Markets Are Losing the Anchor of a Generation

This article from Bloomberg may be of interest to subscribers. Here is a section:

There was one necessary condition underlying the bond market’s ability to shrug off the worst inflation numbers in a generation after only a week; nobody is really sure if they believe the Fed. Credibility is vital to central banks, and I argued for Businessweek on Thursday that it is indeed as important an anchor to the monetary system as gold used to be. A round trip like this showed extreme hesitance to accept the Fed’s guidance; arguably, the currency of its forward guidance has been adulterated.

That said, the Fed can’t have lost all credibility. The rebound in bond yields started Thursday morning as Jerome Powell began taking his second day of questions from Congress. Unlike on Wednesday, he said that his commitment to get inflation back down to 2% was “unconditional.” That, like many central banking pronouncements in the past, had an effect. But it's still concerning that the Fed needs to be more shrill to get its message across; it does look as the coinage of forward guidance is being debased:

Meanwhile, a telling indicator of how far sentiment has swung back toward bracing for a (disinflationary) recession comes from inflation breakevens. German inflation expectations have receded after a dramatic surge over the last 12 months, although they still remain higher than they were at the beginning of the year. The same is not true of US breakevens for average inflation over the next 10 years, and for the five years starting five years hence. Both are now lower than they were in May last year — an extraordinary fact given the extent of the inflationary shock since then, and the new geopolitical drivers for inflation that have arisen this year. If you’re convinced that much higher rates of inflation are on the way, along with higher interest rates to combat them, then the market is still making it very cheap for you to bet on that outcome

There is talk of the ECB raising rates in July, but Europe is already in a recession and Germany is fearful Russia will stop natural gas exports through the original Nordstream pipeline altogether. Against that background the ensuing economic contraction would make the case for interest rate hikes moot.

The reality for the Eurozone is domestic demand is subpar at the best of times. The export engine keeps the respective economies chugging along, but the demographic lag from decades of below replacement rate births is impossible to ignore. Coupled with the risk of peripheral sovereign spreads breaking on the upside and causing an existential crisis, it is hard to imagine how policy can get objectively tight.

