Mining Supply

Thanks to a subscriber for this note by Jim Sinclair which refreshes the mining supply cliff argument for gold mining which has been a mainstay of the gold market for as long as I can remember at least. Here is a section:

Please review the charts below "Mine Supply since 1970 and Projection to 2030" produced by Dan Popescu via Thomson Reuters Eikon. These charts indicate that in the coming years, the mine supply will be reduced by half of its supply during 2018. Mr. Popescu is an independent gold/silver analyst whose projections in the mining supply are consistent with my own. Few investors understand the gold industry, and the reasons for the approaching decline are numerous and industry specific. An understanding of the gold mining industry is necessary in order to understand why the mining supply of gold is dramatically and rapidly shrinking. Junior gold producers and new miners will have an almost impossible task to achieve what Tanzanian Royalty has already achieved thus far. The analysis to support these charts is dry and complex subject matter, which I hope to provide in the most easily understandable read...

Secular bull markets in commodities result in step-ups in the marginal cost of production. Prior to the commodity bull market, it was common to see production costs at around $200- $400. Today that figure is generally between $700 and $1000. Additional new supply needs to come in below $1200 to have any chance of development. Additionally, since prices were trending lower between 2013 and 2016 there were very few people who were willing to finance mining expansion plans of any hue, much less gold.

In order to reinvigorate appetite for investing in new mine supply prices will have to rise. However, the price will not rise unless there is sufficient demand to keep it at elevated levels. The renewed weakness of the Dollar, and rising inflationary pressures are a potential bullish catalyst for precious metals.

Gold is now at the upper side of its developing 18-month range. Veteran subscribers and gold investors will remember that it was not unusual for gold to spend 18 months ranging during the early to mid-stages of its bull market from 2003. At the same time, those lengthy medium-term consolidations were generally completed in Septembers. While a short-term overbought condition is evident, a clear downward dynamic would be required to check potential for additional upside.

Silver has lagged gold’s performance for much of the last six months but is currently firming from the region of the trend mean and the odds of the downward bias to trading being resolved with an upside breakout are improving.

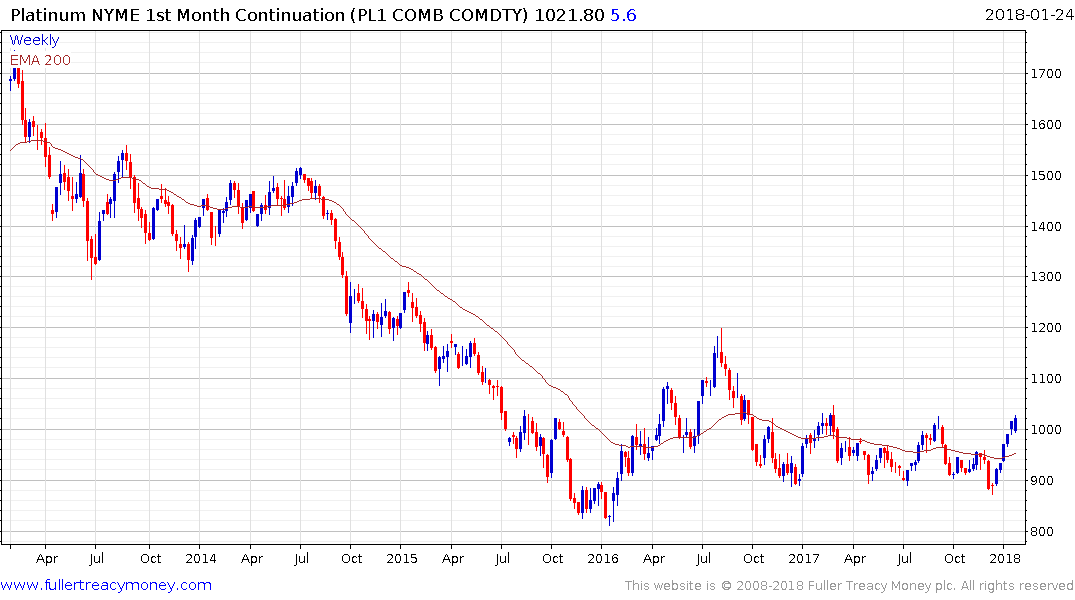

Platinum is consolidating in the region of its 2017 highs and will need to sustain a move above to confirm a return to medium-term demand dominance.