More U.S. LNG Heads to Brazil, Nearing Ranks of Top Asian Buyers

This article from Bloomberg may be of interest to subscribers. Here is a section:

More U.S. liquefied natural gas headed to Brazil last week, as the South American nation joins the ranks

of South Korea, China, and Japan as America’s top importers in 2021.

With 80 total cargoes in transit, at least ten tankers are currently destined for China, while six each are headed to Brazil and South Korea, according to vessel data analyzed by Bloomberg News. Year-to-date, Brazil is now just seven shipments behind Japan for third place in importing U.S. LNG.

Many of the cargoes to China have already been weeks in transit, but at least one left in September as the nation tries to curb demand amid higher prices. At least two September departures are headed to Brazil, which continues to battle drought impacting the nation’s hydroelectric power.

U.S. export supply has been unabated recently as the five-day moving average for net flows was measured at 11.0 billion cubic feet on Sept. 8, 4.9% higher than the year-to-date average.

Exporters have loaded 19 tankers thus far in September, a 4.4% cargo-per-day decrease from August, when 88 cargoes were exported.

Brazil’s drought has resulted in a significant demand shift in the liquefied natural gas markets. The country normally relies on hydro to provide electricity but those plants have been running below capacity for two years. The below chart of rainfall at hydro plants suggests the nearest relief tends to arrive in the early part of the year in line with seasonal factors.

That suggests continued demand for LNG cargoes for the at least the next few months. The added expense of burning imported gas rather than domestic hydro is a significant cause of the perception rising inflation. Additional demand drivers for LNG have also been a significant cause of energy cost inflation in the UK and Europe as natural gas prices have surged higher this year.

The Nordstream 2 pipeline is now in place. The only question is how long full commissioning will take. Gazprom wants to begin sending gas through the pipeline by October 1st. That will depend on how long German regulators take to make a decision. The supply shortage which has plagued European gas markets will not last indefinitely. The acceleration in prices is unlikely to be sustained beyond the short term.

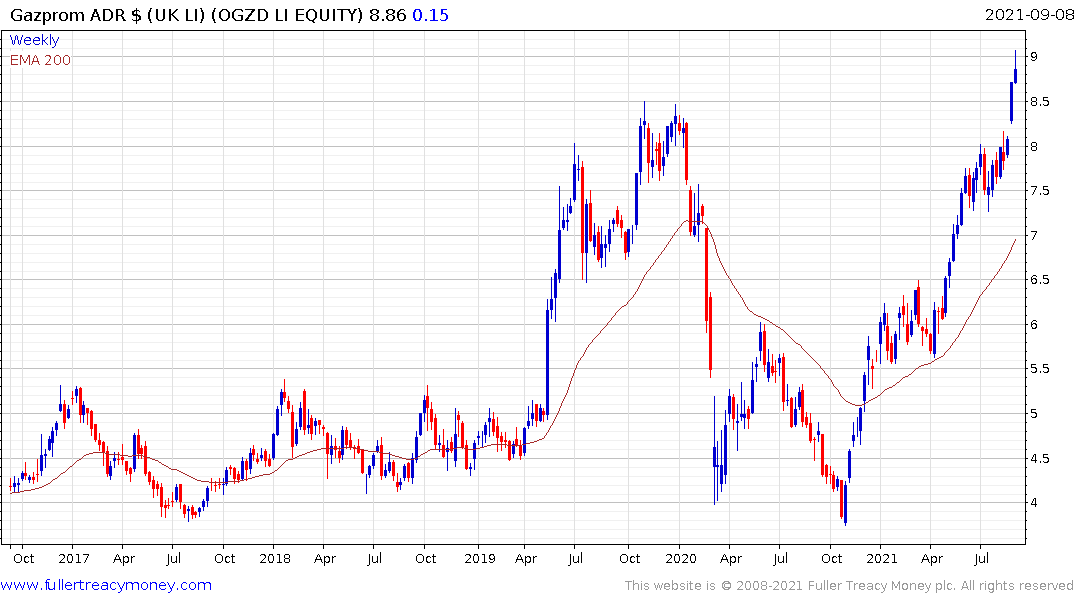

Gazprom PJSC hit a new recovery high today but is somewhat overbought in the short term.

