Macy's is closing another 100 stores

This article from Money.com may be of interest to subscribers. Here is a section:

Macy's closures come amid a sixth-straight quarterly decline in sales. However, sales fell less than feared and the company said it's "encouraged" by recent sales trends. Wall Street applauded the dramatic store closures, sending the stock surging 17%, its best day since 2008.

Macy's said its new strategy is to concentrate its financial firepower and talent on its best-performing locations. The department store plans to invest in strong stores by highlighting new vendors, increasing the size and quality of its staff and investing in new technology.

"We operate in a fast-changing world, and our company is moving forward decisively to build further on Macy's heritage," Macy's CEO Terry Lundgren said in a statement.

Macy's said the store closures could result in the loss of about $1 billion in sales, even after accounting for shoppers who would go online and to other Macy's locations. The company plans to offset that loss in sales by cutting costs, even beyond shutting down these stores.

It's not clear how many jobs will be impacted by these moves. Macy's told CNNMoney it won't detail layoffs until it finalizes its store closure list.

Macys, and a number of other big box retailers, have two problems. They rely on physical locations which tend to have a boring feel and their products are too expensive. Nevertheless they command sizeable, albeit shrinking shares of the consumer market and have impressive real estate holdings which have appreciated considerably since the credit crisis.

Macys’ decision to close 100 stores is an acceptance that its business model is badly in need of revitalisation. Freeing up cash from the disposal of real estate is likely to be net positive for the share price but with retail sales becoming an increasingly competitive market it will have to fight hard to regain the trend consistency that was evident until last year. The share is now testing the region of the trend mean following an impressive two-week rally but will need to sustain a move above it to signal a return to demand dominance beyond the short term.

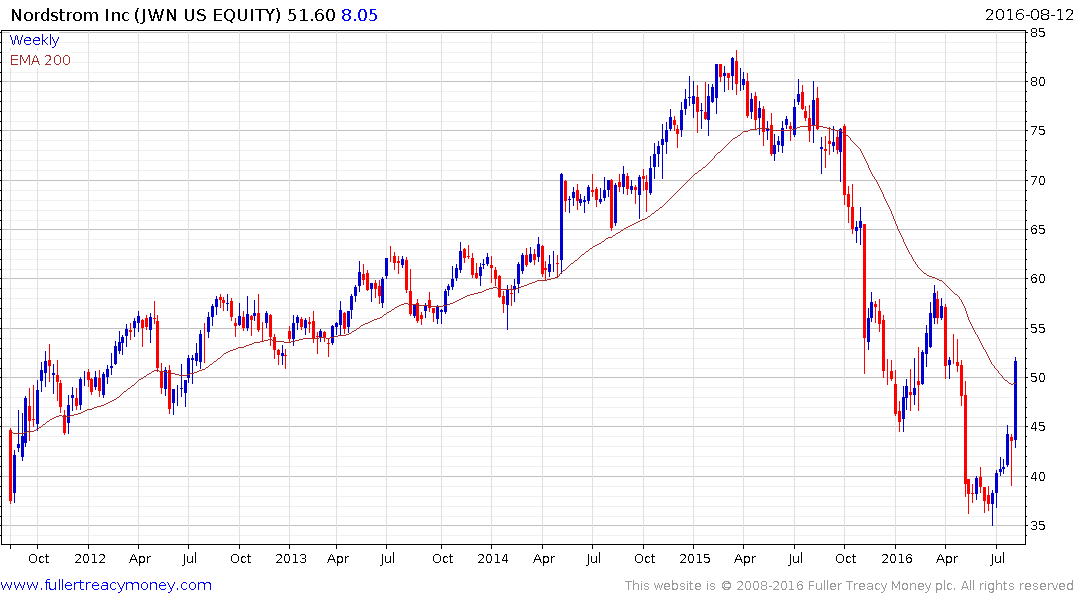

Nordstrom and Gap both have similar patterns.

Meanwhile JC Penny is testing the upper side of a more than two-year base.

