New Nafta Could Settle Canada-U.S. Lumber War, Resolute CEO Says

This article by Jen Skerritt for Bloomberg may be of interest to subscribers. Here is a section:

A renegotiation of Nafta could be used to settle a lumber dispute that’s been simmering between Canada and the U.S. for decades and threatens to make housing unaffordable for thousands of Americans, according to the world’s largest newsprint maker.

The Canadian government will probably want lumber included in a new North American Free Trade Agreement, Richard Garneau, chief executive officer of Montreal-based Resolute Forest Products Inc., said by phone. “I think that makes sense,” he said.

The U.S. has initiated an investigation into softwood lumber imports amid allegations Canadian timber is heavily subsidized and shipments are harming U.S. mills and workers. President Donald Trump has also signaled that the U.S. may seek more favorable terms in trade pacts such as Nafta.

A previous softwood lumber agreement expired in October 2015. That was followed by a 12-month moratorium, during which Canada was able to continue shipping lumber tariff-free.

Lumber is a highly political commodity since the US has a domestic industry but also needs to import from its northern neighbour to supply is burgeoning housing market. Home starts hit their highest level since 2007 in December which is a testament both to high home prices and the health of the US economic expansion.

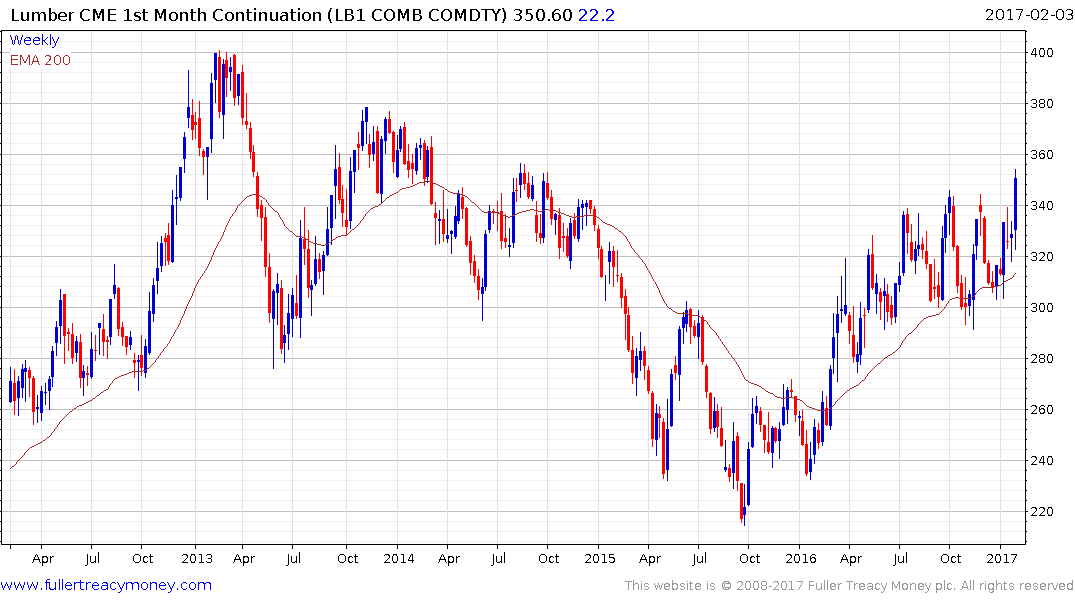

Lumber prices were limit up yesterday and are now trading at new two-year highs. While somewhat overbought in the short-term, a break in the medium-term progression of higher reaction lows would be required to question potential for continued higher to lateral ranging.

There is potential for US lumber companies to benefit if the commodity becomes the subject of US attempts to support domestic industries not least as part of a renegotiation of NAFTA.

Potlatch (Est P/E 28.07, DY 3,.49%) has held a progression of higher reaction lows since early last year and posted a large upside weekly key reversal from the region of the trend mean this week.

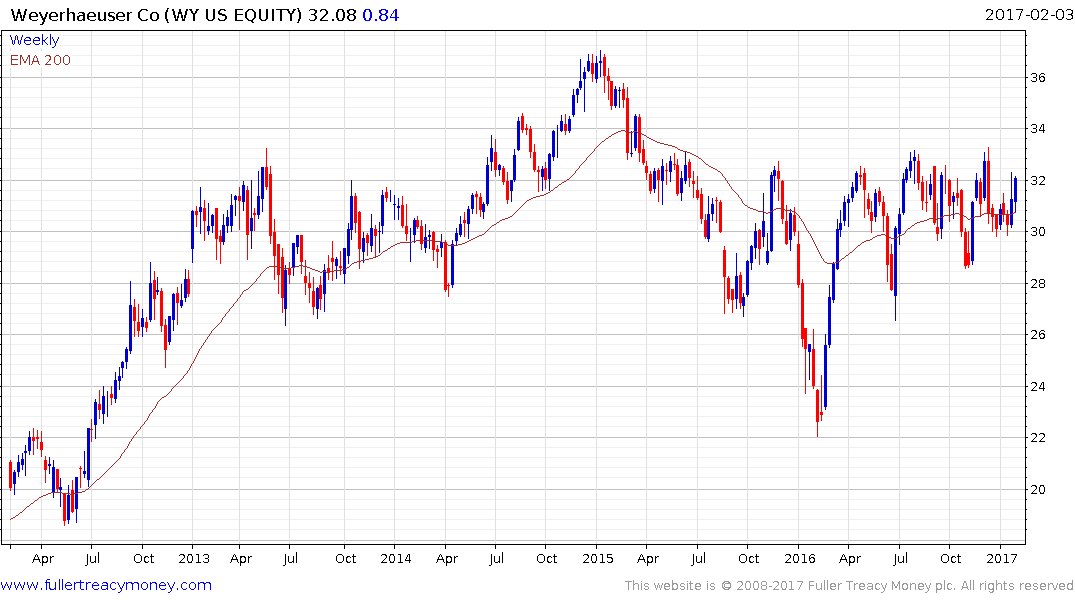

Weyerhaeuser (Est P/E 27.91, DY 3.89%) has been ranging with a mild upward bias for almost a year and a sustained move below $30 would be required to question medium-term scope for a successful upward break.