MedTech DataBook

Thanks to a subscriber for this heavyweight 326-page report from Kristen Stewart for Deutsche Bank. Here is a section:

HCA noted that admission growth was just below 1% for the first quarter; however, the company noted that it is too early to call it a trend. HCA is optimistic that it has several things that are providing some support i.e. recovering economy in many of markets it tends; health reform and to a lesser extent some natural utilization rebound. HCA pointed out that it is optimistic about what it has seen in terms of volumes although it cautioned that it is too early to call it a trend. Additionally, management noted that in 1Q14, the healthcare reform was a growing number for them and it reiterated that it was very encouraged with the trends that it has seen throughout the quarter (HCA reported its health reform numbers along with its 1Q’s results).

Tenet noted that the inpatient admissions and outpatient visits in the states that expanded Medicaid were both up 17% in Tenet’s facilities. Emergency Department volumes were up 25% while there were substantial declines in the volumes of uninsured charity patients in inpatient, outpatient and the ED (down 33%, 24% and 28% respectively). Based on these results, management noted that there has been a substantial conversion of uninsured into paying status early in the year. Management believes that this is a very helpful indication of how health reform is working, and it thinks that it is also very encouraging to the extent that states that have not yet expanded Medicaid will do so at some point in the future.

In regards of the non-expansion states, Medicaid inpatient admissions declined 1% while outpatient visits and ED volumes grew 1% and 2% respectively.

Uninsured and charity volumes in non-expansion states increased 2% in inpatient admissions while decreasing 10% and 6% in outpatient and ED visits, respectively. Net/net the payer mix trends are largely favorable with clear differences in Medicaid expansion states.

Community Health Systems estimates that over the next three years its uninsured adjusted admissions could decrease from about 8% (today) to 4% (2016), which translates into approximately $800 million (4% of about $20 billion revenue) of additional revenue before any reductions or bad debt or co-payment issues. Moreover, management expects healthcare reform to contribute 0.5% to 0.8% to its EBITDA in 2014. Management noted that both CHS and HMA are well positioned to participate as a network provider on various health insurance exchanges. Specifically, it noted that it has hospitals located in 9 of the top 10 highest uninsured states and 26 of top 30 highest uninsured states. In 1Q14 and in Expansion states and on a same store basis, self-pay adjusted admissions declined 30% while Medicaid adjusted admissions grew 8% (self-pay adjusted admission represented 5.3% of admission and Medicaid adjusted admission represented 23.3% in 1Q14). Of note, admissions and adjusted admission from expansion states represent approximately 25% of the total. Lastly, management noted it expected an approximate 15% decline in self-pay adjusted admissions in 2014.

Here is a link to the full report.

The Affordable Care Act has made health insurance available to a previously unserved demographic. Removing pricing uncertainty for this group of people ensures they will use health services more rather than only in response to an emergency. All markets function similarly, when prices for a vital commodity decline enough; demand increases.

This is good news for service providers. Insurance companies were able to cut provision and increase premiums. Medical products, devices and consumables manufacturers should all see continued demand growth for their products. A great deal of this news is already in the market, so that a number of related shares trade at a premium to the wider market.

Some of the more interesting chart patterns include:

