Mexico's Trump-Fueled Rout Belies Latin America Markets Bonanza

This article by Ben Bartenstein, Aline Oyamada and Isabella Cota for Bloomberg may be of interest to subscribers. Here is a section:

“Latin America will recover more than other regions in GDP terms and do more reforms,” said Dehn, a London-based head of research at Ashmore Group, whose top pick is Brazil.

President Michel Temer’s push to pass spending and pension overhauls is another reason investors remain bullish on Brazil.

The real has jumped 19 percent this year, the second-largest advance in the world, helping bolster returns in local bonds. It will soar another 10 percent by the second-quarter of 2017 before weakening to 3.4 per dollar by year’s end, according to Gustavo Rangel, the chief Latin American economist at ING Financial Markets LLC and the region’s top currency forecaster last quarter, according to Bloomberg rankings.

While Brazil’s prospects continue to improve, Mexico’s outlook is more mixed. Trump’s pledges to rip up the North American Free Trade Agreement and build a wall along the southern border have unsettled investors in assets from the region’s second-biggest economy, with the peso plunging 16 percent this year. Mexico sends almost 80 percent of its exports to the U.S.

For almost a decade the Dollar trended consistently lower against the currencies of commodity producers and emerging markets. That ended a few years ago and currency market volatility now plays an important role in any consideration of when and whether to invest in these markets.

The collapse in oil prices late last year sent shock waves through market’s dependent on energy exports and its bounce this year was represent a powerful catalyst for a rally. The Dollar’s post-election rally has put pressure on emerging markets once more while oil’s continued relative strength in response to the OPEC supply cut has supported energy producers.

The iShares Brazil ETF has broken its progression of higher reaction lows evident since January and is now testing the region of the trend mean. It will have to find support soon if potential for higher to lateral ranging is to be given the benefit of the doubt.

The iShares Mexico ETF has been trending lower since 2013 and is barely steady in the region of the January low

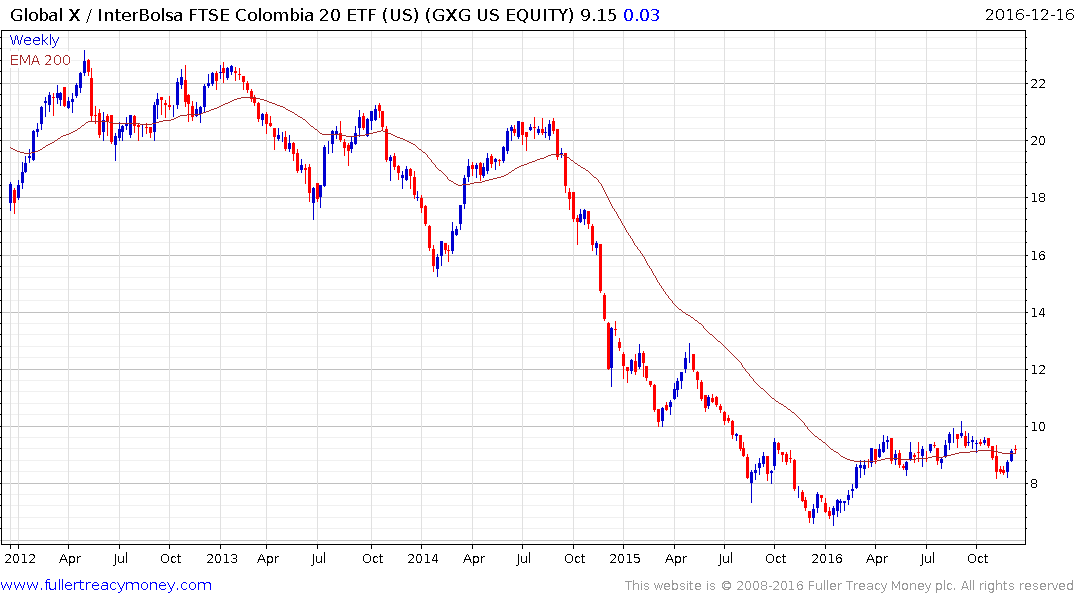

The Global X / InterBolsa FTSE Colombia 20 ETF has base formation characteristics but will need to sustain a move above $10 to confirm a return to demand dominance.

The iShares MSCI All Peru Capped ETF staged a particularly impressive rally from early this year. It has been confined to a ranging consolidation since August. A sustained move below the trend mean would be required to question medium-term scope for additional upside.

