Morgan Stanley predicts huge Hargreaves pricing boost ¨C

This article by Sam Macdonald for FundWeb may be of interest to subscribers. Here is a section:

Hargreaves will announce its new pricing model tomorrow. Morgan Stanley had previously said the new model would have a negative effect on the firm's share price.

Morgan Stanley now says it expects Hargreaves' new pricing model to generate revenues of around 63bps, similar to its current pricing structure.

The firm's AlphaWise survey of 1,072 consumers showed that 38 per cent were willing to pay charges of 100bps on an investment of ¡ê10,000 with a further 24 per cent willing to pay 50bps. Some 16 per cent said they would pay 150bps on a ¡ê10,000 portfolio.

The firm also says platform pricing will be higher than first anticipated by analysts.

Morgan Stanley says: "In all, this leads us to revise our pricing expectations. Our new platform fees begin in Q4 2014 at 60 bps (57bps previously) falling to 56bps by FY2016 (49 previously).

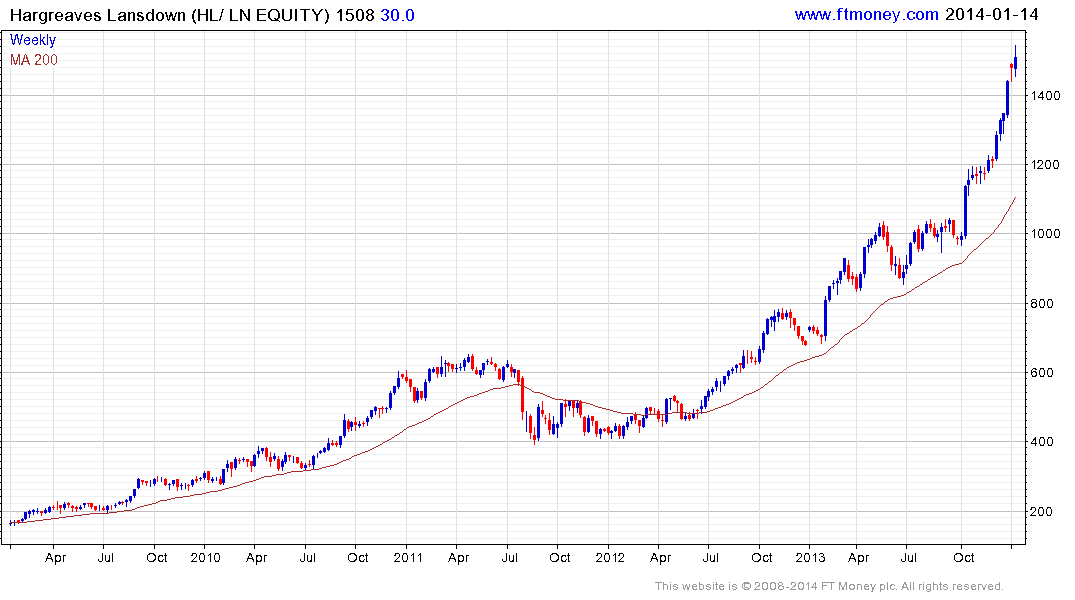

The UK's regulatory overhaul of the financial advisors sector, together with the requirement for a great deal of additional paperwork and qualifications has handed a competitive advantage to the largest providers of fund platforms, not least Hargreaves Lansdown which is accelerating higher.

The share is becoming increasingly overextended relative to the 200-day MA but a clear downward dynamic will be required to check momentum beyond a brief pause.

Elsewhere in the sector, Henderson Group has also been rallying impressively but pulled back sharply today and is in the process of forming a large downside weekly key reversal; suggesting at least a process of mean reversion is unfolding.

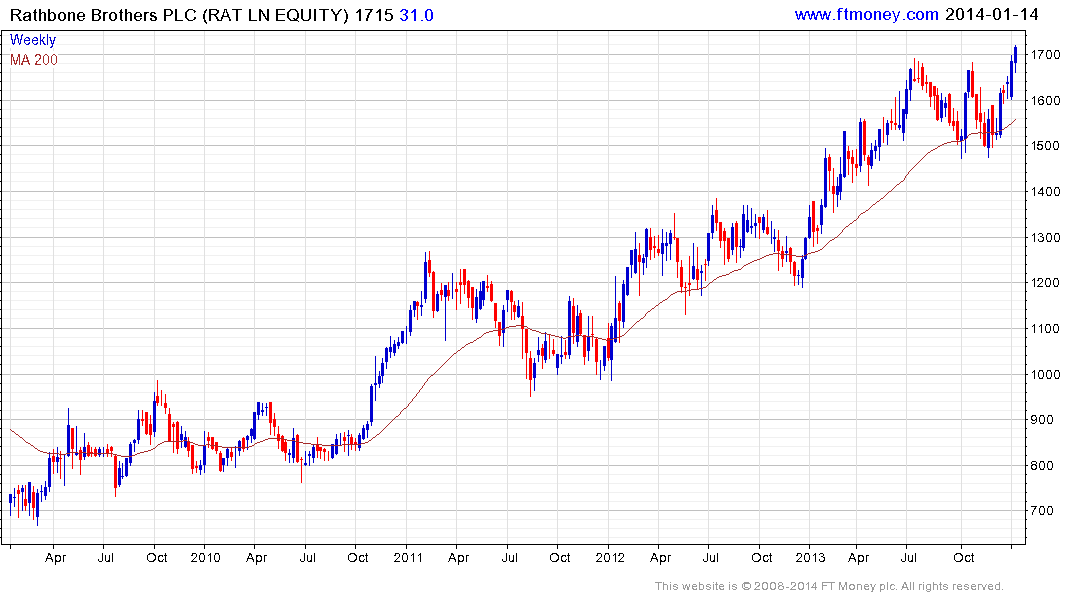

The pace of Rathbone Brothers' advance has been more moderate than either Henderson or Hargreaves but it remains consistent and broke out to new highs yesterday. A sustained move below the 200-day MA, currently near 1550p, would be required to question medium-term scope for additional upside.

Back to top