Musings from the Oil Patch October 4th 2016

Thanks to a subscriber for this edition of Allen Brooks’ ever interesting report for PPHB which may be of interest. Here is a section

What we found surprising in the EIA’s forecast was the lack of penetration by EVs into the vehicle fleet. Based on the bars shown in Exhibit 8 (prior page) for plug-in and all-electric vehicles, the EIA’s sales total is less than one million units in 2040. To be honest, we find that acceptance rate to be extremely low given what the automobile industry is planning, at least based on their rhetoric. As a result, we are not sure what to make of the EIA’s outlook for gasoline consumption, which is shown in Exhibit 9.

We will be working in the future to improve our forecasting model, but the conclusion we derive from our work is that the growth of the EV segment of the vehicle fleet will have an impact on gasoline consumption. The question is how much that impact will be. By 2025, according to our forecast, the impact may be anywhere from 500,000 barrels a day (b/d) to 1.0 million barrels a day (mmb/d) of reduced gasoline consumption. That is the equivalent of one to two huge refineries in this country. Moreover, the destruction of gasoline demand in later years becomes even more meaningful – nearly 2.5 mmb/d to 4.6 mmb/d - a huge impact on the refining industry let alone overall oil consumption in America. If we extrapolate the U.S. experience to the rest of the world, there will be a noticeable impact in transportation fuel markets. Regardless of whether our forecasts are right or not, the issue of EVs, and the associated issue of self-driving cars, will have an impact on oil demand, forcing the oil producing and refining sectors to have to re-examine their long-term strategies.

Here is a link to the full report.

I’ve been thinking recently about the manner in which people buy their cars and how this could influence their decisions on whether to buy electric vehicles. This article from Bloomberg carries some important statistics on leases. Here is a section:

Leases accounted for 28 percent of new-car sales in September, up from 20 percent in 2012, according to car-sales tracker Edmunds.com. GM, Ford and Fiat all have reported strong sales in the latest quarter. As the chart above shows, they and Toyota have all ramped up their leasing in recent years.

One of the primary attributes of leases is that if you want to keep costs down you take a lower mileage limit. If the average commute is say 20 miles that equates to 9600 miles per year assuming a working year of 240 days. That does not leave a lot of room for taking longer trips like family vacations, weekend excursions or just going out to dinner on a regular basis. From talking to people at rental car companies the practice of saving one’s personal car for every day driving while renting a car for longer trips is quite common in Los Angeles for just this reason. I wonder if the transition to electric vehicles will enhance this practice.

It is possible that people use an electric vehicle for day to day travel, making savings in running costs, fuel etc. but opt to rent a gasoline or hybrid fuelled car for longer journeys. That kind of transition would .not require the massive leaps in autonomous vehicle technology that would spur a future transition to a roaming autonomous fleet waiting on passengers but it could act as a bridge to that eventual goal. .

Tesla’s more expensive cars with a range of 450 miles under normal road conditions are already approaching ranges that allay anxiety about being stuck in the desert miles from a charging station.