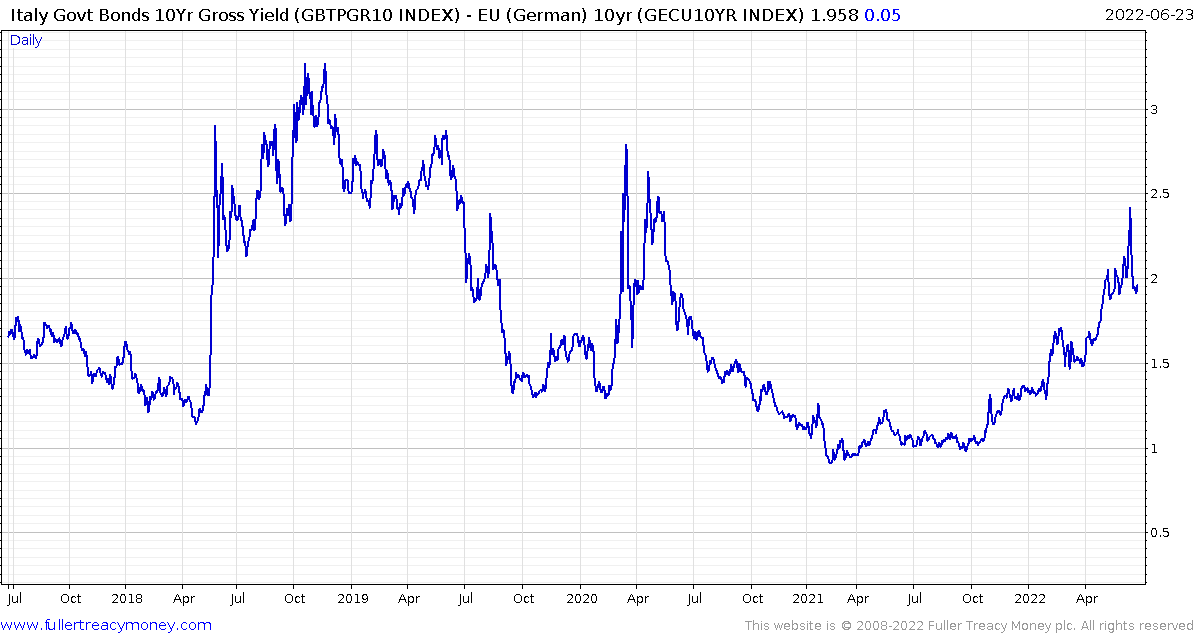

Italian and Spanish sovereign spreads have not had the big bang decline which would signal a medium-term peak. It seems likely the ECB will have to do more to allay bond investors’ fears the periphery is no position to tolerate tighter conditions.

The big question is whether the USA is going to follow Europe into Japanisation. The ECB tried to raise rates in 2011. That lasted for about six months, then they cut the rate from 1.5% to 0% and remained at zero until now.

The minimum required of the Euro STOXX Index will be to sustain a move above the 200-day MA to signal a return to demand dominance.

The minimum required of the Euro STOXX Index will be to sustain a move above the 200-day MA to signal a return to demand dominance.

