Musings from the Oil Patch May 2020

Thanks to subscriber for this report by Allen Brooks for PPHB which may be of interest. Here is a section on battery metals supply:

The potential for a change in battery chemistry from lithium-ion to lithium-sulfur could help. A massive switch does not appear to be underway. The big change in EV battery technology – a move to solid state lithium batteries – appears to have been pushed out to 2030 or beyond, versus the prior expectation that it would arrive in the early 2020s. Now, battery research firms are focusing on how EV manufacturers may need to become involved in the procurement of battery raw materials, as well as completely revamping their supply chains to lower their cost.

The real challenge will be in the battery raw material procurement. A chart from Benchmark’s webinar shows what the limitation is for EVs. It is raw materials. In the firm’s forecast for 34 million EVs in 2030, it is expected that there will be sufficient lithium-ion battery manufacturing capacity to produce 43 million EVs. The challenge is that lithium supply will only meet the needs of 19 million EVs, while cobalt will only be able to supply 17.9 million EVs. Those limitations equate to roughly a 45% supply shortage.

One can certainly ask many questions about how investors will perceive EV manufacturers getting involved in mining operations to ensure adequate availability of raw materials for batteries. Or, will the EV manufacturers figure they will just leave this endeavor to battery suppliers? Who has the capital available for such new ventures? What are the geopolitical risks, depending on where new supply sources are found? Will the new supplies improve, or complicate the existing raw materials supply chains? Will we be held hostage to foreign suppliers? What are the ESG issues associated with mining rare earth minerals? There is the possibility of another potential supply source, that being recycling old EV batteries, although such efforts are currently uneconomic.

Here is a link to the full report.

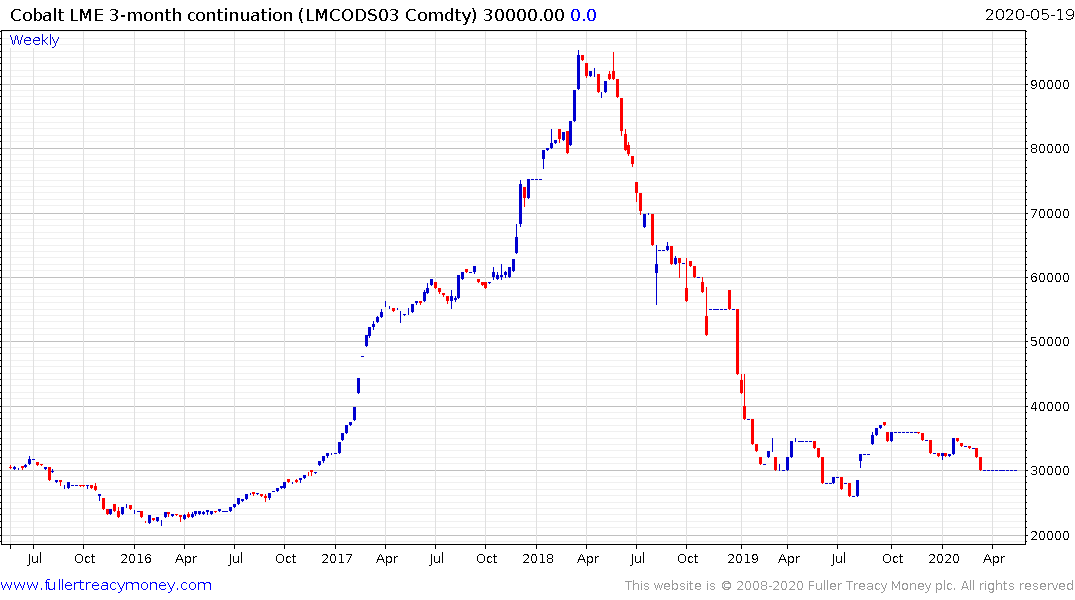

A number of the newest battery chemistries do not use cobalt. That is particularly true of the batteries Tesla is producing for its Chinese manufactured cars. The bubble in cobalt prices which peaked in 2018 alerted all manufacturers to the risk represented by supply inelasticity. The technological edge they have since developed means the metal will no longer be required to manufacture batteries or the use case will be substantially reduced. It’s a great example of the adage from the commodity markets that “the cure for high prices is high prices”.

At the other end of the spectrum nickel is being used even more in new battery chemistries. Concurrently cobalt is a by-product of nickel mining. The nickel price rallied today to break a nine-month downtrend and a clear downward dynamic would be required to question near-term scope for continued upside.

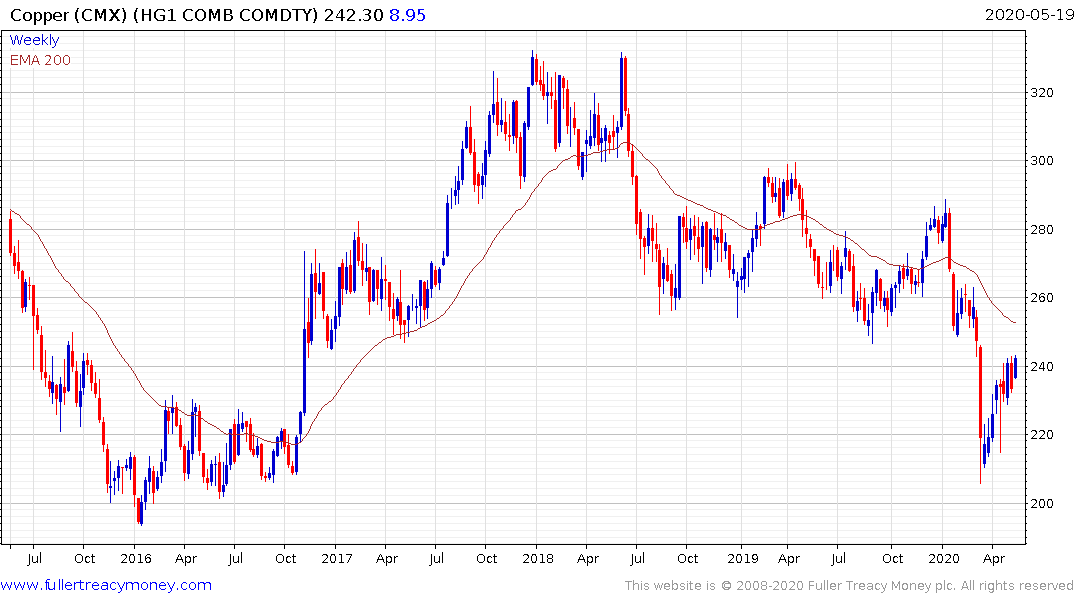

Copper has held a sequence of higher reaction lows since late March and a sustained move above $2.50 would confirm a failed downside break.