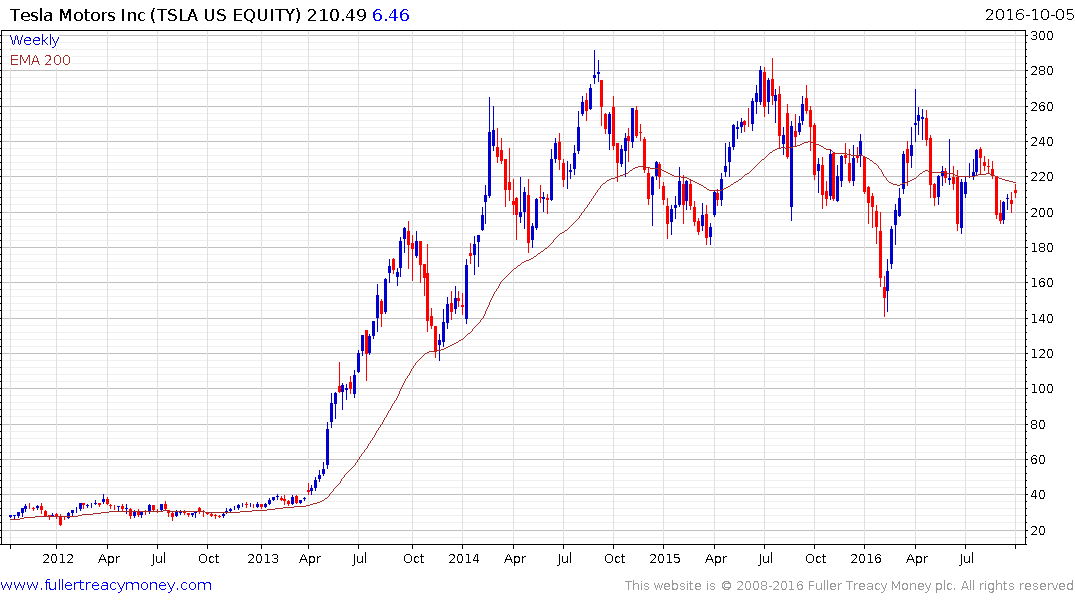

That as well as the cache that goes along with owning one is helping to boost sales among single family home owners (apartment buildings down have charging stations). The share however is still trading on an aggressive multiple and the recent impressive sale figures did little to boost the price.

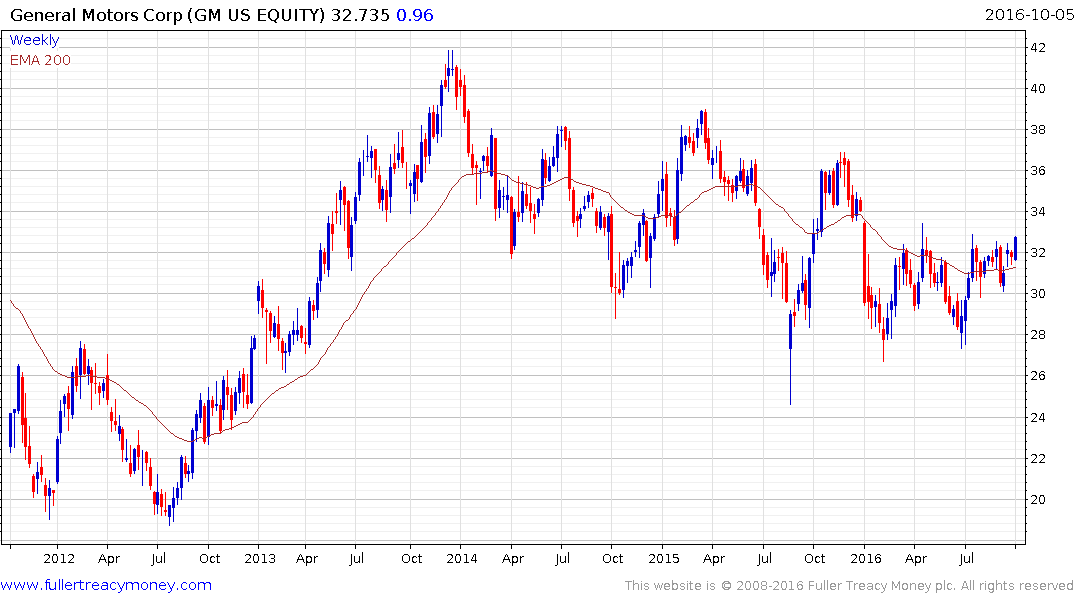

GM (Est P/E 5.6, DY 4.64%) on the other hand is trading on much more conservative valuation and is profitable. The share hit a new closing high for the year today and a clear downward dynamic would be required to check potential for additional higher to lateral ranging.

Ford (Est P/E 6.9, DY 4.79%) has firmed from the region of $12 but needs to break the three-year progression of lower rally highs to signal a return to demand dominance beyond short-term steadying.