Minutes of the Federal Open Market Committee

This transcript may be of interest to subscriber. Here is a section on how the balance sheet will be run down:

Participants continued their discussion of issues related to potential changes to the Committee's policy of reinvesting principal payments from securities held in the SOMA. The staff provided a briefing that summarized a possible operational approach to reducing the System's securities holdings in a gradual and predictable manner. Under the proposed approach, the Committee would announce a set of gradually increasing caps, or limits, on the dollar amounts of Treasury and agency securities that would be allowed to run off each month, and only the amounts of securities repayments that exceeded the caps would be reinvested each month. As the caps increased, reinvestments would decline, and the monthly reductions in the Federal Reserve's securities holdings would become larger. The caps would initially be set at low levels and then be raised every three months, over a set period of time, to their fully phased-in levels. The final values of the caps would then be maintained until the size of the balance sheet was normalized.

Nearly all policymakers expressed a favorable view of this general approach. Policymakers noted that preannouncing a schedule of gradually increasing caps to limit the amounts of securities that could run off in any given month was consistent with the Committee's intention to reduce the Federal Reserve's securities holdings in a gradual and predictable manner as stated in the Committee's Policy Normalization Principles and Plans. Limiting the magnitude of the monthly reductions in the Federal Reserve's securities holdings on an ongoing basis could help mitigate the risk of adverse effects on market functioning or outsized effects on interest rates. The approach would also likely be fairly straightforward to communicate. Moreover, under this approach, the process of reducing the Federal Reserve's securities holdings, once begun, could likely proceed without a need for the Committee to make adjustments as long as there was no material deterioration in the economic outlook.

