is now up 28 percent for 2017, vying with aluminum for the title of top base metal of the year.

Chinese investors piled into Shanghai futures at the start of morning session, and prices were locked up by the limit just short of 100,000 yuan a ton, the highest intraday level since November.

MMC Norilsk Nickel PJSC, which competes with Vale SA as the world’s top nickel producer, has warned that the market may have become too bullish too quickly. The company sees this year’s nickel demand from batteries at about 65,000 tons, compared with total usage of 2 million tons, according to Anton Berlin, head of analysis and market development. It will take a few years for EVs to become a significant consumer, he said.

The London Metals Index has been on a recovery trajectory for more than a year with five of the six constituents rallying impressively in 2016 and again more recently. Nickel has been something of a wallflower in that time because it was plagued by oversupply and lacked a clear bullish catalyst for demand dominance.

Speculation that the LME is going to launch a nickel contract specifically aimed at fulfilling the narrow specifications of what battery manufacturers require, nickel sulphate, has heightened awareness that this is a nascent supply inelasticity meets rising demand market.

The London listed ETFS Nickel fund broke sharply higher today to complete a two-year base formation and a sustained move back below $10 would be required to question medium-term recovery potential.

Norilsk Nickel is listed in Russia and on the London International Exchange and is among the largest producers of both nickel and palladium. The share has been ranging in a volatile manner for five years and is now approaching the upper boundary near $20. A sustained move below the trend mean would be required to question medium-term scope for a successful upward break.

Canadian listed Sherritt International is the closest I have found to a pureplay on nickel. The share rallied sharply this week to reverse last week’s decline and completion of the two-year base is looking more likely than not.

Copper is also a major component of lithium ion batteries and that is helping to stoke continued interest in the recovery story. A sustained move below the trend mean would be required to question medium-term scope for continued upside.

London listed Antofagasta has been ranging in a reasonably orderly manner around the psychological 1000p for the last couple of months and is firming from the lower side of its range at present.

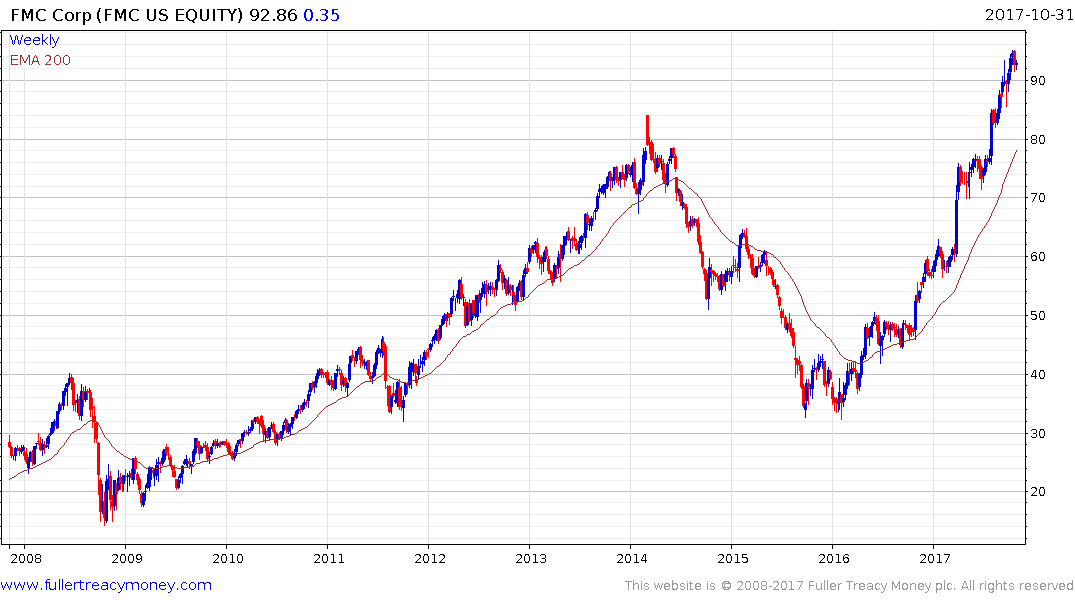

The shares of the most popular lithium plays, such as FMC Corp or SQM, are currently quite overextended relative to their respective trend means and susceptible to some consolidation.