Munger Defends Buffett's Deal

This article by Jason Zweig for the Wall Street Journal may be of interest to subscribers. Here is a section:

Mr. Munger, 90 years old and known for his bluntness, took on critics of the so-called tax-inversion deal, partly financed by Berkshire, in which Burger King Worldwide Inc. BKW -0.52% is planning to relocate to Canada in the wake of its proposed merger with Tim Hortons Inc. THI.T +0.42%

Mr. Munger, who is Berkshire's vice chairman, said that Ontario-based Tim Hortons is the larger of the two companies and, because "the bigger company should get the headquarters," anyone who thinks the deal is motivated purely by tax considerations is "stark raving mad."

Burger King is larger by stock-market value, though Tim Hortons generates more revenue.Mr. Munger made the comments at the annual meeting Wednesday of Daily Journal Corp. DJCO -2.18% , a small legal publishing and software firm in Los Angeles of which he is chairman.

The deal, announced last month, will move Miami-based Burger King's headquarters to Canada. The transaction has the potential to lower the combined company's tax rates, experts say, especially if the company succeeds in expanding internationally, though Burger King officials have said it isn't a tax-driven deal.

Mr. Buffett's involvement thrust the billionaire into a controversy over inversions. Companies say these moves are legal and necessary to keep up with global rivals already taxed at lower, foreign rates.

Charlie Munger’s comments on corporate inversions at this week’s Daily Journal AGM have been seized upon by journalists in what is an emotive issue, not least as the US heads towards the November elections amid increased calls for tax reform. However it was a throw away comment Mr. Munger made towards the end of his talk that has stuck with me.

“Berkshire Hathaway will be the biggest utility in the country within two years” I wasn’t sure he said two years and checked with the subscriber sitting next to me, who thought he might have misspoke but definitely said two years. Since Berkshire’s utility holdings are relatively insignificant relative to the USA sector, the upshot of such a decision suggests a major acquisition is in the pipeline.

There are two main parts to the utility sector – production and transmission. Production is subject to onerous carbon regulations, the need to diversify supply sources and sustain base load but there is a high barrier to entry. Transmission lines need to be repaired and distributed generation may require greater investment but by and large transmission lines represent an established infrastructure with solid cash flows.

According to Burlington Northern Sante Fe’s website they transport enough coal to power 10% of all of America’s homes. Berkshire Hathaway also owns 89.8% of MidAmericanHoldings Company which has substantial coal powered electricity generation activities. It’s not clear if this is what he meant when speaking of Berkshire’s impending dominance of the utility sector but perhaps they are thinking of an additional acquisition which would offer synergy to both businesses.

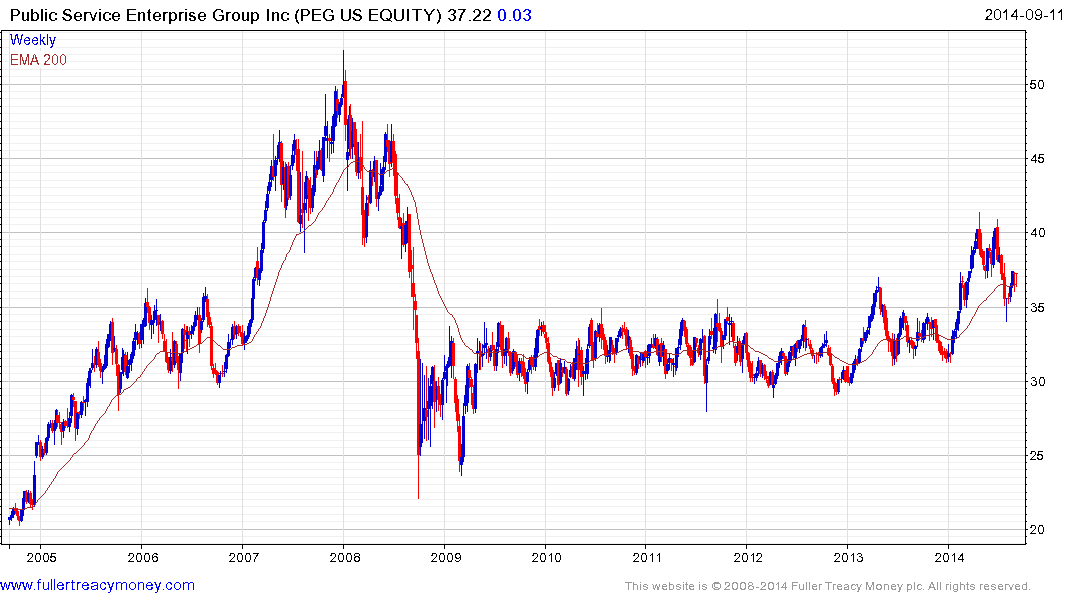

In the transmission sector two of the largest companies in the sector, PPL Corp and Public Service Enterprises appear to be forming first steps above their respective five-year base formations. They will need to find support on their current pullbacks if the recovery hypothesis is to remain credible.

Back to top