Mario Draghi press conference

This stream of twitter comments from The Guardian offers a window to how the market reacted to today’s new conference. Here are two important quotes:

Overall, we expect the economic recovery to continue, albeit at a somewhat weaker pace than earlier expected, reflecting in particular the slowdown in emerging market economies, which is weighing on global growth and foreign demand for euro area exports

And

?[the governing council] emphasises its willingness and ability to act, if warranted, by using all the instruments available within its mandate and, in particular, recalls that the asset purchase programme provides sufficient flexibility in terms of adjusting the size, composition and duration of the programme.

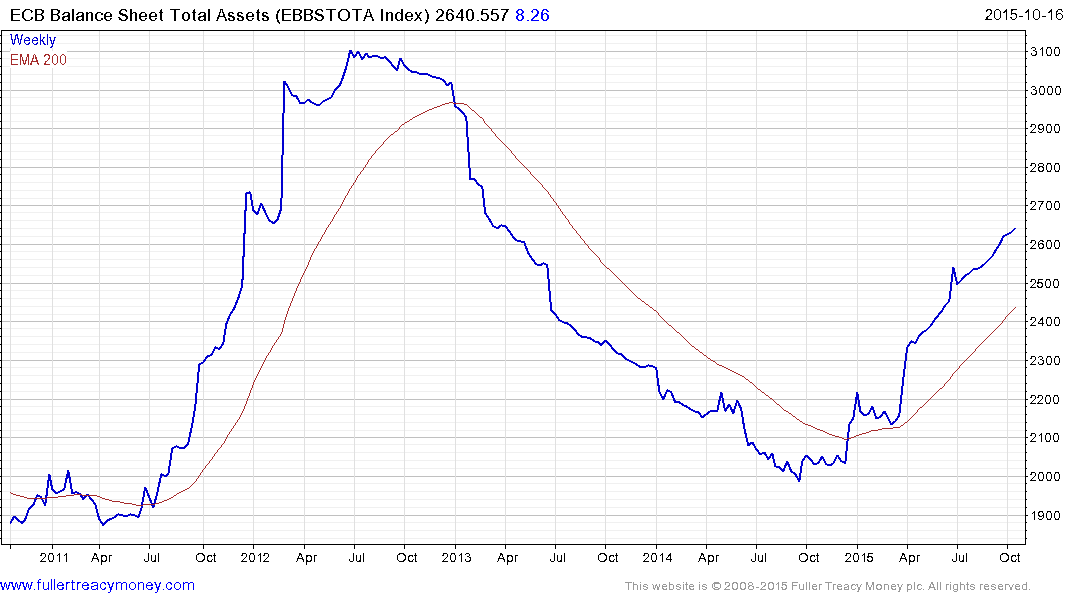

The ECB is a little more than half way through its balance sheet reflation program which they demur from calling QE. There has been speculation from some quarters over the last few weeks, the central bank would not follow through on its earlier commitment to increase the money supply. The ECB only has one official mandate and that is to achieve an inflation target of 2%. It is a long way from that so there is no reason to conclude they will stop printing money. Additionally Mario Draghi’s comments suggest that if additional stimulus is needed it will be provided.

The ECB is well aware the Eurozone needs a weaker currency if it is going to compete. $1.15 appears to be about as high as the central bank is willing to see the Euro go against the Dollar. So far $1.05 has been about as strong as the US is willing to see the Dollar go.

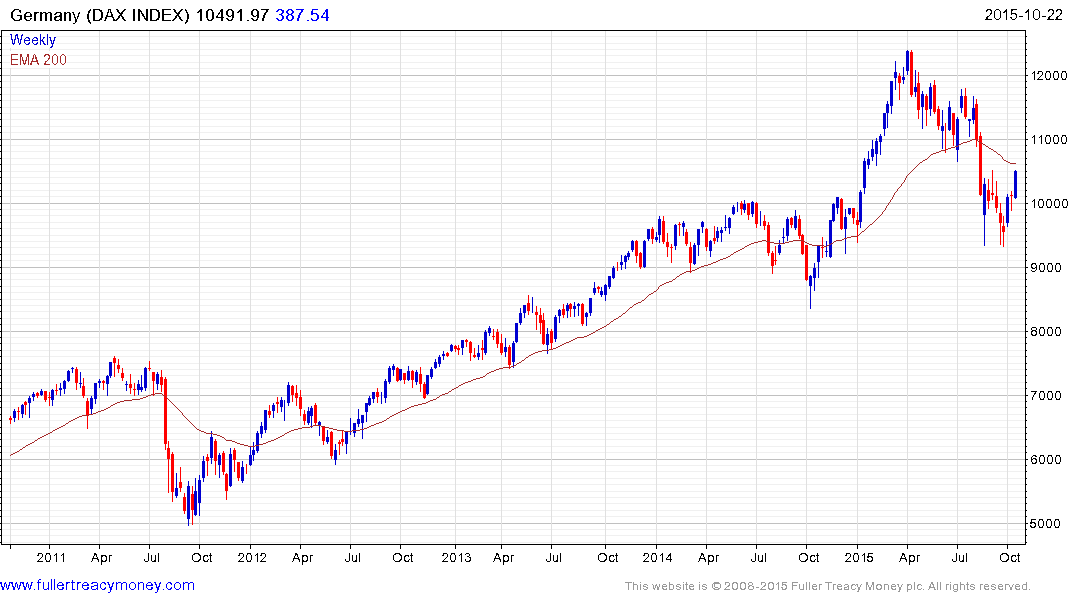

This is particularly good news for Germany which has the least need for a weak currency and helps to explain the relative strength of the DAX this week. The psychological 10,000 level continues to hold and a sustained move below it would be required to question medium-term scope for continued upside.

The merits of QE will be discussed ad nauseam but there is little argument surges in money supply inflate asset prices. We have ample evidence of this from the USA’s experience and there is every reason to expect Eurozone equities will respond in a similar manner over the medium term.