Major Charts Review

We are in the middle of earnings season so there have been both positives and negatives to the news flow over the last 24 hours. Facebook for example was down 4% in the after market yesterday but rallied to a new high today. Boeing has so far held the move to new highs but was not quite able to hold the intraday rally today. Alphabet reports after this evenings close and if the trend is to remain consistent it is due a continued pause.

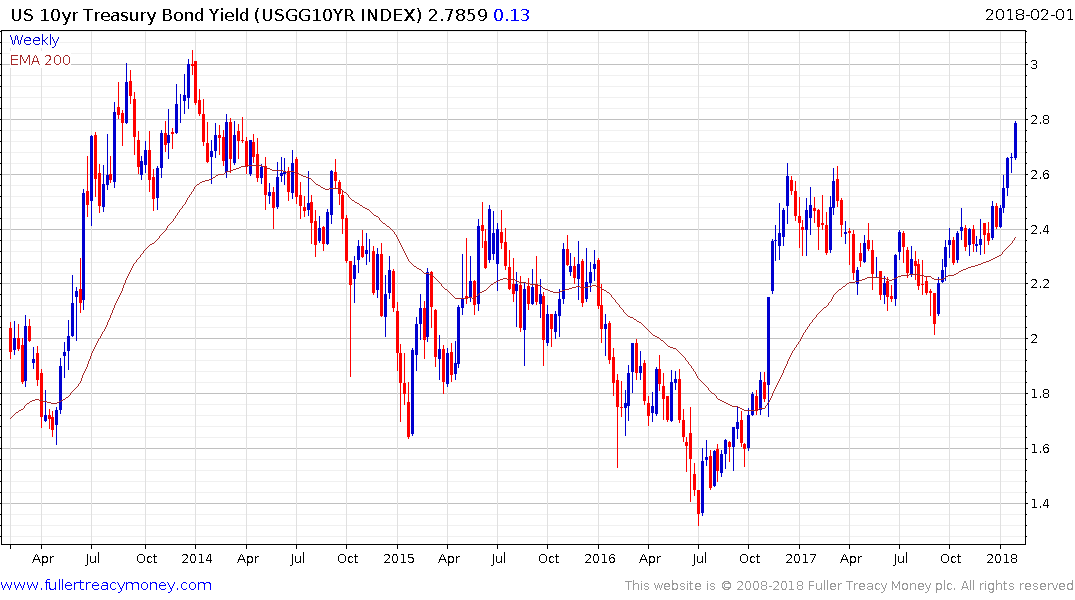

The breakout in bond yields with the 30-yr closing above 3% today and the 10-year rallying today’s that level highlights the sense of angst in the debt markets as the US embarks on a wide ranging, debt-fuelled spending spree after an already impressive economic expansion.

Against that background it is not unreasonable to expect the major stock market indices to pause. Amazon pulled back by approximately 4% today ahead of its earnings announcement after the bell and that is potentially a signal that investors are unwilling to continue to support wide overextensions; suggesting the potential for mean reversion is growing. Its results were ahead of expectations so it will be instructive to monitor how it performs tomorrow.

Meanwhile the Dollar has continued to extend its downtrend, with the Euro closing at a new recovery high today. A clear downward dynamic will be required to question medium-term scope for additional upside.

Gold continues to pause in the region of $1350 which coincides with the upper side of an 18-month range. It steadied today but will need to breakout to new recovery highs to confirm a return to medium-term demand dominance.

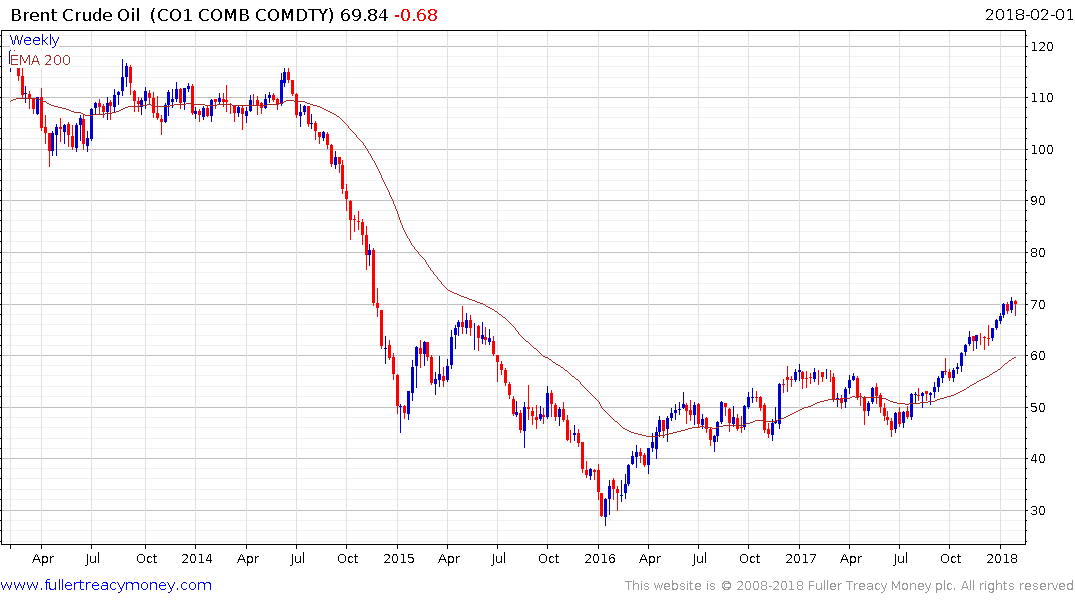

Crude Oil also remains within a narrow range and firmed today towards the $70.