Morning Tack "Leon Tuey Speaks!"

Thanks to a subscriber for this report from Raymond James which may be of interest. Here is a section:

Here is a link to the full report.

Here is a section:

Why the motormouths on Wall Street have so much trouble predicting the market's direction is difficult to comprehend. All they need is a clear understanding of the market's logic, the economic cause/effect relationships that drive the markets. They need to have an understanding and appreciation of the mandate of the Fed. As pointed out on numerous occasions, one of the key mandates for the Fed is to “maintain orderly economic growth and price stability.” It’s a dual mandate and it is statutory. The only other thing they need to remember is that the stock market is a leading economic indicator; the economy does not lead the stock market. When the economy slows and heads into a recession, investors don't need an IQ of Mensa to know what action the Fed will take; the Fed will use all means at their disposal to turn the economy around. (The most powerful tools at the Fed's disposal to affect monetary policy changes are the Basic Monetary Policy Variables - the Bank Reserve Requirement, the Discount Rate, and the Margin Requirement. I wonder how many gurus on Wall Street ever heard of this?). If it doesn't work, they will keep easing until the economy responds. The market being a leading economic indicator, therefore, always bottoms six to nine months before a recovery begins, not after.

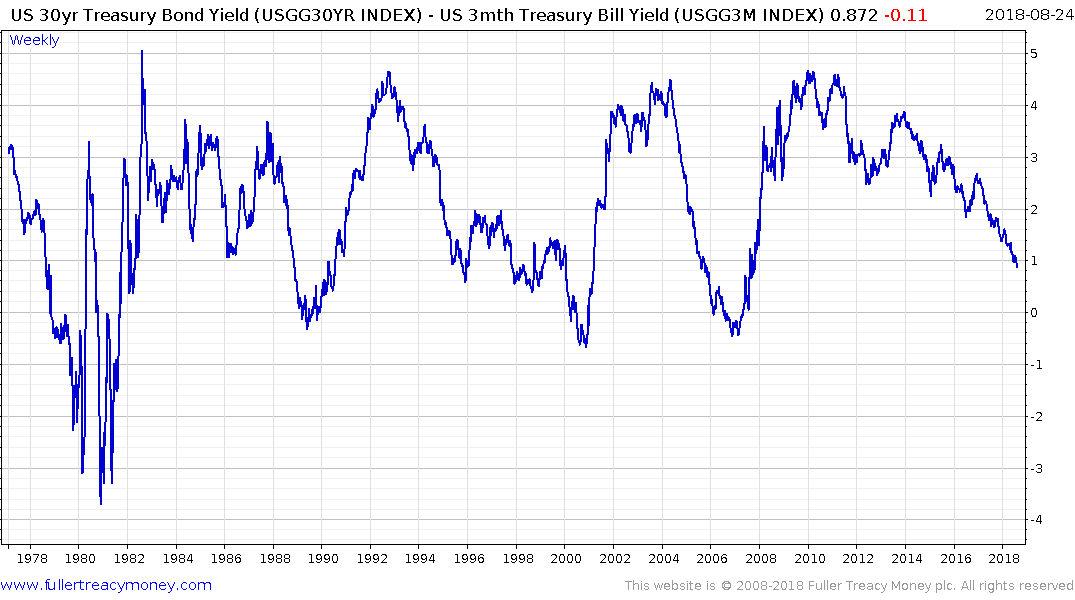

Conversely, when the economy overheats; inflation surges; and speculation is rampant, the Fed will tighten monetary policy by raising the Discount Rate multiple times in succession; by draining liquidity from the system; and invert the Classic Yield Curve. The market, being a leading economic indicator will have peaked and started to head south long before the onset of a slowdown or a recession. This is like night follows day. Yet, this simple logic escapes most on Wall Street. Anyone with an IQ slightly above room temperature would understand this.

Last week [August 13-August 17], "the market" reached another record high. "Not so!" growl the bears. No doubt, they will point out that the S&P 500 Index and the Dow Jones Industrial Average have not exceeded their respective January high. Clearly, they don't know which end is up. These are the same folks who will tell you that "the market" bottomed in March, 2009 which it didn't. "The bottom" was on October 10, 2008 when globally, investors panicked. On that day, over 90% of the U.S. stocks and most other world markets made their lows. These are the same folks who were certain that a bear market commenced in February, 2016, right at the bottom of the correction and a powerful rally ensued. In February of this year, they all thought the world was going to end, again.

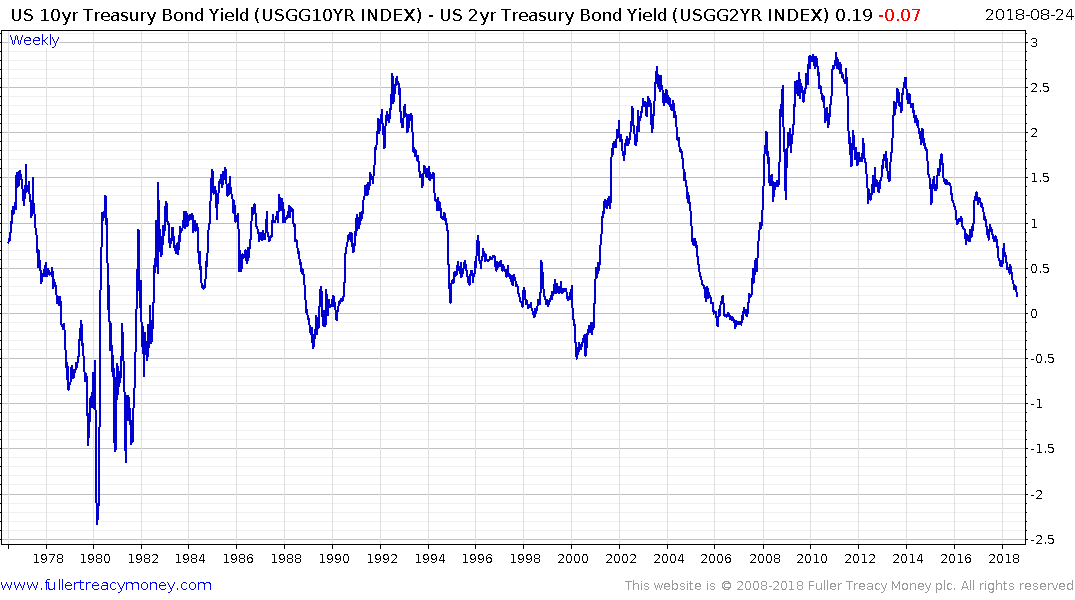

The classic yield curve referred to in the above segment is the difference between the 30-year and the 3-month yields. The more popular measure is the 10-year – 2-year spread. If we compare the two measures the former tends to be less volatile and the exact timing of when they invert also tends to be somewhat different with the longer-term spread being later. However, they are both reliable lead indicators of future recessions.

An important point to remember is that the yield curve tends to become inverted during the third psychological stage of medium-term and secular bull markets. Prices tend to rise for months after the inversion. In fact, it is just that performance that tends to make people question the efficacy of the signal. However, once we get an inverted yield curve, it is then that evidence of top formation has to be taken seriously rather than thinking that it will lead to a medium-term correction.

Right now, the Russell 2000 is leading, not least because of the influence of fiscal stimulus on the domestic US economy. The Index broke up out of its most recent range last week and a sustained move below the trend mean would be required to question medium-term scope for continued upside.