New King of Copper Trading Sees Demand Coming Back Stronger

This article by Mark Burton for Bloomberg may be of interest to subscribers. Here is a section:

By March this year, he was stuck holding video calls with clients and colleagues from his home in Geneva. With the world on lockdown, the outlook for most industrial metals looked bleak. Yet even then, Bintas says there were early signs copper could emerge from the crisis even stronger.

If anything, he’s even more bullish today. Demand is bouncing back in China and stimulus packages being unleashed across the developed world promise to transform the long-term outlook -- particularly with spending on copper-intensive green energy infrastructure. The coronavirus has also disrupted mines and delayed new builds, throttling current and future supply.

“Copper is coming out of this crisis differently,” Bintas said by phone from Geneva. “When lockdowns were eased and people started to return to work, we were surprised to see our customers not only taking deliveries of volumes they’d already bought, but requesting more to cover themselves in case there were any further disruptions to supply.”

With the Federal Reserve talking about leaving rates on hold for more than two years, amid considerable economic uncertainty, the demand for stimulative measures is likely to increase. Infrastructure development provides jobs during the construction phase but also creates a lasting group of assets that foster economic growth in future. Of course, that latter point depends on what stimulus money is spent on but the commodity demand during construction is likely to be the same.

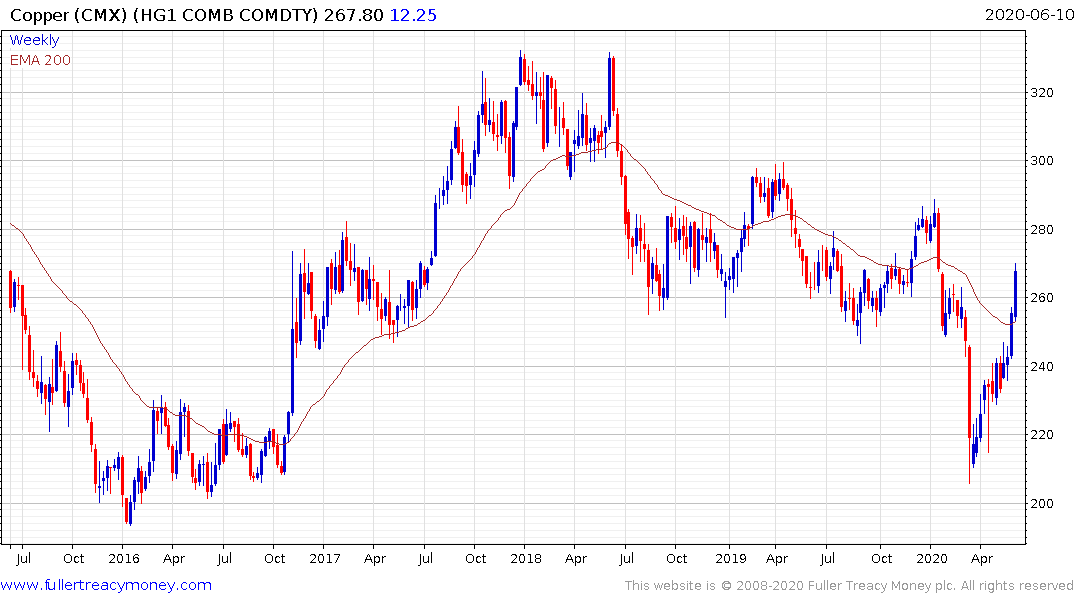

Copper has now successfully pushed back up into the overhead range. The $2.50 should now offer support during any potential process of consolidation.

Nickel continues to hold a medium-term sequence of higher reaction lows and rallied early this month to break the nine-month downtrend trend. A sustained move below $12000 would be required to question near-term scope for continued upside.

Tin found support in the region of the 2015/16 lows and rallied this week to break the more than yearlong downtrend.

