N.Z.â's Key Says Don't Break Out Champagne for Parity Party Yet

This note by Matthew Brockett for Bloomberg may be of interest to subscribers. Here it is in full:

New Zealand Prime Minister John Key speaks at post-cabinet press conference in Wellington on Monday.

?Says NZ dollar’s recent gains generally reflect economic fundamentals of New Zealand

On prospect of NZD reaching parity with Australian dollar, says “just before people break out the champagne for a parity party, we’ve been there many times before and not quite got over the finishing line”Most New Zealanders would prefer NZD “was a little bit lower”

“With dairy prices recovering, that’s the thing I think that’s actually underpinning the exchange rate now”: Key says his view on currency intervention is it’s “not a terribly effective tool”

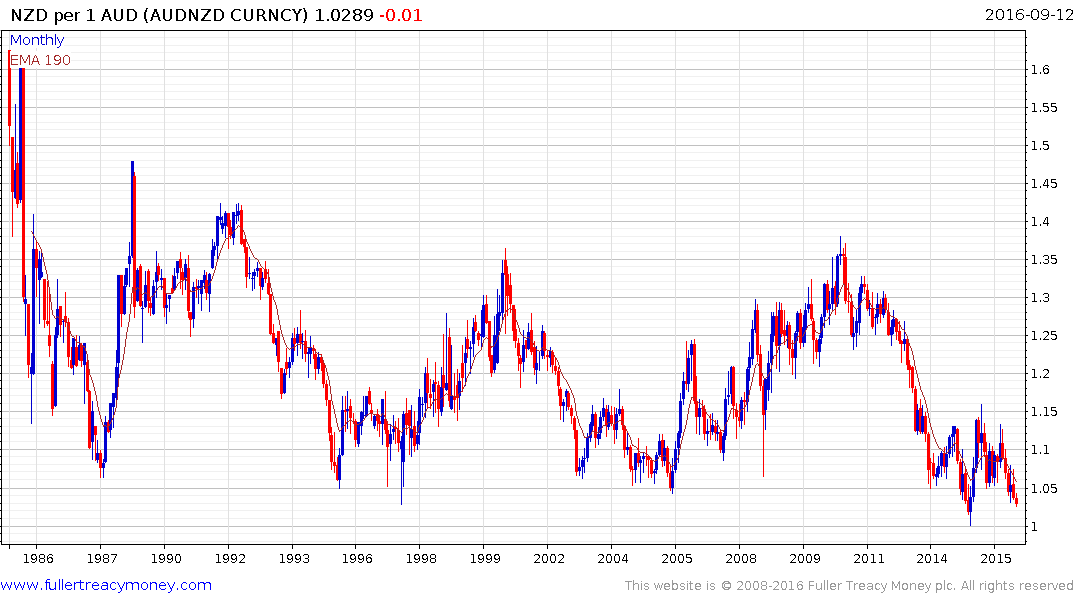

The New Zealand Dollar has not traded above parity against the Australian Dollar in at least 30 years so it represents a psychological Rubicon for investors and a potent threat to the competitiveness of Kiwi exports to its largest neighbour. The rate has contracted steadily over the last month and a break in the short-term progression of lower rally highs, currently near NZ$1.04, will be required to signal Australian Dollar demand is returning to dominance.

The New Zealand stock market has been among the best performing on any developed market this year as wide interest rate differentials, high yielding stocks, a firm currency and buoyant economy spurred investor interest. The Fully Gross 50 Index pulled back sharply today to signal a peak of near-term significance. However, a sustained move below the trend mean, currently near 6850 would be required to question medium-term uptrend consistency.