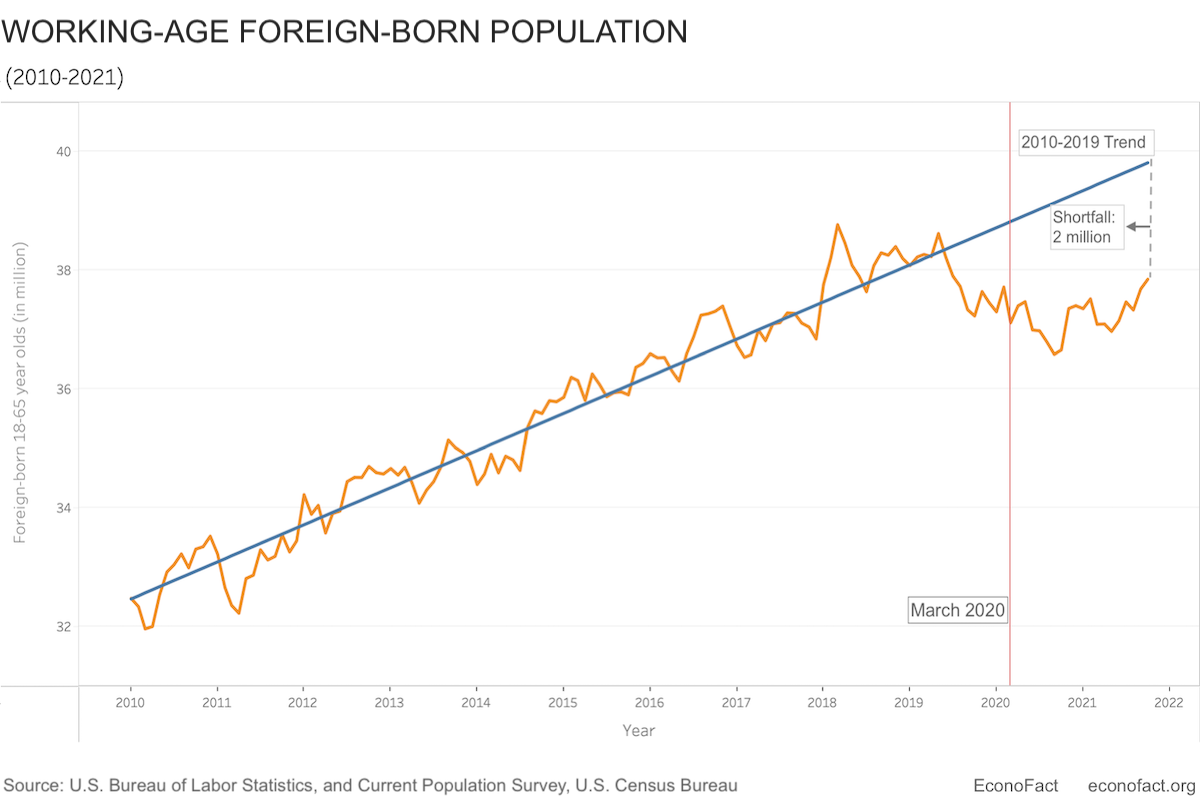

The USA has a well-publicized labour shortage. With panic at the “crisis at the border” it is politically unpalatable to talk about the need for more immigration.

This chart suggests the USA has missed out on 2 million workers because of isolationism and COVID precautions and half of those would have been college educated. Additionally, the labour participation rate is a full percent below the pre-pandemic level so fewer of the native population are working. The replacement rate for retiring baby boomers is not adequate. That points to inflationary pressures during expansions because the economy hits growth limits quicker. Ultimately, it means less economic activity because fewer consumers imply less demand.

This chart suggests the USA has missed out on 2 million workers because of isolationism and COVID precautions and half of those would have been college educated. Additionally, the labour participation rate is a full percent below the pre-pandemic level so fewer of the native population are working. The replacement rate for retiring baby boomers is not adequate. That points to inflationary pressures during expansions because the economy hits growth limits quicker. Ultimately, it means less economic activity because fewer consumers imply less demand.

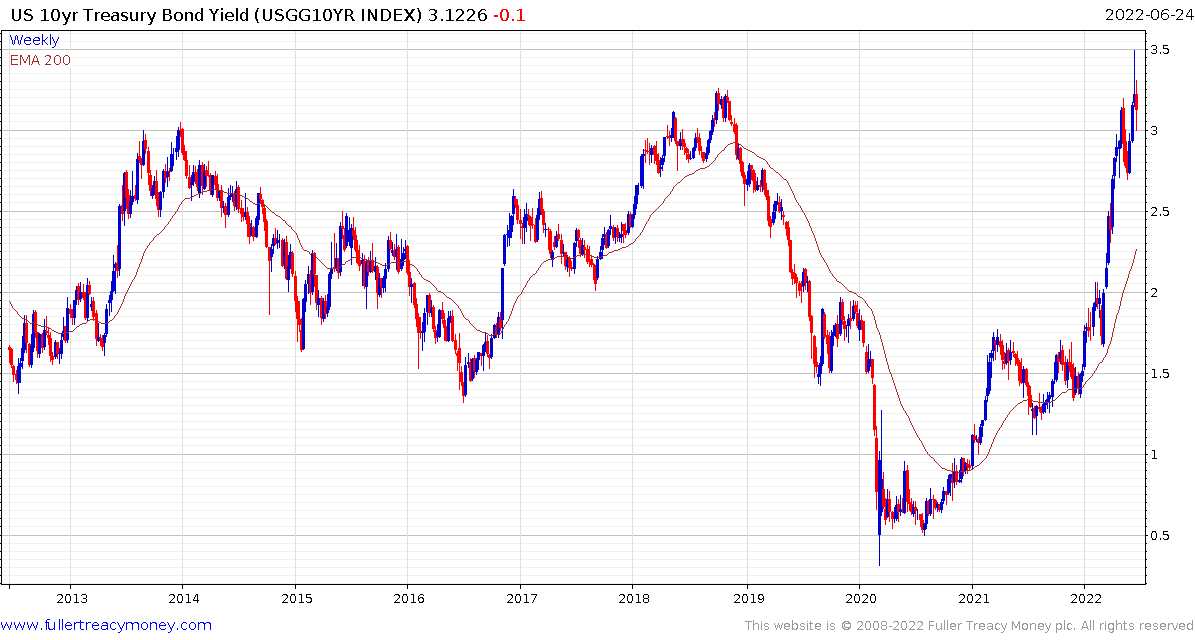

Treasury yields have already had a very big move. Going from 0.5% to 3.5% in two years isn’t normal. It has already priced in a lot of tightening. The whiff of deflationary fears arising from a recession has removed some of the artificially strong demand for near cash items. 3-month yields are firming from the 1.5% area. Since the Fed Funds rate is 1.75%, it is reasonable to expect the 3-month to rise above that level.

