Next Grocery Shock Awaits as Food Giants Face Cooking Oil Risks

This article from Bloomberg may be of interest to subscribers. Here is a section:

The move by Indonesia, which accounts for a third of global edible oil exports, will add to turmoil facing emerging markets from Sri Lanka to Egypt and Tunisia. Even developed countries could see sharp rises in supermarket prices.

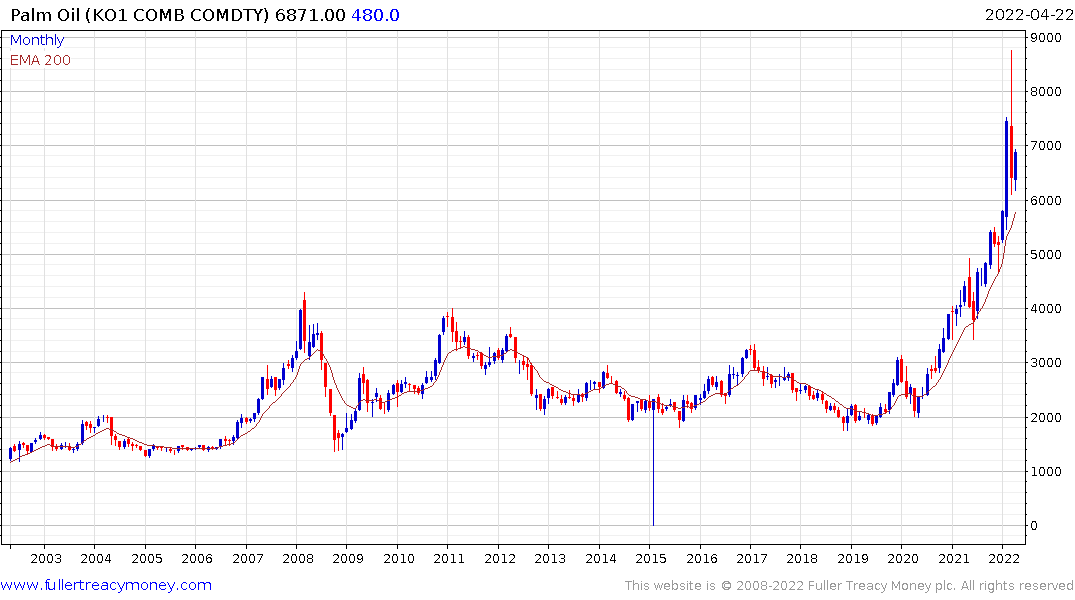

Palm oil is one of the most versatile staples, used in thousands of products from food to personal care items to biofuels. Prices of cooking oils have been on a tear due to drought and labor shortages. Then the war in Ukraine roiled trade of about 80% of global sunflower oil exports, boosting demand for alternatives like palm and soybean oil and sending prices to record highs.

Indonesia’s ban applies to exports of RBD palm olein, a higher value product that has been processed. Exports of crude palm oil and RBD palm oil will still be allowed, according to people familiar with the matter. RBD olein accounts for 30% to 40% of Indonesia’s total palm oil exports.

The move could increase costs for packaged food producers such as Nestle, Mondelez International and Unilever. Nestle declined to comment, while the other companies didn’t respond to a request for comment. It may also force governments to choose between using vegetable oils for food or biofuels.

Palm oil prices initially popped higher on the news of Indonesia’s export ban but were not spared the decline in the wider commodity complex today. Nevertheless, the longer Indonesia’s ban persists the bigger the knock-on effect for regional consumers. Inflationary pressures may ease in industrial commodities, but agricultural prices are less susceptible to slowing Chinese growth.

Malaysia listed; Sime Darby Plantations was spun off in 2018. The share rebounded from the 2021 lows in March and is now testing the upper side of its range. It will need to sustain a move MYR5.5 to confirm a return to medium-term demand dominance.

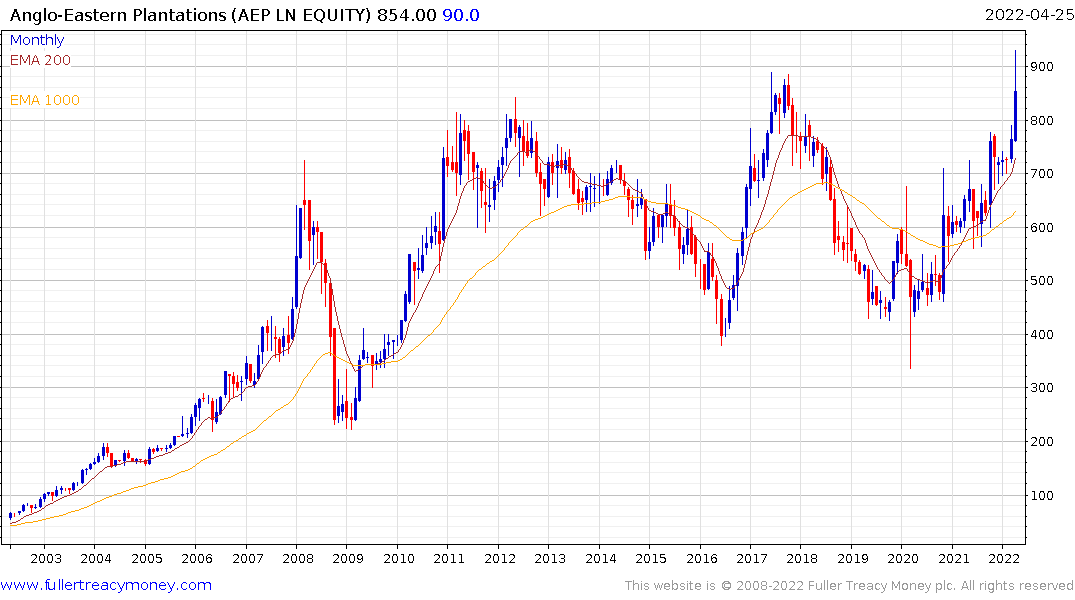

Angle Eastern Plantations is firming from the region of its all-time peaks.