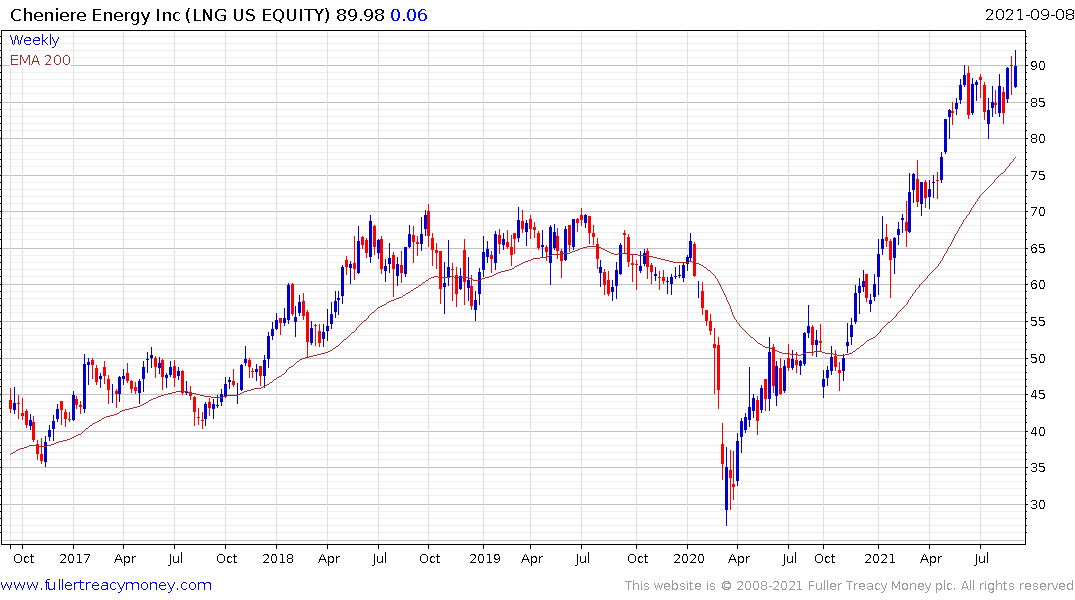

Cheniere Energy briefly hit a new high today too. The share has been consolidating in the region of the 2014 peak for the last few months and a sustained move below $80 would be required to question medium-term scope for continued upside.

Among LNG tanker companies, Exmar is steadying from the region of the trend mean.

Among LNG tanker companies, Exmar is steadying from the region of the trend mean.

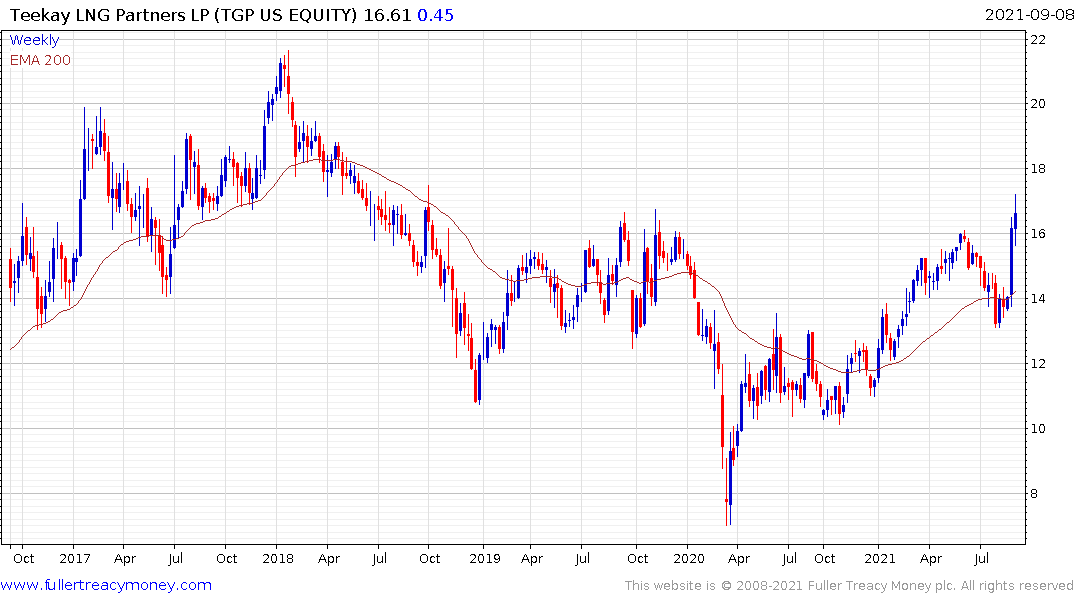

Teekay Energy Partners broke out to new two-year highs to complete its base formation this week.