Musings from the Oil Patch December 13th 2016

Thanks to a subscriber for this edition of Allen Brooks’ ever interesting report for PPHB which may be of interest. Here is a section:

From GM’s viewpoint, it needs to generate sufficient ZEV credits to avoid sharp fines or being shut out of the California market entirely. One analysis went as follows: In 2015, GM sold 219,962 vehicles in California. To avoid fines, it needs state-awarded ZEV credits equal to 14% of the units sold, or 30,794. That can be achieved by selling 7,698 Bolts that earn GM four credits each, or 10,082 Chevy Volt plug-in hybrids, or a combination of the two. What GM understands is that ZEVs are compliance vehicles, so pricing the Bolt to both achieve its ZEV credit needs and take market share from other auto manufacturers can be a smart strategy, even if they are losing so much money per unit. If GM can earn more ZEV credits than it needs, those can be sold to other manufacturers who are falling behind their ZEV credit goals. This is all part of the clean air gambit in which companies that are “doing more than they need to” in meeting certain thresholds find that they hold pieces of paper that increase in value over time and can be successfully monetized. Selling $139 million of excess ZEV credits was what enabled Tesla Motors (TSLA-Nasdaq) to achieve third quarter profits on a GAAP basis.

But what are the economics of electric vehicles for buyers? The Associated Press’ automobile writer recently test drove the GM Bolt and interviewed the executive in charge of marketing it. Virtually everyone acknowledges that the car lacks outstanding design, but the word the GM exec uses to describe the Bolt is “practical.” For tech-savvy Millennials that sounds more like their grandma’s car. However, the Bolt is the first electric vehicle to get over 200 miles per charge (238 miles, exactly). It does have lots of interior space, a near-silent ride and emits no tailpipe emissions. Moreover, the Bolt can go from zero to 60 miles per hour in 6.5 seconds, out-muscling some muscle cars. Even more important, the Bolt is now at showrooms in California and Oregon, while its prime competitor – the Tesla Model 3 – will not be available until the end of 2017.The problem for the Bolt is its cost. The list price is $37,495 including shipping. After the federal tax credit of $7,500, the purchase price drops to $29,995, to which you need to add roughly $1,200 for a 240-volt home charging station, bringing your out of pocket expense to own a Bolt to $31,195. For comparison, a comparably equipped, gasoline-powered Chevy Cruze compact hatchback with automatic transmission costs $23,670 with shipping, a difference of $7,525.

Here is a link to the full report.

For a car GM is losing $9000 on, the price of $37,500 is still steep even if someone is dedicated to the ideal of an emission free future. That cost is going to have to come down if predictions of widespread uptake are to prove credible. The pace at which the energy density of batteries is doubling (around 5 years) is too slow to suggest the cost is going to come down quickly through technology alone. That is part of the reason Tesla is investing so heavily in economies of scale when building its battery manufacturing capacity.

GM has rallied impressively over the last size week and has held a progression of higher major reaction lows for more than a year. While somewhat overbought in the short-term a sustained move below $32 would be required to question medium-term scope for continued higher to lateral ranging.

.png)

Tesla has held a progression of lower rally highs for most of this year and will need to sustain a move above the trend mean to begin to signal a return to demand dominance beyond short-term steadying.

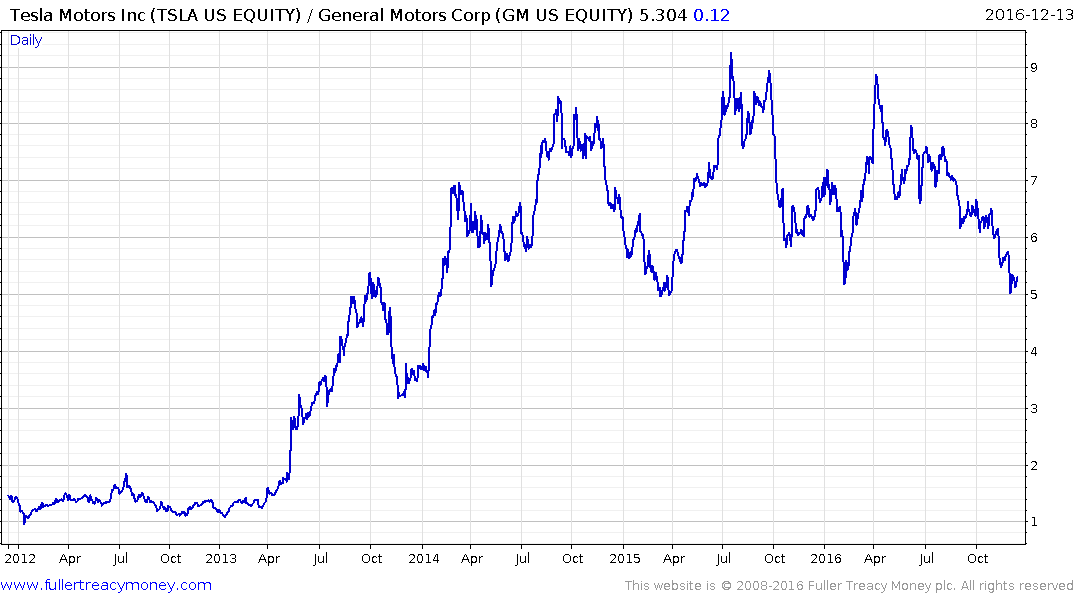

Interestingly the Tesla/GM ratio has returned to test the lower side of the range that has prevailed over the last four-years and a sustained move below 5 would be required to question near-term scope for Tesla to outperform.