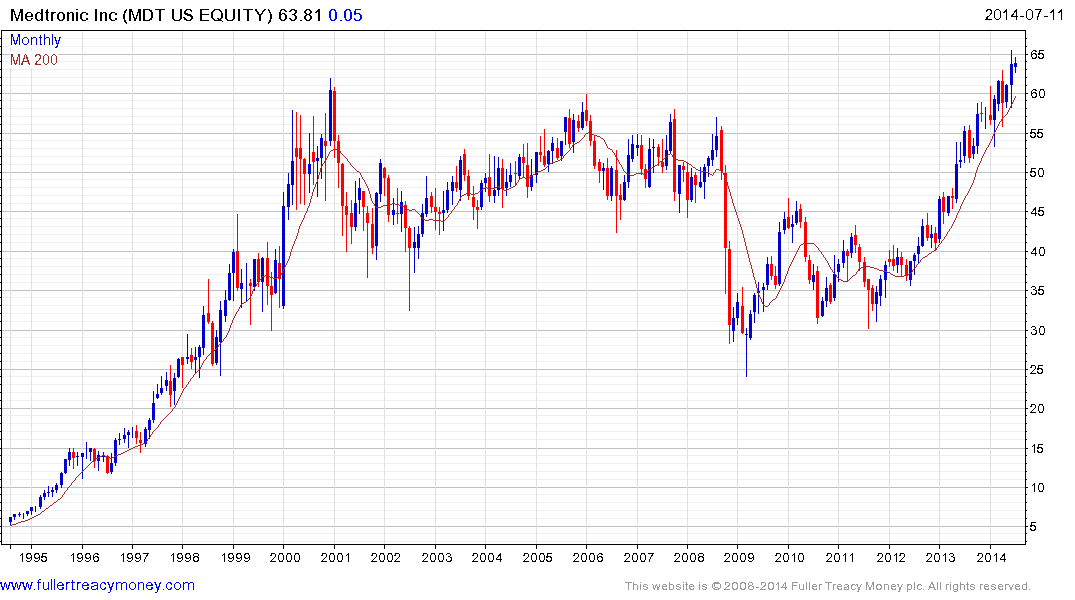

Medtronic ranged below $60 from 2000 and broke out to new all-time highs in June. While somewhat overbought, a sustained move below the 200-day MA would be required to question medium-term scope for additional upside.

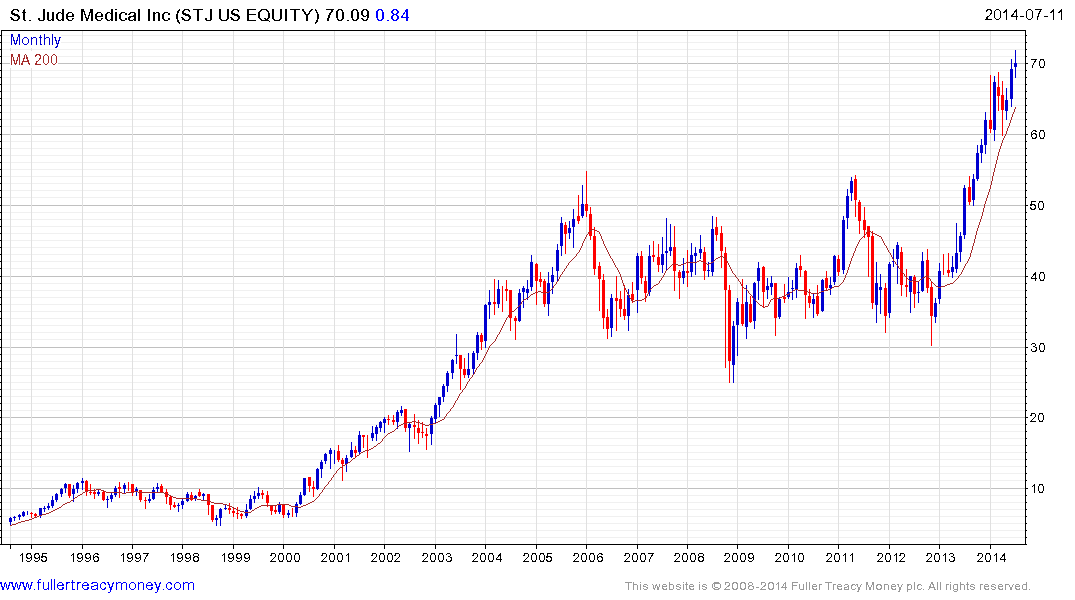

St. Jude Medical completed an 8-year range last year and despite being somewhat overbought in the short-term, it continues to hold a progression of higher reaction lows.

.png)

Tandem Diabetes has yet to post positive earnings and is in a sector with significant growth potential but where competition is increasing. The share has returned to test the $14 area but will need to demonstrate support with a clear upward dynamic to indicate a return to demand dominance.

Elsewhere in the diabetes sector, Insulet encountered resistance in the region of the 200-day MA this week suggesting some additional support building will be required before higher prices can be sustained. DexCom has a similar pattern.

