Macro Outlook: Will the Fed's Pivot Save the Day? Guggenheim Partners

Thanks to a subscriber for this report by Brian Smedley for Guggenheim may be of interest to subscribers. Here is a section:

The U.S. economy is slowing as headwinds mount and tailwinds fade

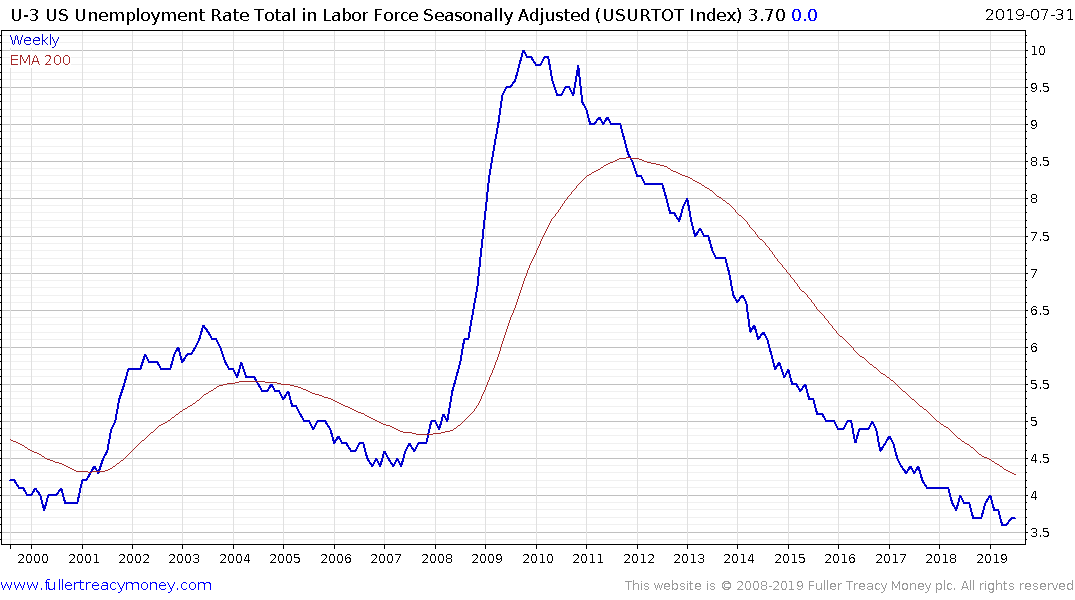

The labor market is tight but is beginning to lose momentum, a clear late-cycle signal

Our research continues to point to a recession beginning in H1 2020

The next recession could be prolonged due to limited policy space at home and overseas

A looming recession means reducing risk, upgrading credit quality and extending duration

Here is a link to the full report.

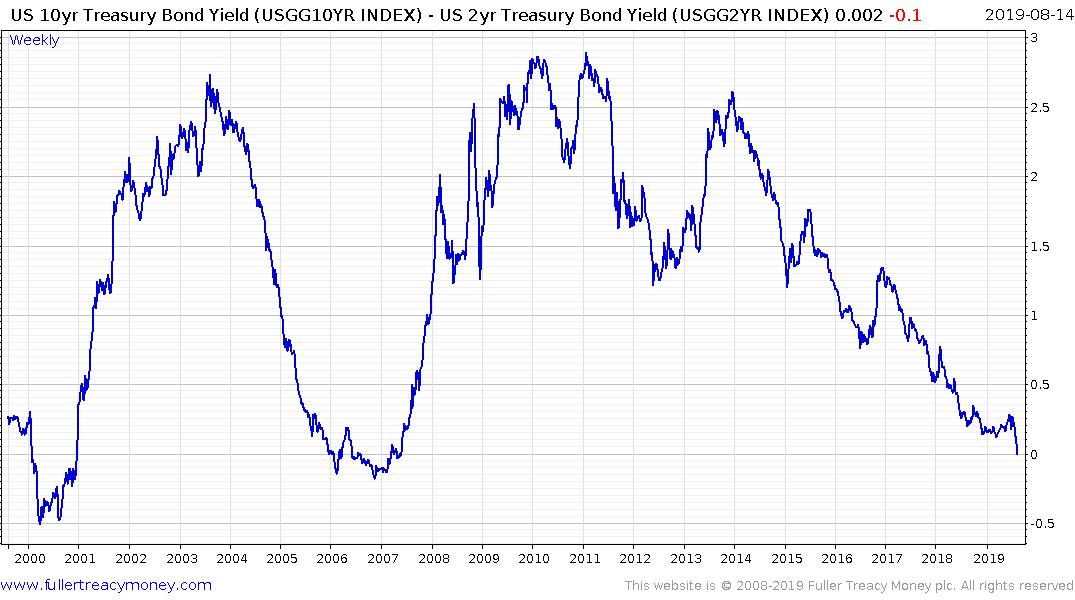

For a recession to begin at the beginning of 2020 growth would have to be negative in this quarter. That’s a big ask in my opinion. The one thing we know about the inversion of the yield curve spread is it has a long lead time. On the last two occasions it offered an 18-month lead indicator of trouble in the economy. That suggests we should probably be looking at after the US Presidential Election rather than before it for a source of strife. However, we will need to be guided by the price action.

