Musings From the Oil Patch November 17th 2015

Thanks to a subscriber for this edition of Allen Brooks’ ever interesting report. Here is a section on the outlook for the US Dollar:

We were surprised by Mr. Lee’s argument, but intrigued when he said it was based on an examination of interest rate movements and the value of the U.S. dollar over the past 35 years. As we began to investigate this history, we found another report issued by Andrew Garthwaite of Credit Suisse (CS-NYSE). According to Mr. Garthwaite, “Optimism on the dollar is widespread, and our house view is for further dollar strength.” He noted that his firm had conducted a survey of its investor clients and found that 70% expected the dollar to continue appreciating over the next 12 months. His report was titled “Where could the consensus be wrong?” He identified reasons why the U.S. dollar rally could be approaching an end. One reason was that he found history was not on the side of the consensus view. He wrote, “The dollar has historically fallen after the first Fed rate hike; indeed, the first rate hike on the last five tightening cycles was associated with the dollar weakening by around 10% over the following three months.”

Mr. Garthwaite’s report produced the chart in Exhibit 6 on the previous page. The chart shows the movement of the trade-weighted dollar for the 90 days prior to the date of the first interest rate hike and then for the next 260 days. What can be seen is that for the five interest rate hikes tracked, the value of the dollar fell for roughly the first 80-120 days following the interest rate increase. After that period, the value of the dollar rose following the 1999 rate hike, but it took about 180 days for the 1994 and 2004 rate hikes to mirror the 1999’s dollar’s value pattern. The patterns displayed in this chart would seem to support the claim about what might happen to the value of the U.S. dollar after the Federal Reserve raises interest rates in December. Clearly that argues that what has been a headwind for crude oil prices since the second half of 2014 and all of 2015 so far could become a tailwind during the first quarter of 2016 and possibly for much longer.

Here is a link to the full report.

Considering the fact the Fed is so widely expected to raise interest rates in December or early next year it is very possible investors are initiating their positions ahead of the event so that once the news is released there may be little additional demand to fuel a further rally. This tendency of market participants to anticipate predictable outcomes is what the old market adage of “buy the rumour, sell the news” is based on.

The Dollar Index is currently testing its March peak near the psychological 100 area and is somewhat overbought in the short term. Some consolidation in this area is possible but a sustained move below the trend mean would be required to question medium-term Dollar dominance, particularly against the Euro.

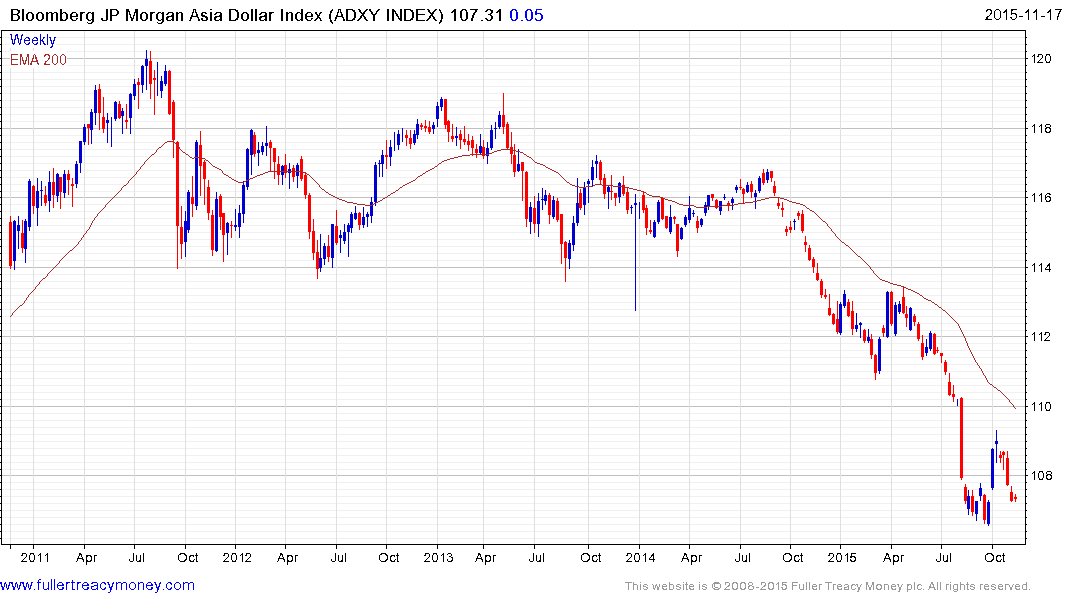

The Asian Dollar Index remains in a medium-term downtrend as it pulls back from the region of the 200-day MA. It will need to hold the 106 area if support building is to be given credence and a sustained move above the trend mean will be required to question the overall supply dominated environment.