Newmont offers to buy Australia's biggest miner amid gold merger spree

This article from the Financial Post may be of interest. Here is a section:

Yamana’s outgoing executive chair Peter Marrone told The Financial Post last month that he expects a wave of gold mergers as executives and investors seek to maintain margins amid higher production costs and declining grades of the metal.

Resource industries are on the front lines of the climate challenge, whether it be coping directly with extreme weather, or indirectly through rising costs associated with adjustment and policies such as carbon taxes. Gold miners face an additional layer of difficultly because their deposits are yielding less ore that’s dense with gold. Lower grade mines can still be profitable, but only if extraction costs are lowered.

Aside from the sale of Yamana, which has properties and mines in Canada, Brazil, Chile and Argentina, there have been at least eight notable combinations since 2018, when Barrick Gold Corp. and Randgold Resources Ltd. announced an $18-billion, zero-premium, all-share merger.

Finding new large-scale mining projects is a fraught with difficulty. That leaves little option for major miners than to pay up for competitors. Newcrest has tried to focus on tier-one assets, led by the Cadia mine in New South Wales. The low cost of production at that mine has funded international expansion. No doubt, Newmont views the security of production as a sound investment.

The challenge for investors is the value proposition in gold miners is obvious but the share performance has not cooperated. Newcrest popped higher on the news but it is still significantly below the 2019 peak despite the higher levels for gold since then.

Since Barrick has already stated they are not going into a bidding war and Zijin would be unlikely to be approved by the Australian government, there is good chance this merger will be approved.

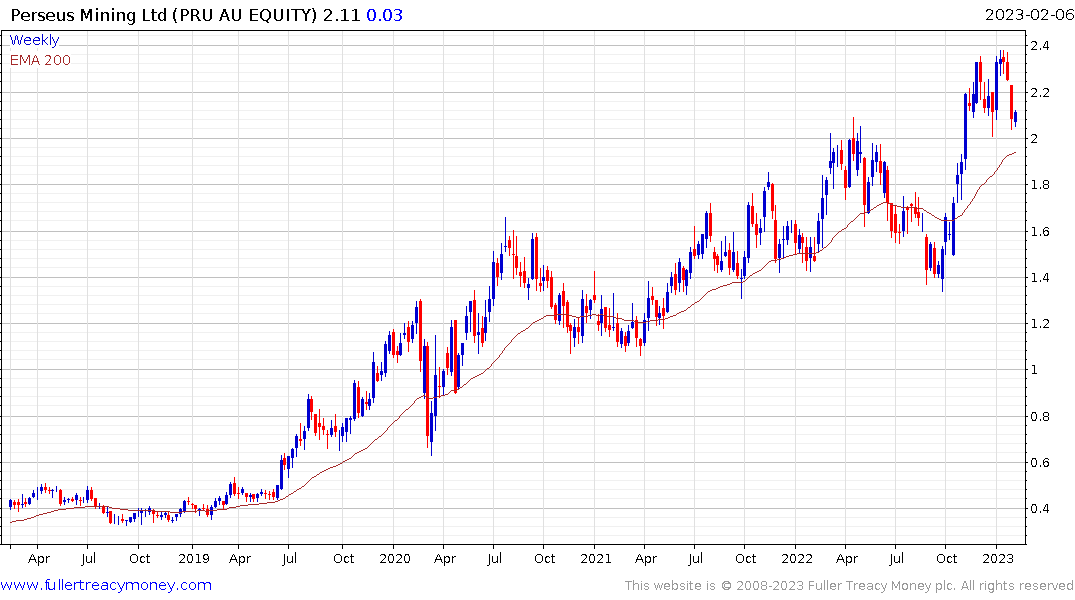

That opens scope for increasing M&A activity among somewhat smaller companies. Some of the potential targets include Perseus Mining, I-80, and Northern Star Resources.

Perseus Mining remains in a consistent medium-term uptrend and is currently firming in the region of the 200-day MA.

.png) i-80 is also approaching the region of the trend mean.

i-80 is also approaching the region of the trend mean.

Northern Star Resources is short-term overbought but a sustained move below the trend mean would be required to question medium-term demand dominance.

Northern Star Resources is short-term overbought but a sustained move below the trend mean would be required to question medium-term demand dominance.

Meanwhile gold continues to unwind its own overbought condition following last week’s downside weekly key reversal. It begs the question how many mining CEOs will have the fortitude to buy the dip?

Meanwhile gold continues to unwind its own overbought condition following last week’s downside weekly key reversal. It begs the question how many mining CEOs will have the fortitude to buy the dip?