Narrowing Arabica-Robusta Coffee Spread to Lure Buyers

This article by Marvin G. Perez for Bloomberg may be of interest to subscriber. Here is a section:

Lowest premium in nine years will spur arabica demand, Julio Sera, risk- management consultant at INTL FCStone in Miami, says in telephone interview.

* “Who’s going to buy robusta if you can get cheaper arabica?”

* Recent sell-off is overdone and gives roasters and other end- users a chance to lock in supplies in coming months, while speculators unwind some bearish bets

* Prices will probably swing widely before end of month, 2Q

* On Thursday, futures spread between arabica in N.Y. and robusta in London narrowed to 24.4c/lb, lowest since Jan. 14, 2008, when Bloomberg data starts; on Friday, premium rose as much as 17% to 28.5c; average in 2016 was 58c

* On Friday, arabica coffee for Sept. delivery jumps 5.4% to $1.2275/lb

* On Thursday, price slumped as much as 5.4% to $1.155, lowest since March 3, 2016

There is a key difference between the CRB Index and the CCI Index or as they are often referred to as the CRB and the Old CRB. The CRB is liquidity weighted so it is heavily influenced by oil. The CCI (Continuous Commodity Index) is unweighted to it should give us a better reflection of investor interest in the commodity sector.

The CCI has declined for 9 of the last 11 sessions and has been led lower by the energy sector. The agriculturals; especially sugar, Arabica coffee and cocoa, have also been particularly weak but for entirely different reasons.

Arabica coffee accelerated lower yesterday to test the lows posted in early 2016 near 110. The Arabic price has been subject to some quite acute volatility over the last decades but has found support above or close to 100 on a number of occasions. It bounced today to pressure some of the shorts but upside follow through next week would signal a low of at least near-term significance has been found.

Robusta has exhibited a pattern of demand dominance since early 2016 but pulled back sharply in March. It has held a progression of higher reaction lows since then and bounced emphatically from the region of the trend today. A sustained move above $2200 would reassert medium-term demand dominance.

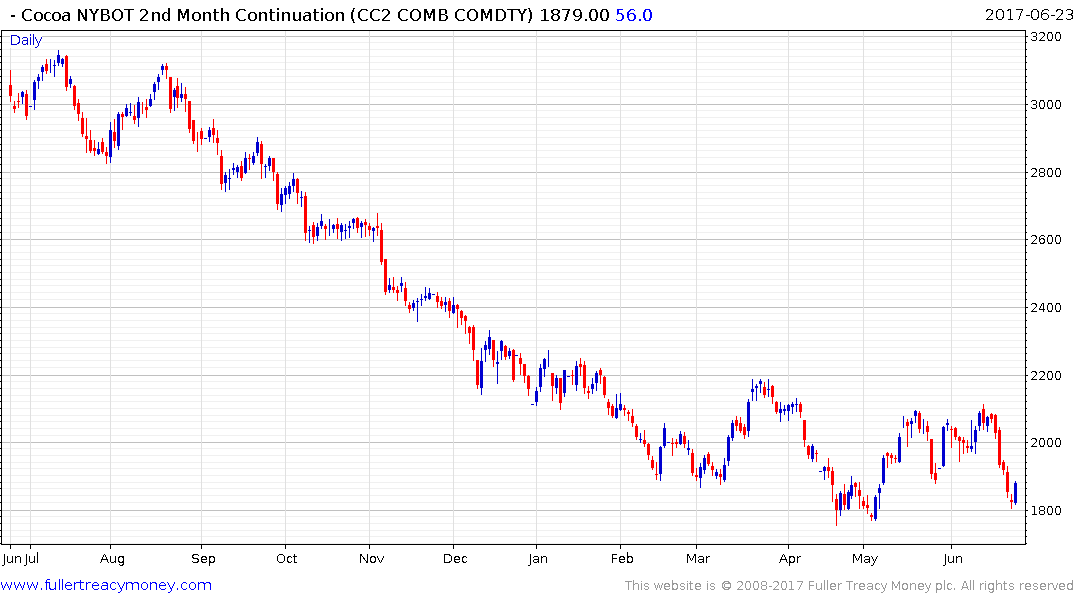

Cocoa collapsed in the latter half of 2016 but has lost downward momentum over the last few months and bounced toward from above the $1800 area.

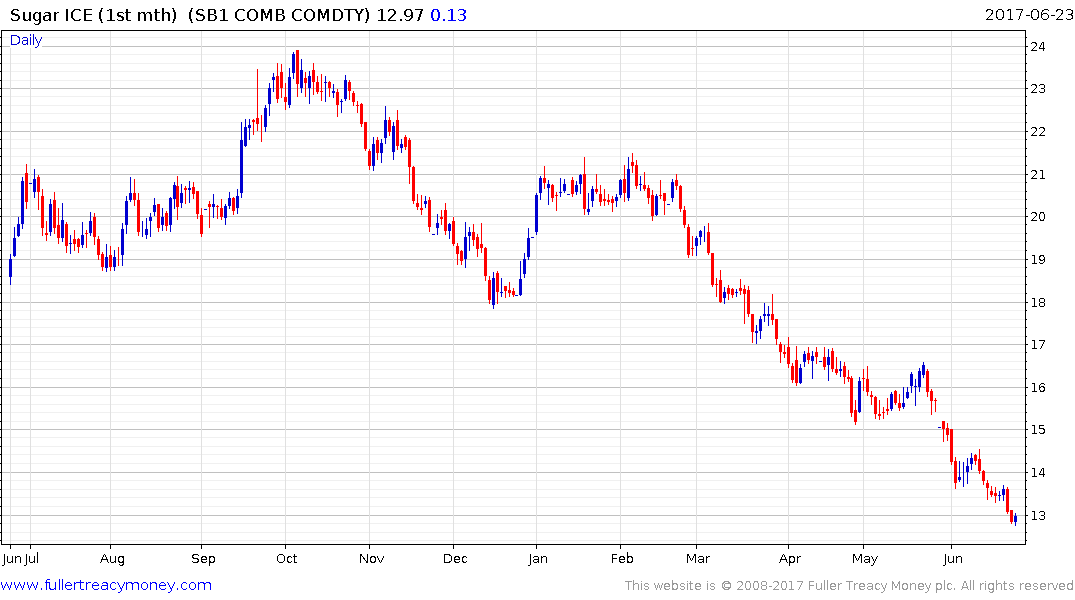

Sugar is becoming increasingly overextended but there is little evidence of demand returning to dominance just yet.

Back to top