New JPMorgan Flash-Rally Theory Sends Message on Today's Market

This article by Alexandra Scaggs for Bloomberg may be of interest to subscribers. Here is a section:

Some big names back JPMorgan’s view that it’s often tougher to trade Treasury securities in the roughly $500 billion-a-day cash market than the derivatives that track them. The Federal Reserve Bank of New York touched on the topic in a recent blog post. Sam Priyadarshi, head of fixed-income derivatives trading at Valley Forge, Pennsylvania-based Vanguard Group Inc., the largest private holder of Treasuries, says the relative ease is encouraging his team to trade more in futures. His team trades Treasuries for some of the firm’s active portfolios.

The JPMorgan analysts looked at measures of trading activity and the depth of the markets’ liquidity to determine the source of the steep drop in yields in October 2014. They found that shortly before the decline, volume in 10-year Treasury notes spiked. In contrast, trading volume in 10-year futures contracts only peaked after the note’s yield had plummeted to its low for that day, they said. They also found that, in futures, average transaction costs were lower, and distribution of market depth across the order book was more stable.

Activity in the Treasury market is receiving a great deal of attention at present. The level yields are at right now suggests to some people a recession is imminent, but other economic factors are considerably more benign. That is contributing the sense of dissonance many people feel.

The fact that upwards of $8 trillion in Euro, Yen and Swiss Franc denominated debt is trading with a negative yield has a lot of people on edge. The end of the Federal Reserve’s quantitative easing program has also altered the status quo, while the spike in junk yields raises questions about who is exposed. However there are some additional considerations that are potentially more important for the medium-term outlook.

The USA and UK are no longer engaged in quantitative easing (QE) which means their respective Treasuries are not issuing new bonds at the same pace. European and Japanese central banks are still engaged in QE and have an incentive to issue additional debt when rates are so attractive. However, fiscal restrictions, particularly on Eurozone governments, means they are focused on paying down debt rather than taking out new debt.

Simultaneously, regulators, both international and domestic, have introduced a slew of additional rules which boil down to identifying sovereign bonds as Tier 1 (risk free) capital. They have made sure banks, insurance companies and pensions have to hold more Tier 1 capital to protect against another financial crisis, despite the fact it was a once in a century event.

If you take these two factors together you have a supply inelasticity meets rising demand scenario. More than any other factor that helps to explain why yields are so low when economic activity is reasonably steady. This also helps to explain the fact the cash bond market is less liquid than futures.

Treasury yields continue to pause above the 1.5% area and potential for an additional reversionary rally remains more likely than not. However a change to the above factors will be required to break the long-term downtrend.

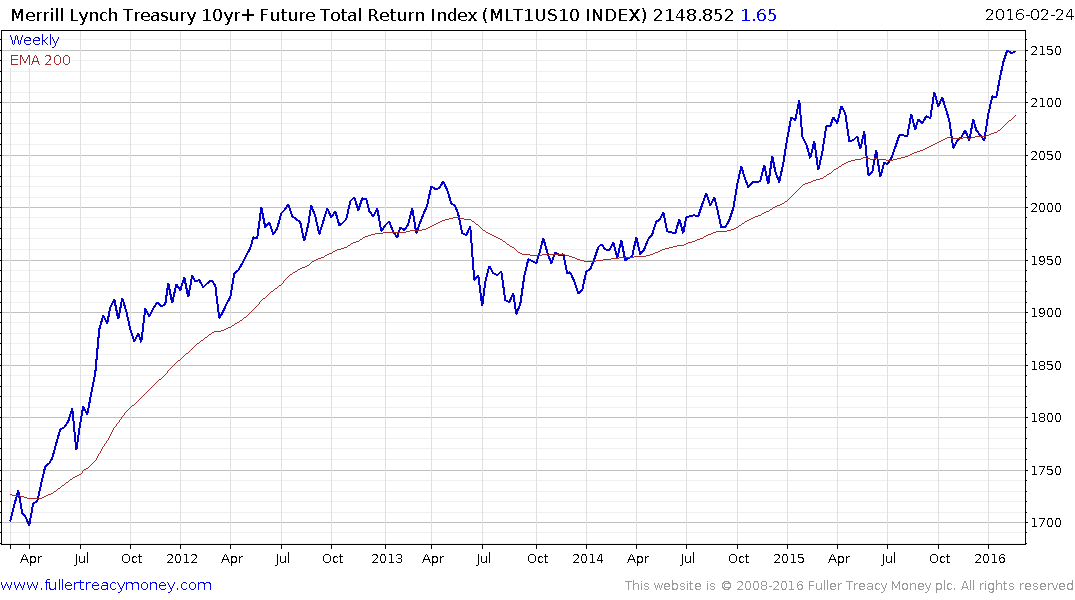

The Merrill Lynch 10yr+ Treasury Futures Total Return Index broke out to a new all-time high in January and is somewhat overbought at present. A sustained move below the trend mean would be required to begin to question the consistency of the medium-term uptrend.