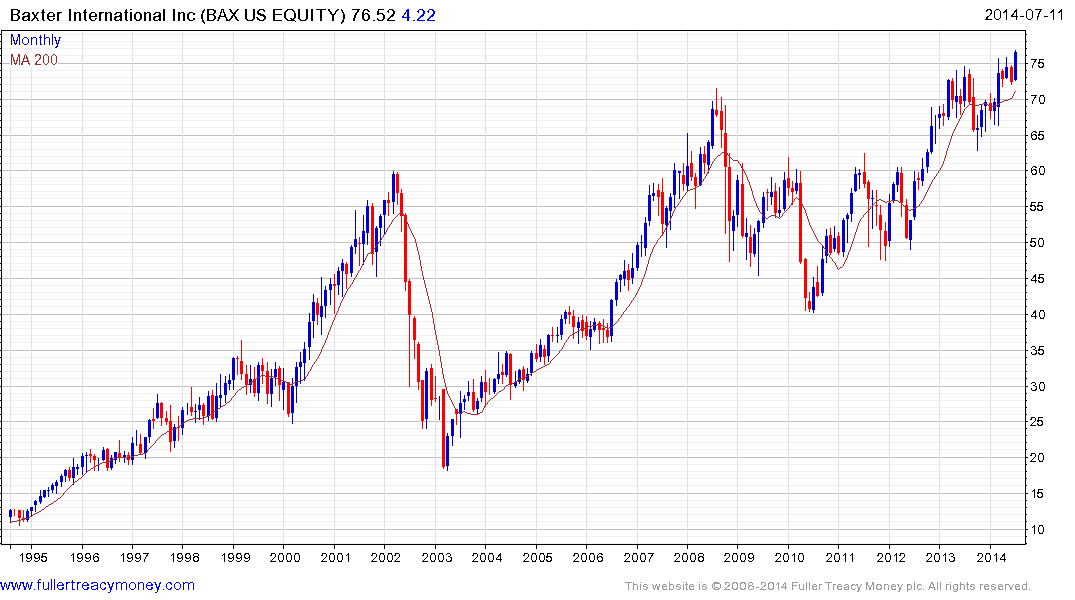

Baxter International has been consolidating in the region of the 2007 peak for much of the last year and broke out to new highs this week. A sustained move below $72 would be required to question medium-term scope for additional upside.

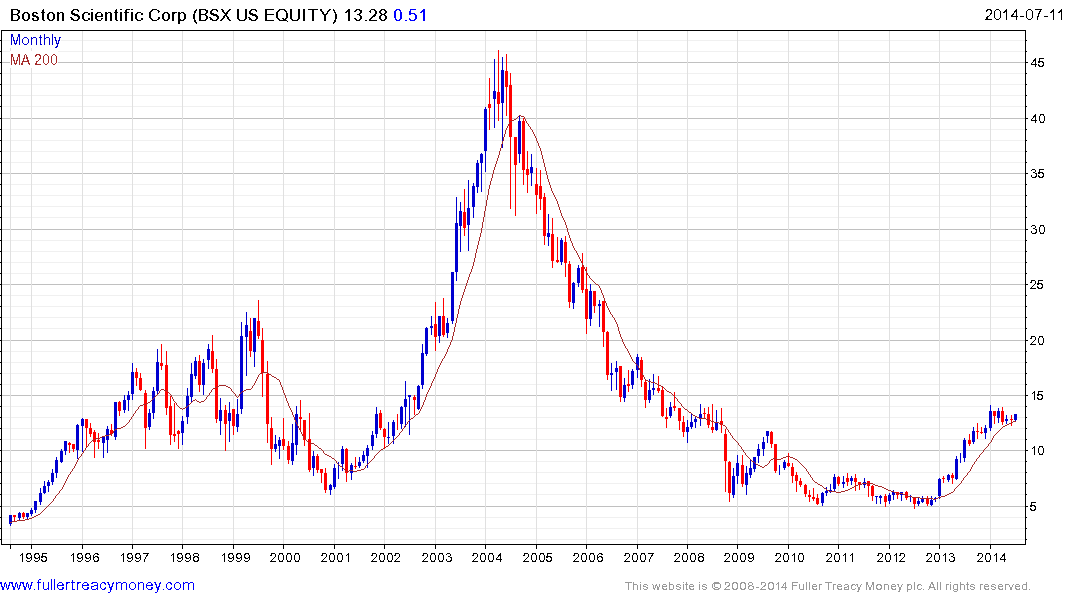

Boston Scientific more than doubled last year and has been confined to a ranging consolidation since January. It found support in the region of the 200-day MA last week and a sustained move below $12.25 would be required to question medium-term recovery potential.