Megacaps Are Now S&P 500's Curse as Smart Beta Gets Payback

This article by Dani Burger for Bloomberg may be of interest to subscribers. Here is a section:

The reversal of fortunes holds a bullish signal at a time when few can be found, marking a restoration of breadth in a market that saw some of its narrowest gains on record last year.

Beneficiaries include the large swath of smart beta funds that seek to neutralize the impact of megacaps, a strategy that saw outflows in the last four months after stumbling in 2015.“Due to the S&P 500’s market-cap construction, looking back over the last 12 to 24 months, large companies masked a lot of the pain that’s been borne by the more common share price,” said Eric Wiegand, senior portfolio manager at the Private Client Reserve of US Bank in New York, which oversees $128 billion. “Beginning to see that broaden out sets a much healthier undertone.”

?Wider gains are part of a subtle normalization in the U.S. stock market after its worst start ever, evidenced by a loosening in relative valuations among companies and greater dispersion in price returns. Correlations with oil and currencies have unwound as big-picture concerns such as the global economy, China and the Federal Reserve eased.

Diminished breadth not only crushed size-agnostic strategies in 2015 but meant that megacaps obscured the market’s fragility. Fewer stocks went up, with the 10 biggest by market value rising more than 20 percent while the rest of the S&P 500 fell 3.5 percent on average, the biggest gap since 1999.

The lack of breadth in the wider market was a topic of concern last summer ahead of the August drawdown and was also a factor in the steep decline in January. However with so many shares pulling back in January the subsequent bounce has been broad-based which has contributed to the outperformance of the equal weighted index of late. Additionally the outperformance of most of the top-10 largest cap shares last year suggested they were unlikely to be capable of turning in a similar performance this year.

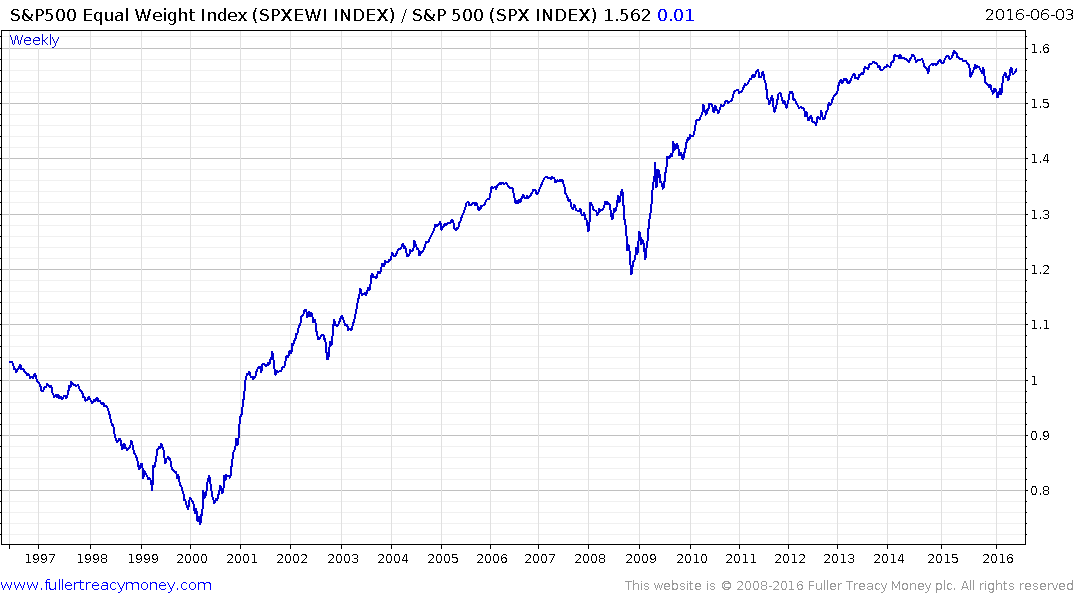

The S&P500 Equal Weight Index/S&P500 Index ratio highlights this movement. The Equal Weight Index found relative support in January and continues to bounce. A break in the progression of higher reaction lows would be required to signal a deterioration in market breadth.

.png)

In nominal terms, the Equal Weighted Index underperformed by so much last year that even with an impressive rally it has not yet rallied back to test the peak near 3400. Nevertheless, a sustained move below 3150 would be required to question potential for additional upside.

The Russell 2000, which had also underperformed because of a deterioration in market breadth, found support three weeks ago in the region of the trend mean and moved to a new recovery high last week. A sustained move below 1100 would now be required to question potential for additional higher to lateral ranging.