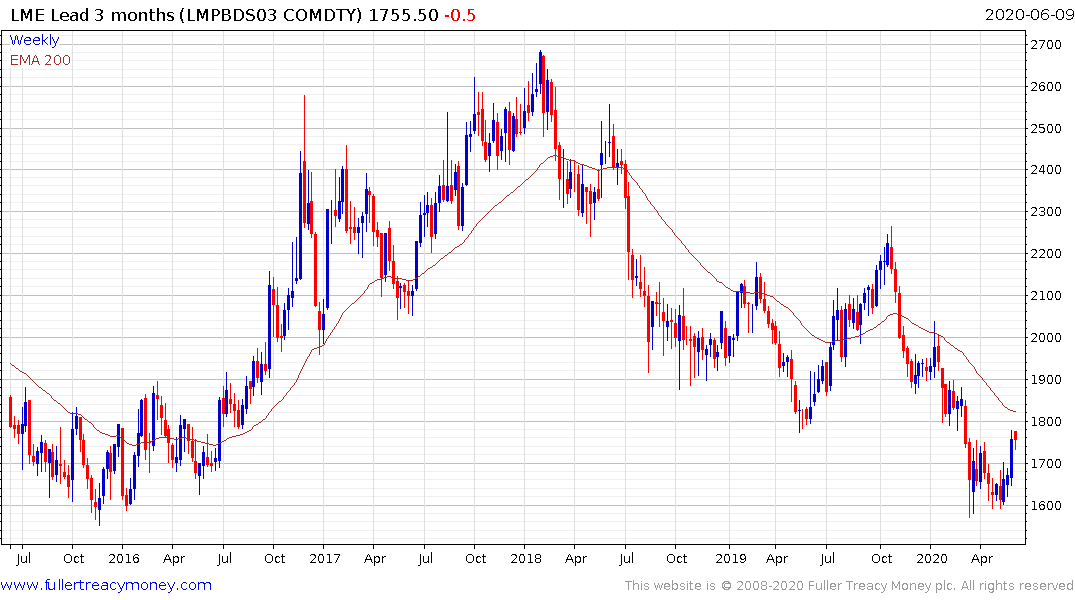

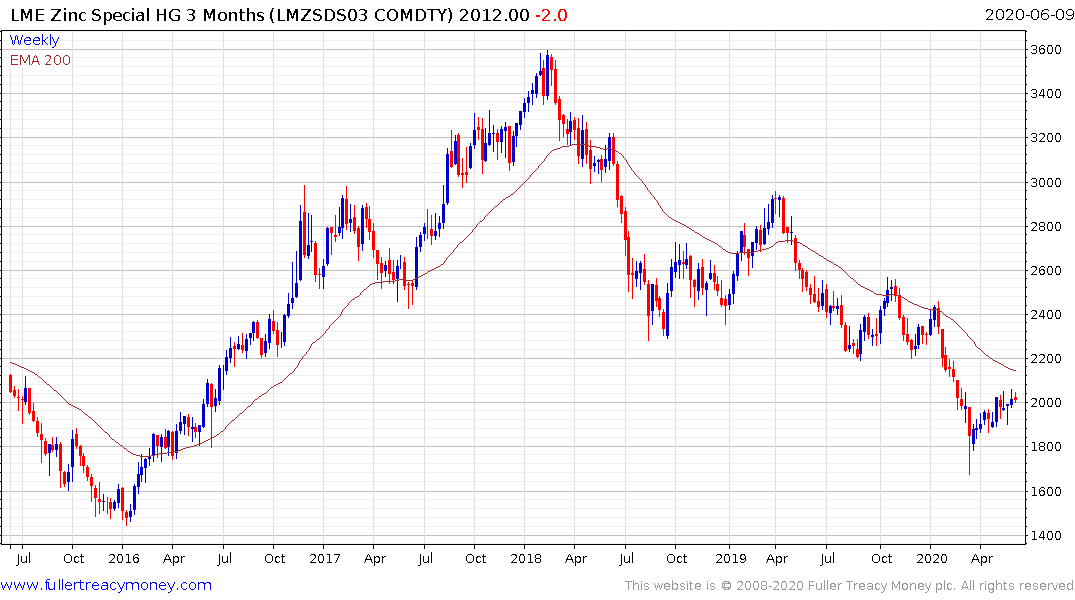

Lead, Zinc and Aluminium have all bounced from previous areas of support. They have yet to do enough to conclusively break their downtrends but momentum is on their side.

The FTSE-350 Mining Index has pushed back up into its trading range. A sustained move above 20,000 would confirm a return to medium-term demand dominance.

The big question overhanging the industrial metals sector is the impact the loss of Brazilian exports is having on the global supply/demand picture. Brazil seems to be nowhere near getting their coronavirus outbreak under control. The Bolsonaro government appears to be fudging statistics at best or lying at worst. Will supply pick back up when the coronavirus is eventually contained and will demand have recovered enough by that time to absorb the additional supply?

Back to top