Micro-grids at the threshold

Thanks to a subscriber for this report from Berenberg Thematics which may be of interest. Here is a section:

Batteries allow micro-grids to tap multiple revenue streams: Storage is helping micro-grid to transition beyond suppliers of just back-up power. Aggregation of storage and generation assets within a micro-grid creates a VPP and is capable of providing much-needed resiliency services to the central grid. Demand for these services is more than doubling every five years due to rising renewables in the generation mix. In Europe, this trend will likely continue considering targets to increase renewables by 20% by 2020.

Block-chain and batteries make electricity trading possible: Utilities in the US and Europe are trialling block-chain technology, which, coupled with storage, can enable electricity trading within and also between micro-grids. Unhindered electricity trading is necessary if we are to overcome the intermittent, geographical and seasonal limitations of renewables. Batteries only offer a limited solution as overcoming these issues in the absence of fossil fuel generation would need uneconomic oversizing of storage capacity.

Smart grid will be based on storage, micro-grids and electricity trading: We forecast the grid-connected micro-grid market globally to grow to $10bn by 2021 from under $0.5bn in 2016. Battery storage (residential and large) is estimated to play a major role and we expect 30GWh of micro-grid, which translates into a $5bn market opportunity by 2021. Fuel cells could be important for micro-grids as they are the most efficient generation technology – 15% adoption of fuel cells in microgrids will translate into 7.5Gw of demand and a market worth more than $2bn.

Here is a link to the full report.

Electricity traders have represented one of the largest demographics at The Chart Seminar over the last few years. At least part of the reason for that interest in Behavioural Technical Analysis is because it is a market with a bewildering array of fundamental inputs; coming with a slew of local considerations which contribute to volatility. That is before one considers the innate volatility of the energy markets. Therefore, an understanding of crowd psychology, the rhythm of markets and how one market can affect another are valuable tools which are going to be all the more important as the energy markets fracture with the growth of microgrids.

Utilities have long paid out strong reliable dividends because they control networks with high barriers to entry which consumers have no choice but to participate in. The additional overlay of regulatory supervision is both a protection for established providers as well as an inhibiting factor in innovation. It is exactly the staid nature and strong cash flows of the sector which make it ripe for disruption as technological innovators continue to pressure long established mores.

Only last week I was chatting with a property developer whose next venture is to build off grid homes in the canyons around Los Angeles. The plots he has acquired are comparatively cheap because they are not served by utilities but are proximate to highly prized real estate locations. He aims to achieve this by employing solar panels, batteries and onsite wells all of which have collapsed in price over the last decade.

That growth of independent living is both a reaction to the high cost of real estate and energy as well as a renewed sense of libertarianism which one might think of as a modern version of homesteading. Over the summer there was a great deal of media attention about the creation of a microgrid based on the Ethereum blockchain in Brooklyn. It allowed property owners with solar panels to sell electricity to their neighbours without recourse to the utility for anything other than access to the network.

Nevada’s decision last year to side with utilities and force solar electricity providers to pay for access to the network is an important consideration regarding the growth of microgrids. If I have an energy production source and you are a consumer, I need to get you the electricity on a net basis but the system only works if the entire network sustains base load. That means some form of utility will need to be somewhere in the background and there is a cost to maintaining the network.

The energy intensity of developed markets has been trending lower for some time as the services sector has grown in importance. The domestic sector is now the largest consumer of electricity in the UK for example. More than any other factor that represents a challenge for utilities because the rollout of electric vehicles, domestic batteries and solar panels means that electricity is quite possibly the transportation fuel of the future which is a bullish factor for utilities but the incentive to generate one’s own electricity is growing all the time.

Here is an additional section from the above report:

Flow batteries offer even further reductions in the cost of storage. The main reason for this is while the overall cost of the system could be similar to lithium ion at $300/kWh, it can be cycled indefinitely as the electrolyte that stores energy in the system does not degrade with time. Let us assume that a conservative 20,000 cycles (and 100% depth of discharge) for a flow battery system would translate into a levelised cost of $0.015/kWh. This is the reason why in the US power purchase agreements of solar plus flow battery-based systems have been signed at $0.045/kWh. A US flow battery company claims it can provide solar plus storage system at a levelised cost of as low as $0.04/kWh. This is nearly free and reliable electricity and shows that there is no reason why renewables with storage cannot be much cheaper than central generation and transmission.

Utilities may initially have to build more generating capacity, but could quickly be overtaken by domestic capacity. In turn that will require a smart grid and potentially even more network capacity. In either or both cases utilities are facing into an investment cycle which will likely require capital raises and potentially put pressure on dividends. The recent downward pressure on National Grid for example may reflect that need.

Meanwhile the companies providing the required infrastructure should benefit.