Treasury yields have already had a very big move. Going from 0.5% to 3.5% in two years isn’t normal. It has already priced in a lot of tightening. The whiff of deflationary fears arising from a recession has removed some of the artificially strong demand for near cash items. 3-month yields are firming from the 1.5% area. Since the Fed Funds rate is 1.75%, it is reasonable to expect the 3-month to rise above that level.

As yields at the long end ease back, the buy-the-dip instinct will likely pull interest back into the highly leveraged tech sector. The ARK Innovation ETF is down 75% from its peak but a short covering rally could easily see it revert back to the mean which would be a 54% rally from current levels. I remain of the view most highly leveraged tech stocks are likely to experience lengthy base formations, but the end of an accelerated downtrend trend can often see sharp rebounds.

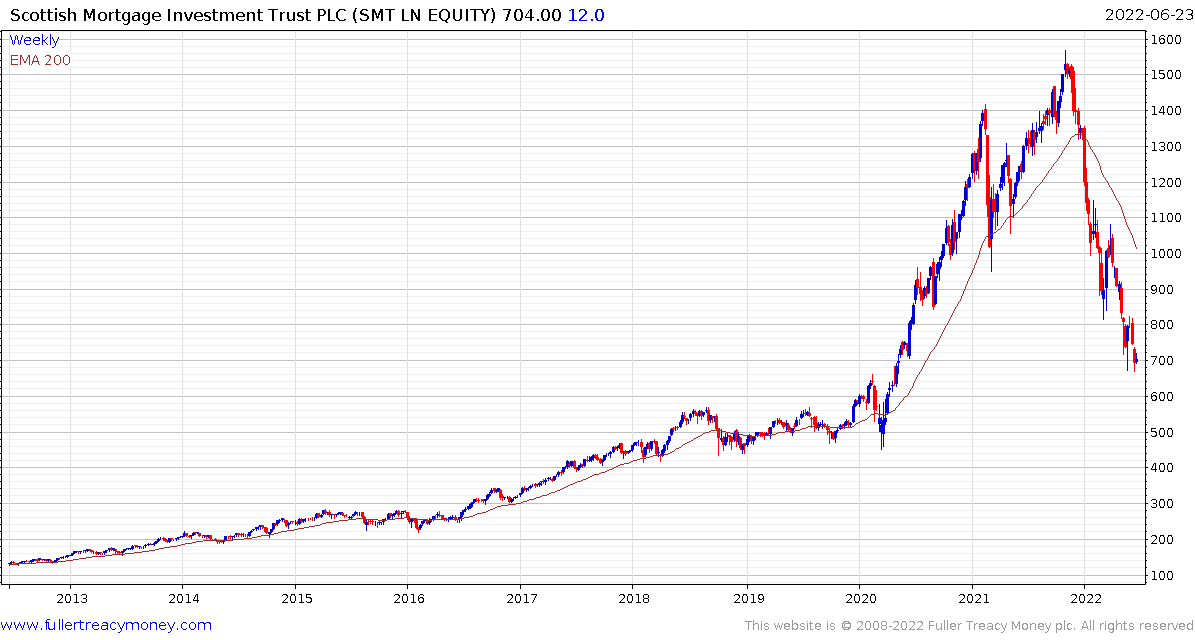

The Scottish Mortgage Investment Trust which was the go-to tech focused fund for UK investors has more than halved. It is now trading at its widest discount to NAV (14.7%) since the tech crash of 2002/03.

The price has fully unwound the pandemic surge and is showing initial signs of steadying. If the early 2000s experience is any guide, a period of support building will be required but that is very dependent on the trajectory of liquidity.

Back to top