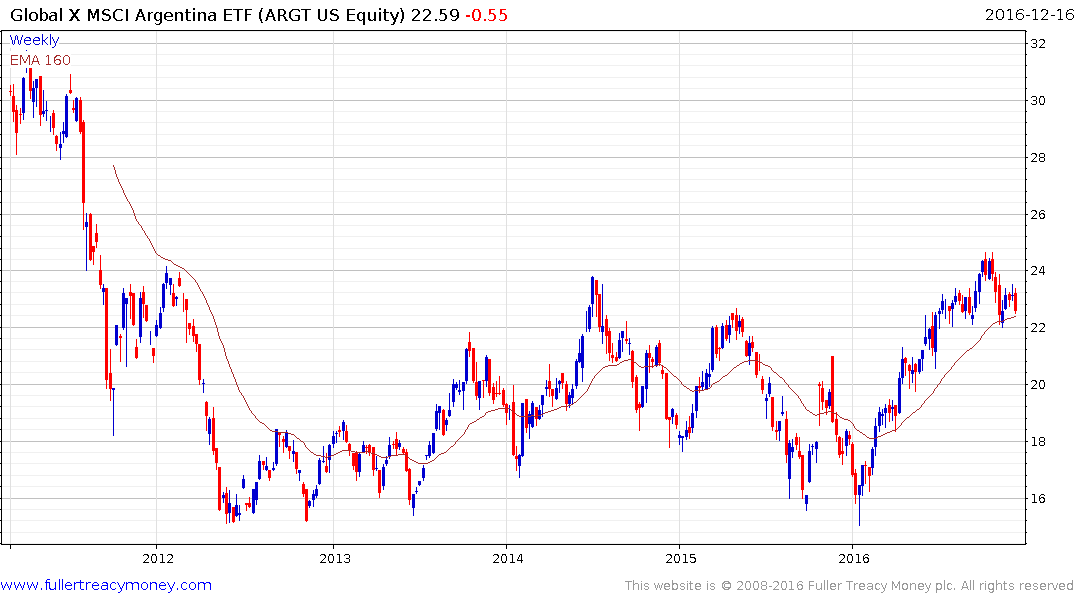

The Global X MSCI Argentina ETF has been rallying for most of the year but has lost momentum over the last month and will need to hold the $22 area if potential for additional upside is to be given the benefit of the doubt.

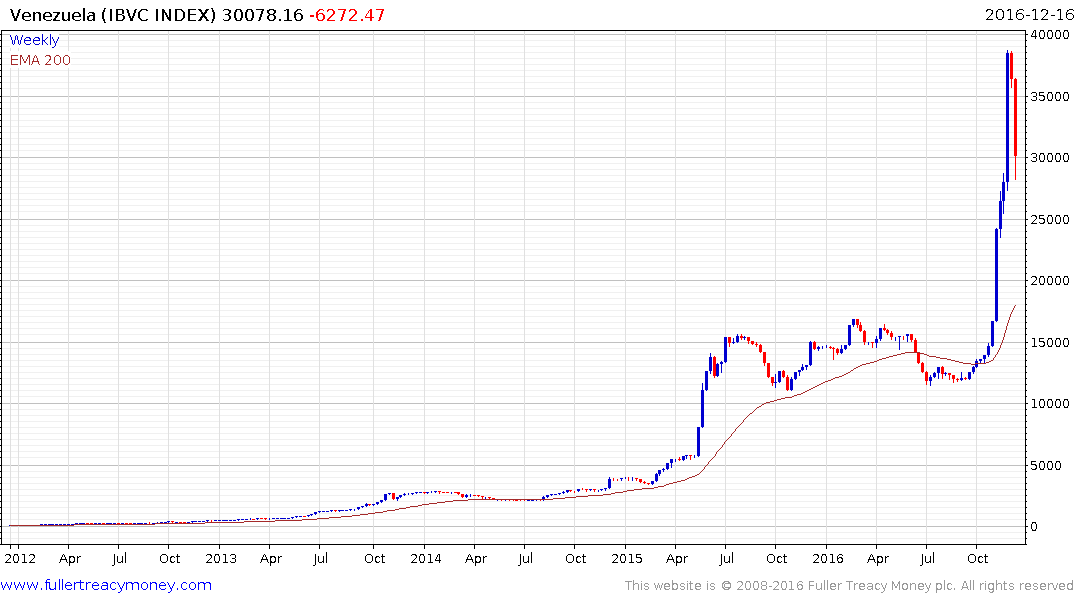

Venezuela is not an investable market and is subject to hyperinflation which is reflected in the stock market’s nominal performance.