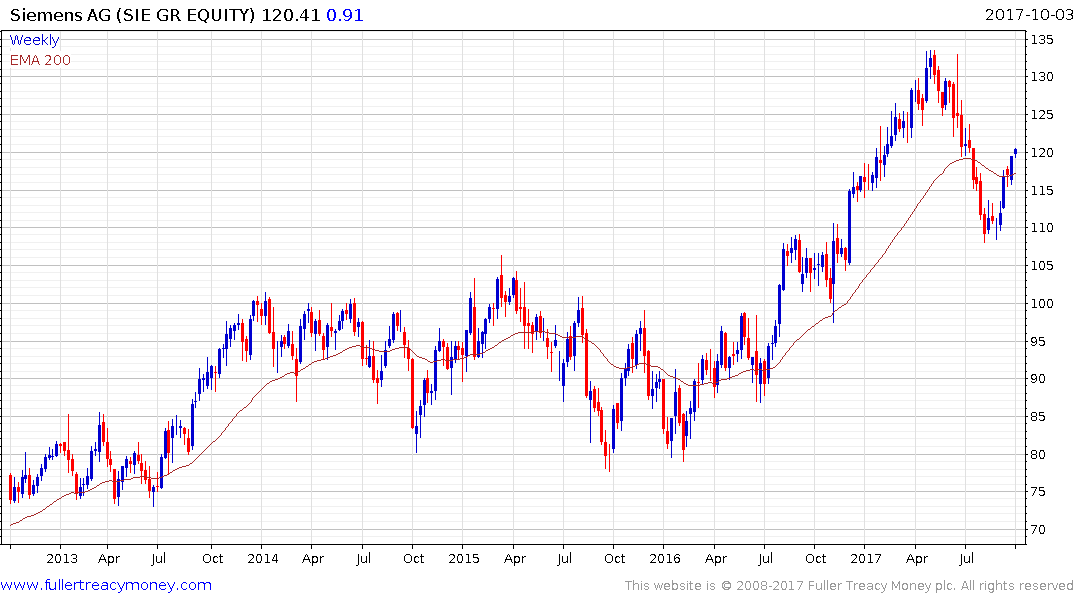

Siemens pulled back in a high beta manner relative to Europe but has bounced in a similar manner over the last few weeks as the region found support; aided by the weakness of the Euro.

ABB is leveraged both to providing energy networks and industrial automation. It has also bounced over the last couple of weeks and is back testing the upper side of a seven-year range.

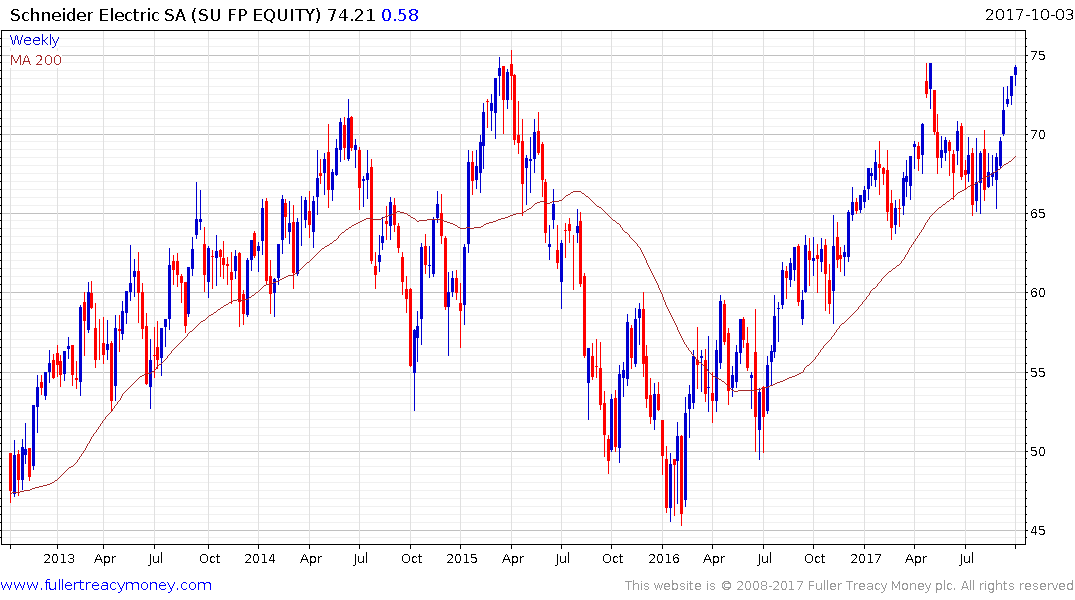

Schneider Electric is also back testing its peak of the last few years and while somewhat overbought in the very short term, a sustained move below the trend mean would be required to question medium-term scope for additional upside.