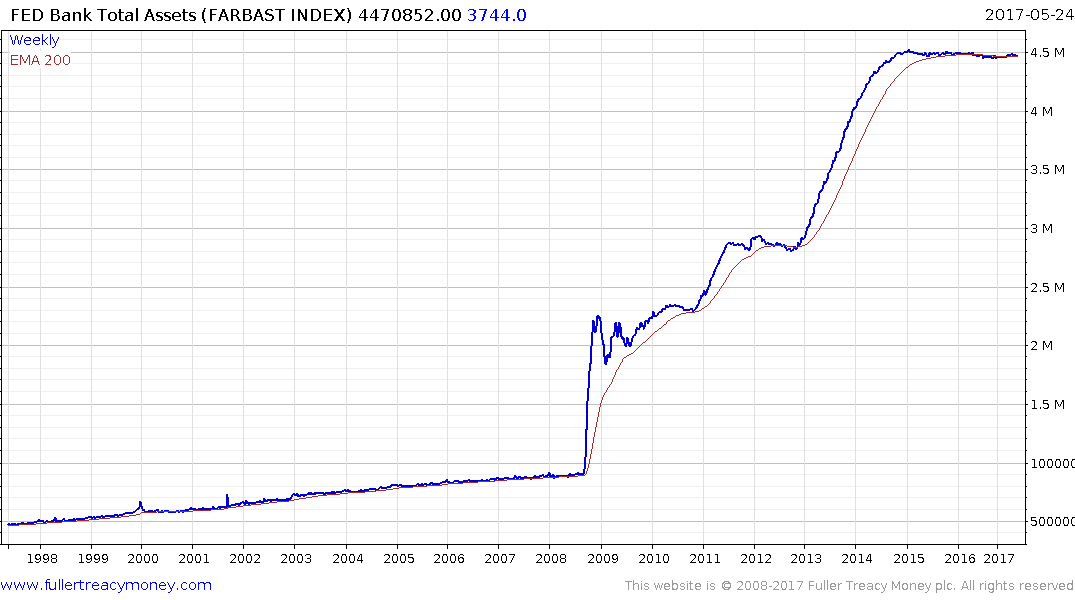

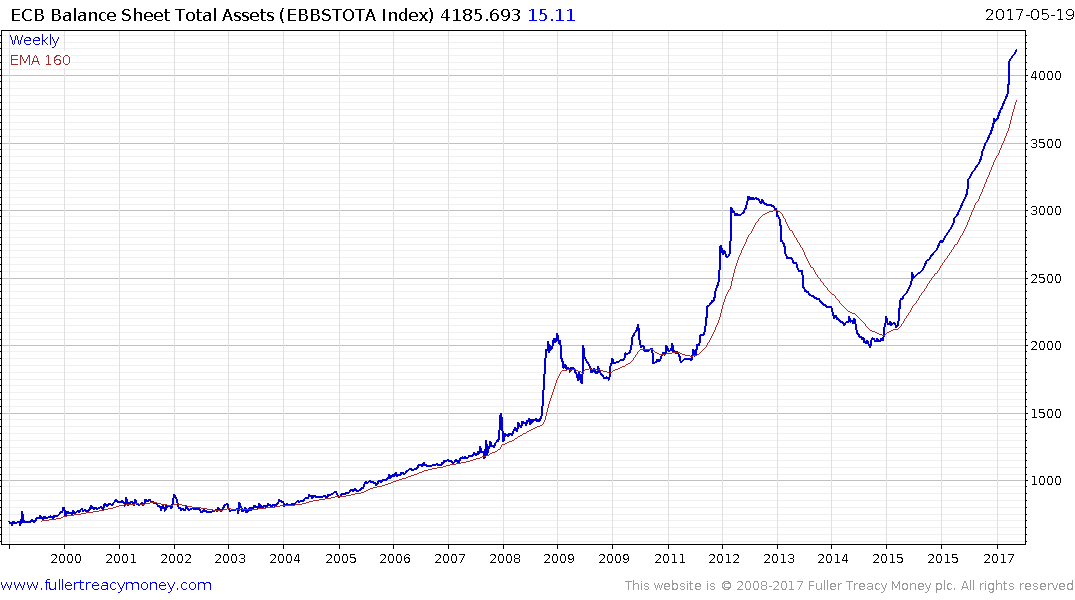

Over $4 trillion is still a lot of money, even in the bond markets and how the Fed succeeds in shrinking that number is going to have a significant effect on both the markets and the economy. The ECB embarked on a similar policy between 2012 and 2014; taking €1 billion off its balance sheet so we have a template for what effect that might have on other asset classes.

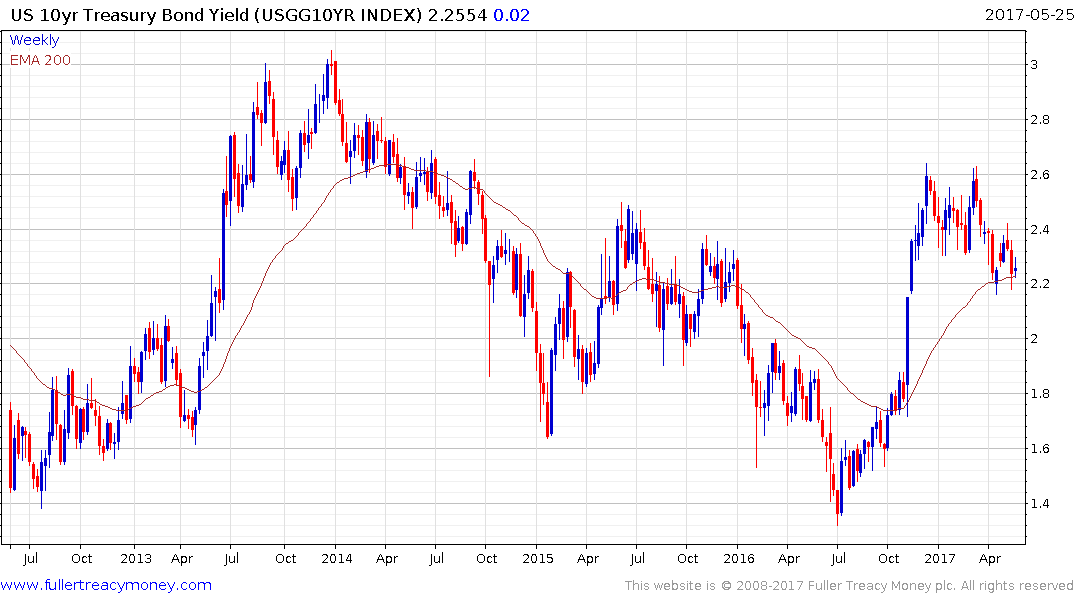

Unsurprisingly it is not great news for bonds. When the Fed does not reinvest maturing issues or reinvest coupons it creates a dearth of demand for new issues which the rest of the market has to fill. Between 2012 and 2014 German Bund yields rose from 1.2 to 2% before collapsing as the market began to price in the ECB reversing course.

