Negative interest rates are the dumbest idea ever

This interview of Jeff Gundlach by Christoph Gisiger for Finanz und Wirtschaft may be of interest to subscribers. Here is a section:

Energy companies are playing an important role in the junk bond sector. What would oil at $ 38 mean for the credit markets?

Just like oil, the high yield market has enjoyed the easy rally. I think it’s basically over. I don’t see how you are supposed to be all fond off high yield bonds, since they are facing enormous fundamental problems. I thought people would learn their lesson but the issuance in the years 2013/14 was vastly worse than the issuance in 2006/07. Also, in the bank loan market covenant lite issuance rose to 40% in 2006/07. In this cycle it climbed to 75%. The leverage in the high yield bond market is enormous and you’re about to have a substantial increase in defaults. I wouldn’t be surprised if the cumulative default rate in the next five years were going to be the highest in the history of the high yield bond market.

What would be the consequences of that?

We are now in a culture of default. There is no stigma about defaulting anymore. During the housing crash, homeowners walked away from their mortgages. That was the beginning of a massive tolerance of default. Today, people talk about Puerto Rico defaulting like it’s nothing. But if Puerto Rico defaults why won’t some clever person in Illinois say: «Let’s default, too! » Constitutionally, Illinois is not allowed to default, but Puerto Rico wasn’t either. For Illinois it just seems impossible to pay their pension obligations. And then, what about Houston, what about Chicago, what about Connecticut? I am surprised that people have lost their focus on the enormity of the debt problem. Remember, in 2010 and 2011 there was such a laser focus on the debt ceiling in the US and we were worried about Greece. Nobody is worried anymore. People are distracted by this negative interest rate experiment.

The first time I visited Boston was about four years ago and there was a sign from Prudential above the Charles which proclaimed “We have $1 trillion under management”. That’s an impressive number but what popped into my head was “What do they own?” The answer of course is that a great deal of that money is invested in bonds. In fact regulators insist conservative portfolios, aimed at the pensions market, have to own bonds in order to ensure some degree of security that future liabilities can be met. The fact bonds have been in a 35-year bull market has only bolstered the sector’s “risk free” credentials.

The credit crisis resulted in massive central bank intervention in the bond market and yields accelerated lower. The risk in pointing out that this is a clear ending signal is in being accused of being the boy who cried wolf. The reality is that borrowers such as corporations and governments have every incentive to increase their debt burdens when interest rates are at rock bottom levels and well below the cost of equity funding. Regardless of the fact that the best time to buy back shares is when their prices are low, the argument for doing so it still supportive as long as the spread between debt and equity funding costs is still in debt’s favour.

A point I covered in Crowd Money is one of the defining characteristics of every crowd is a tolerance for contradiction. By identifying what the contraction is we can gain a good idea of what the problem is likely to be that eventually bursts the bubble. For bonds the supposition that you can increase the supply of debt forever without ever having to worry about credit risk is a clear contradiction. However it is not yet something worrying investors because no catalyst has emerged to question the viability of the practice.

Rather than wait for an eventual top to complete we feel duty bound to try and identify what the catalyst is likely to be. The imposition of negative interest rates is clearly a new venture of modern central banks. Since it has never been tried before, at least in this form, we do not know what the result is going to be. What we do know is that anything which affects the ability of companies and/or governments to fund debt refinancing is likely to represent a problem which would lead to higher default rates.

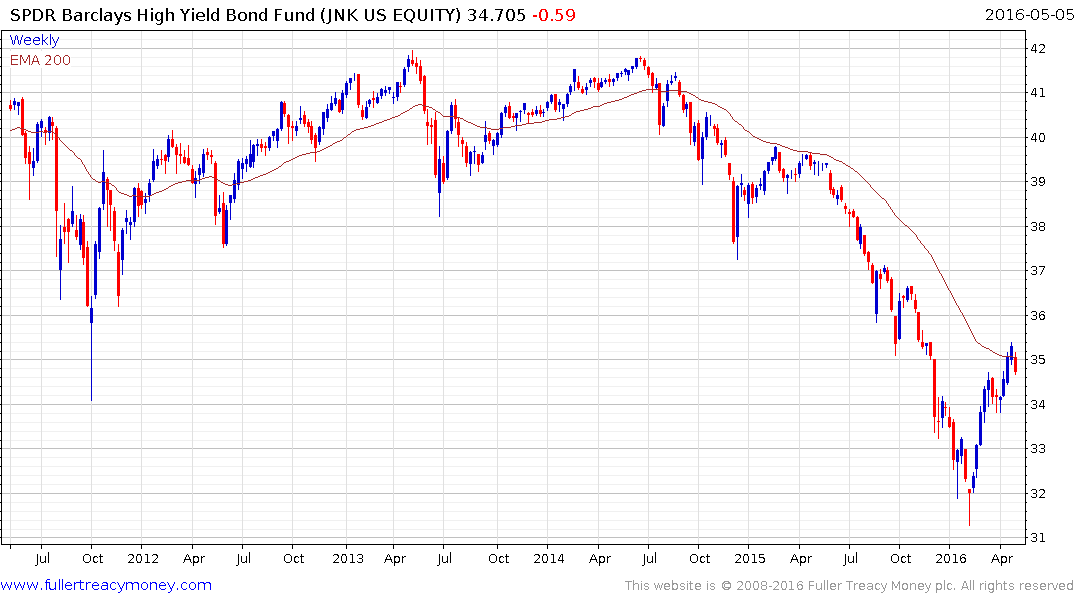

The $12 billion SPDR Barclays High yield bond Fund (JNK) is a reasonable barometer of conditions in the high yield sector and it shares a high degree of commonality with oil despite the fact only about 9.5% of the fund is invested in energy. The fund has closed its deep overextension relative to the trend mean and a some consolidation of what has been an impressive rally appears more likely than not.