MBA Chart of the Week: Estimated Total Commercial Mortgage Maturities

This article from US REO Partners may be of interest. Here is a section:

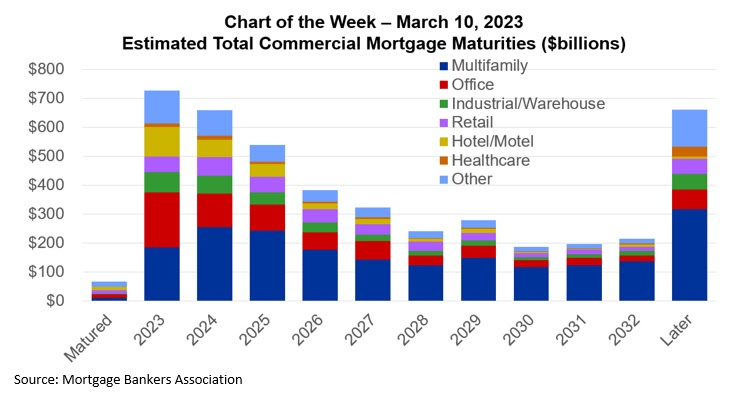

This year’s survey, however, collected information on $400 billion of bank-held commercial and multifamily mortgages—23 percent of the outstanding universe. Using this year’s survey results, for the first time we are expanding our loan maturity analysis to include an estimate of the maturity profile of all commercial and multifamily mortgages—including the more than $1.7 trillion on bank balance sheets.

The analysis estimates that of approximately $4.4 trillion of outstanding commercial/multifamily mortgages, $728 billion (16%) matures in 2023 with another $659 billion (15%) maturing in 2024. Hotels/motels see the largest share maturing in 2023 (34%) followed by office (25%). Multifamily is the property type with the smallest share of outstanding mortgage maturing this year (9%).Among capital sources, 26 percent of the outstanding balance of loans held by credit companies and other investor-driven lenders will mature this year, as will 23 percent of the balances held by depositories and 22 percent held in CMBS. Only 7 percent of life company loans and 2 percent of GSE/FHA loans come due this year.

The high yield corporate sector used the pandemic to refinance. The maturity of that part of the debt market is now a lot closer to the end of the decade. Commercial real estate did not have that opportunity because vacancy rates were so high, no one was willing to throw money at them.

The next three years will represent a significant capital call for the commercial mortgage market. That’s going to be challenging with yields where they are today.

OAS spreads on investment grade CMBS are breaking out. Ahead of the credit crisis spreads of 225 basis points were normal. Today’s value of 670 is approaching the 2020 peak.

The iShares CMBS ETF remains under pressure as it encounters resistance in the region of the 200-day MA.

.png)

Meanwhile, the SPDR High Yield Bond ETF is firming from its recent low.

That graphically illustrates risk is focused in commercial real estate. Therefore, the question is what would force a mark to market event for the commercial real estate sector? Many of the loans are floating rate so any companies with the wherewithal will be interested in paying down the debt.

WeWork is actively attempting to renegotiate leases at present. They are holding the threat of bankruptcy over landlords to secure better terms. The regional banks also have more exposure to their local commercial real estate sectors than their larger competitors. Cities like New York, San Francisco and Los Angeles which have seen population flight are most at risk. It’s not a coincidence that the banks which went bust like SVB and Signature bank were based in these cities.

This article focusing on shadow banking may also be of interest. Here is a section:

But the recent demise of SVB Financial Group is raising questions of how much lending banks have given to shadow financiers. Consider, the largest portion of Silicon Valley Bank’s $74 billion loan book consisted of so-called subscription lines given to private equity, a typical nonbank lender. This kind of credit is especially useful when money is tight — they give private funds the flexibility to complete deals without having to go to their investors each time they need cash. But they are also hard to offload, in part because they are not assessed by major credit ratings agencies.

There are other exposures. Fund managers routinely use temporary lines of credit from banks, or warehouse lines, to pay for leveraged loans before packaging them into bonds known as collateralized loan obligations. Products such as CLOs and other asset-backed securities are now the largest non-bank source of corporate loans, commanding a 29% market share as of the end of 2021. Meanwhile, private equity also tap their Wall Street bankers for net-asset-value loans during periods of market upheaval, often times to shore up their portfolio companies. But since there is limited public disclosure, we do not have a clear sense of how much exposure banks have, and whether we should be worried about spillovers. We can only speculate.

Around $150 billion in leveraged/corporate debt needs to be refinanced every month for the next three years. That suggests a lot of debt is going to be repriced at significantly higher rates until rates are cut.

That’s why banks remain under pressure even with a blanket guarantee on deposits.