.png)

Throughout that period the Euro was firm because the supply of the currency was falling as the effect of the ECB running down its balance sheet withdrew Euros from circulation.

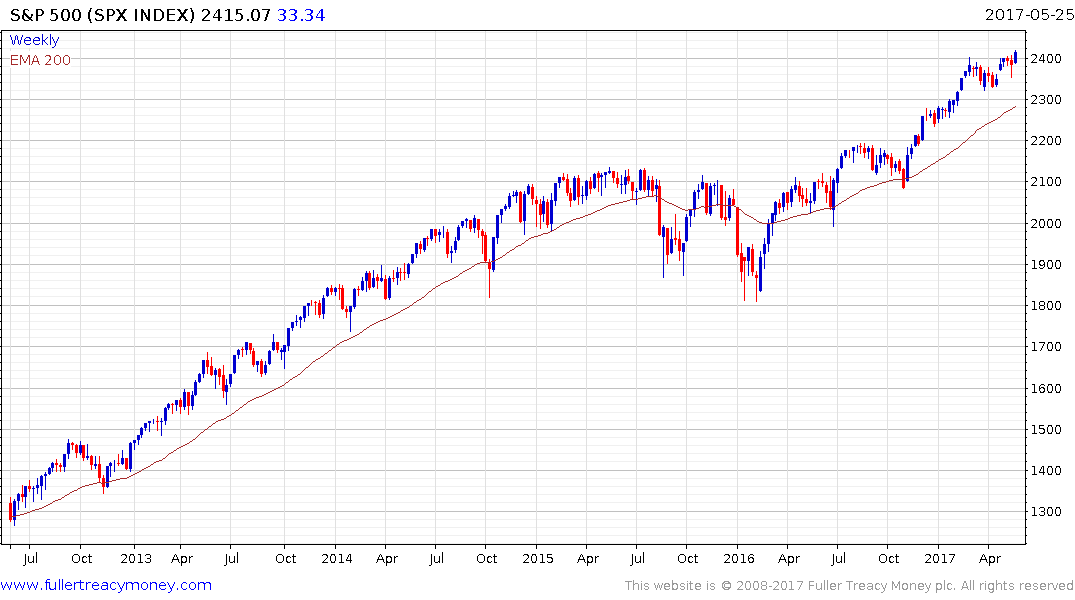

It was also a particularly strong period for the stock market not least because while the ECB was withdrawing supply the majority of other central banks were still printing.

The Fed has specified the words “gradually” in its statement so while we do not yet know what that means we can be potentially conclude it will be in the order of $40 billion a month and will be equally spread between Treasuries and mortgages. It will be at pains to try not to influence the market but the removal of a major source of demand is a significant event and sure to influence bond investors.

Right now US Treasury yields are hovering around 2.2% which coincides with the April low and the region of the trend mean. A sustained move below that level would be required to signal a return to demand dominance.

Currencies are always a ratio so if the ECB is still expanding its balance sheet while the Fed is shrinking its balance sheet that should be positive for the Dollar. The Dollar Index has been retreating since the turn of the year and there is little evidence just yet of a change in the direction of trading.

Reducing the size of its balance sheet could reduce pressure on the Fed to raise interest rates which could steepen the yield curve if longer-dated yields rise. That would be good for the banking sector and would help increase margins and their ability to make loans. That could improve the outlook for the stock market.

Of course it is also worth considering why the ECB had to reverse course. The withdrawal of monetary fuel from the bloc’s economy has sharply deflationary effects. That suggests that when the Fed says it is going to take a gradual path it means it.

Back to top