A story has been circulating on social media about the large number of food processing facilities destroyed by fire this year. Regardless of how significant these events are on aggregate; these kinds of stories stoke concern among consumers about potential shortages.

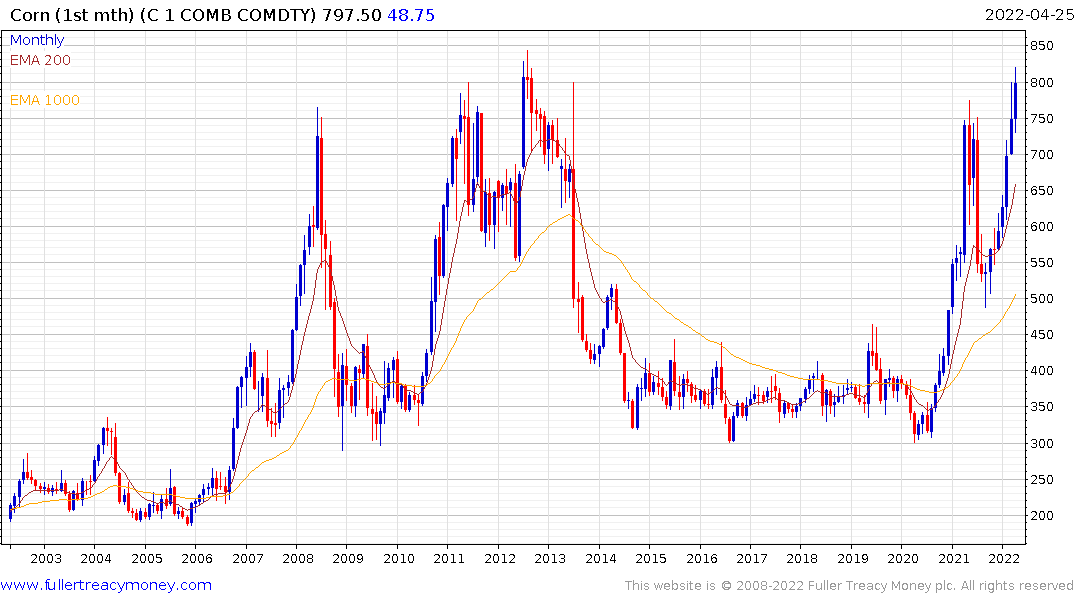

Corn remains in the region of the all-time highs but is quite overextended in the short term. If oil prices come down demand for ethanol should be less urgent. That suggests betting on significantly higher prices in the short-term is less likely to be fruitful than waiting for a pullback.

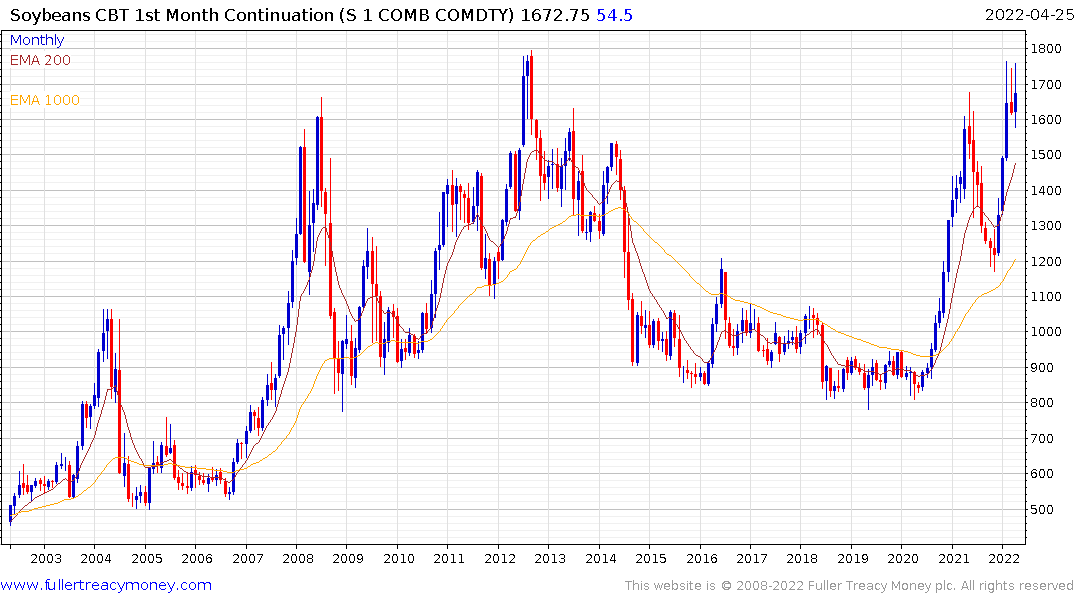

Soybeans are also pausing in the region of the all-time peak. Wheat prices have already posted a lower high.

Soybeans are also pausing in the region of the all-time peak. Wheat prices have already posted a lower high.