MSCI index change massive for China markets

Thanks to a subscriber for this article by Laura Suter for fundstrategy.co.uk which may be of interest. Here is a section:

The MSCI’s inclusion of Chinese American Depository Receipts (ADRs) into its indexes, which is expected to be announced tonight, is a “massive change” for the indexes, say experts.

The MSCI is expected to announce the inclusion of Chinese ADRs after US market close tonight.

The inclusion will occur in two stages: one at the end of November and another in May 2016.The move is big for China, says Eng Teck Tan, senior portfolio manager at Nikko Asset Management, and will see the representation of technology firms in the China index increase, while China’s share of the emerging market and global indexes will rise.

ADRs are predominantly invested in internet and technology firms, such as Alibaba, Baidu and Netease. The inclusion of ADRs will take the technology representation of the MSCI China index up from 13.5 per cent to 24 per cent by the end of May, says Mike Kerley, Asia fund manager at Henderson Global Investors.

This is an important development for Chinese companies because it unleashes a potent source of additional demand for their shares. Speculation MSCI would admit A-Shares to its global emerging markets portfolio contributed to the run-up in prices earlier this year and the expected announcement has contributed to speculative interest in Chinese ADRs on this occasion. Subscribers can review a comprehensive list of US listed Chinese companies in this section of the Chart Library.

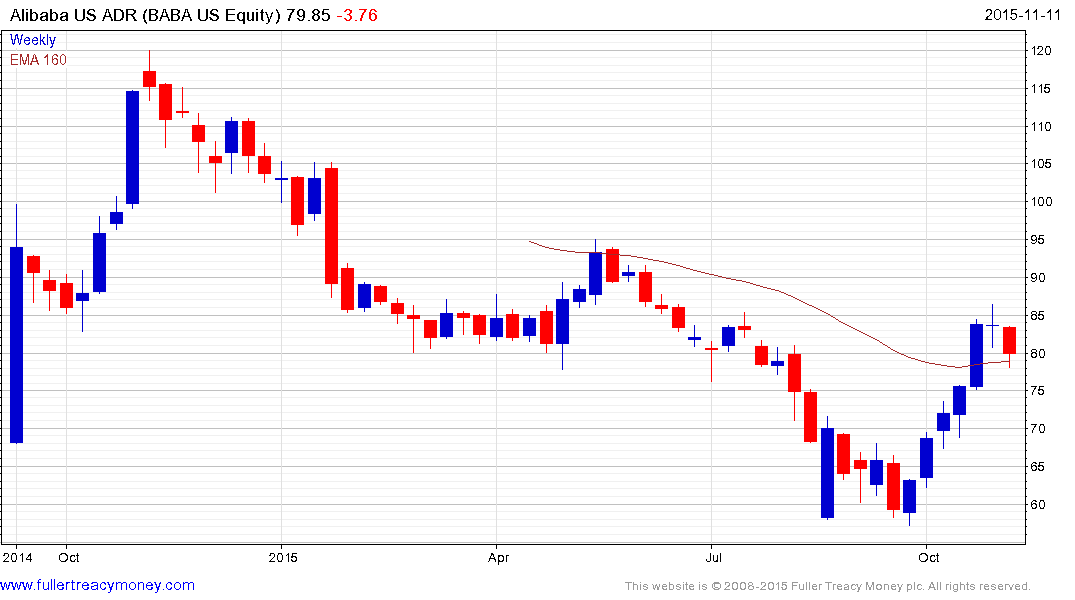

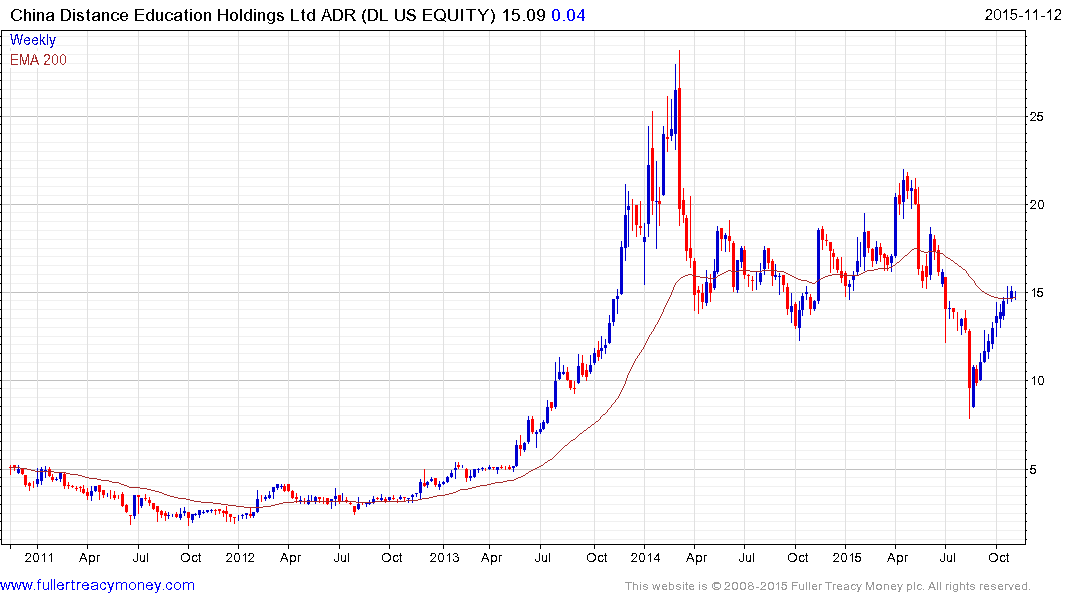

Major beneficiaries of the expected announcement rallied impressively over the last four weeks. Netease, Baidu, Alibaba and China Distance Learning among others have already staged impressive short-term rallies from their respective lows. Some consolidation of gains is possible following the announcement but the benefit of the doubt can be given to higher to lateral ranging provided they hold their respective lows.