Netflix Tops Estimates for Quarter, Projects Continued Gains

This article by Lucas Shaw for Bloomberg may be of interest to subscribers. Here is a section:

Netflix Inc. posted its strongest start to a year since the company went public 16 years ago, thanks to strong growth in markets across Latin America and Europe.

The company added 7.41 million subscribers in the first quarter of the year, according to a company statement Monday, easily topping analysts’ projections of 6.35 million. Netflix now has 125 million paying customers, the most of any online TV network.

The company, the best-performing stock in the S&P 500 this year, is proving one quarter at a time that investors’ confidence in its online TV service has been justified. Netflix is using its growing subscriber base and deep pockets to poach talent from the biggest program suppliers and build a Hollywood studio for the internet age.

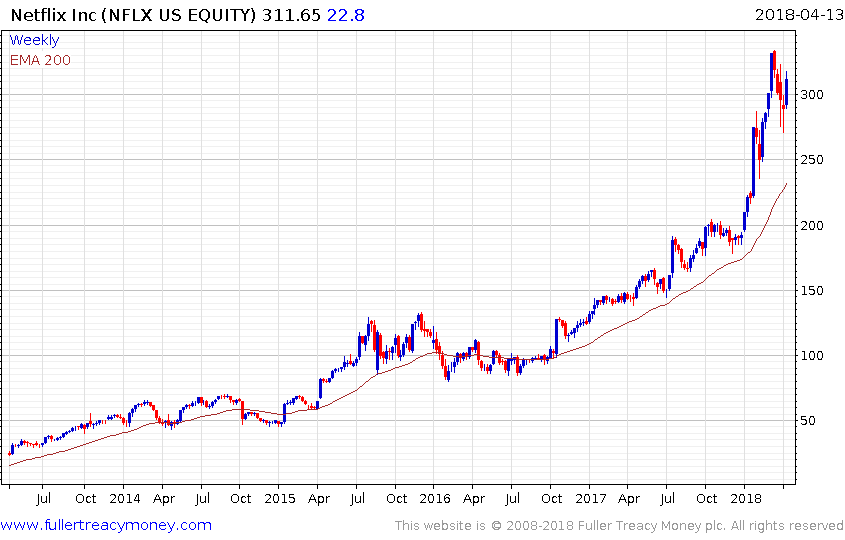

Shares of Netflix rose as much as 8.3 percent to $333.21 in extended trading after the results were announced. The stock fell 1.2 percent to $307.78 at the close in New York and is up 60 percent this year.

Netflix said first-quarter profit rose to 64 cents a share, up from 40 cents a year earlier and meeting analysts’ projections of 64 cents. Sales for the quarter grew 40 percent to $3.70 billion, compared with Wall Street projections of $3.69 billion.

For the current quarter, Netflix is predicting earnings of 79 cents and revenue of $3.93 billion. That compares with analysts’ estimates of 65 cents a share in profit and sales of $3.89 billion.

Netflix came out with earnings immediately after the close and successfully added more subscribers than it was forecasting while earnings were as expected. The company has also made clear it intends to fund additional growth with debt and cashflows will be negative for the foreseeable future.

The share was retesting its peak in afterhours trading. The big question is the extent to which the lows posted in February hold. The $270 level now represents the most recent higher reaction low.