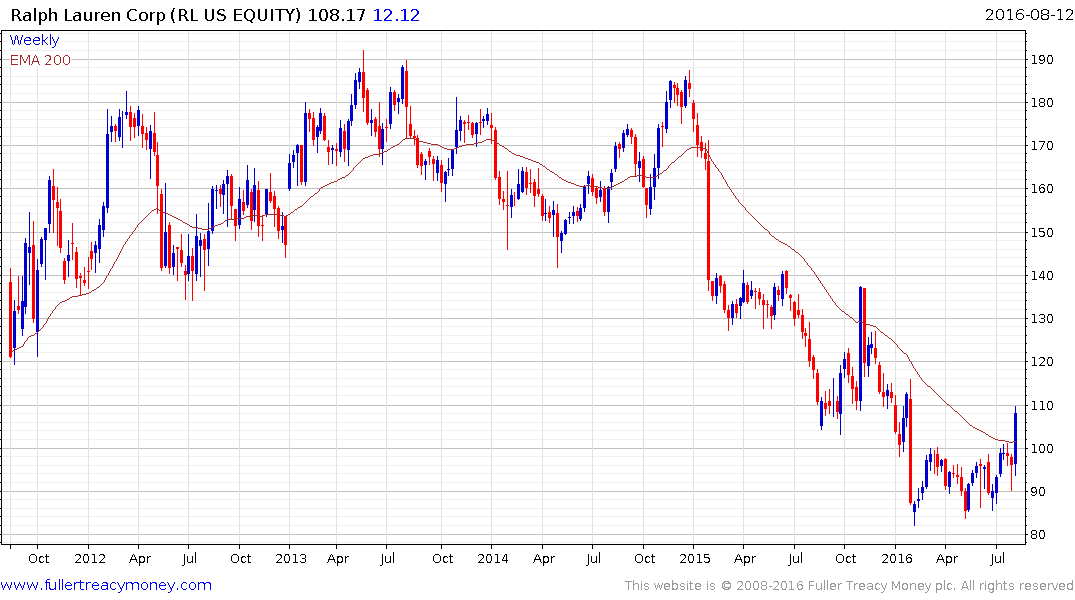

Ralph Lauren may be benefitting from its position as outfitter for the US Olympic team and has pushed above its 200-day MA.

Amazon remains the clear leader in retailing and continues to expand its dominant position. The share continues to extend its uptrend and a clear break in the progression of higher reaction lows would be required to question the consistency of the advance. Despite Wal-Mart’s decision to challenge Amazon through its acquisition of Jet.com, perhaps the greatest risk to its dominance would be an anti-trust suit.

Among discounters TJX remains in a broadly consistent medium-term uptrend and a sustained move below the trend mean would be required to question medium-term scope for additional upside.

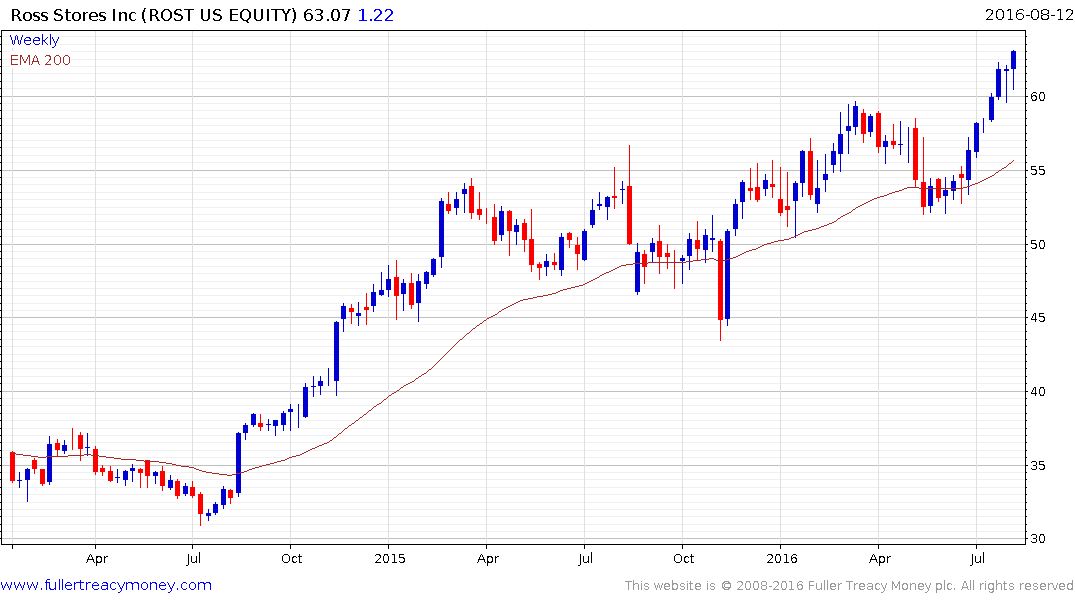

Ross Stores has a broadly similar pattern.