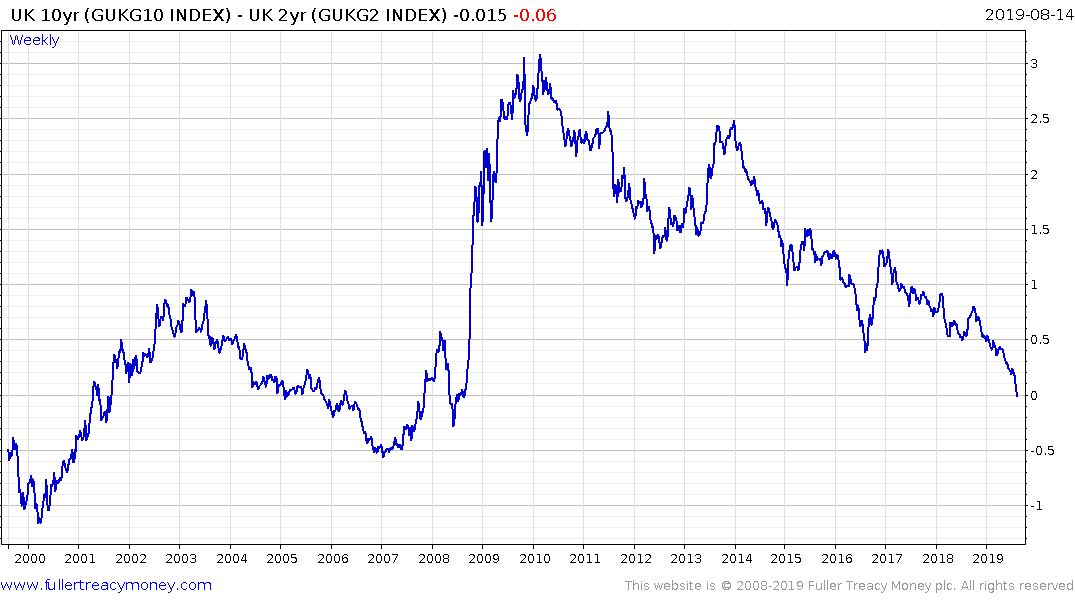

The UK economy posted a quarter of negative growth and its yield curve moved into negative territory today. That suggests it provides no lead indicator value for the UK market but its inversion does suggest a UK recession is all but baked into forecasts. The weakness of the Pound has so far shielded the stock market for the worst effects of the weakness but the region of the trend mean needs to hold on the FTSE-100 if the benefit of the doubt is to continue to be given the benefit of the doubt.

The US market erased yesterday’s rebound and came back to test the region of the trend mean. It ideally needs to find support in this area if the benefit of the doubt is to continue to be given to the upside.

.png)

US 10-year yields continue to contract as investors pour money into any bonds that still have a positive yield regardless of currency risk. The convexity of the market favours long-term bonds suggesting there is more demand that section of the yield curve which has resulted in the swift contract of the yield curve spread over the last couple of weeks.

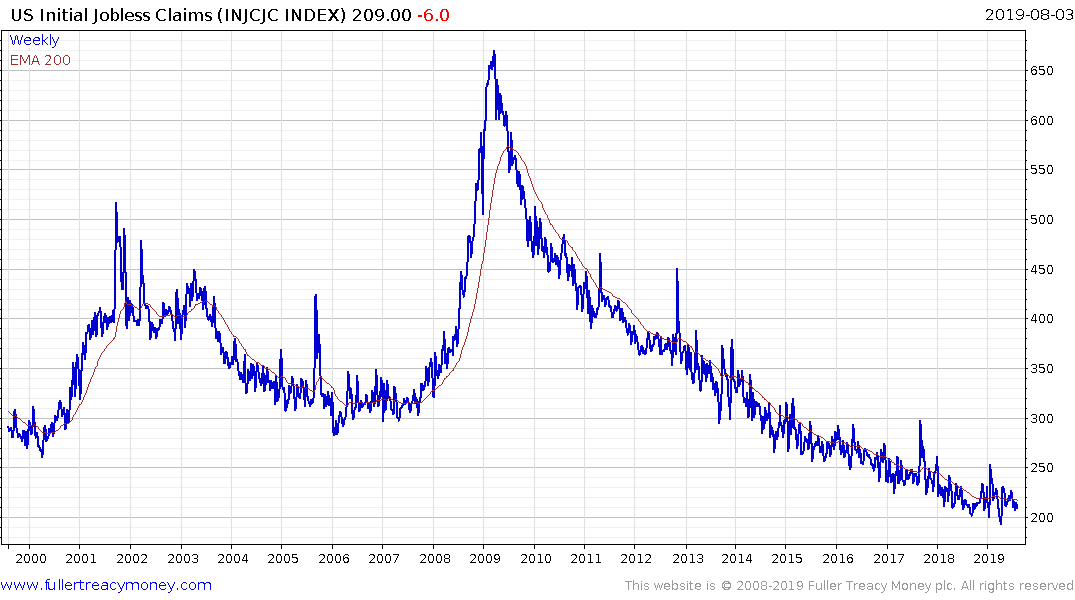

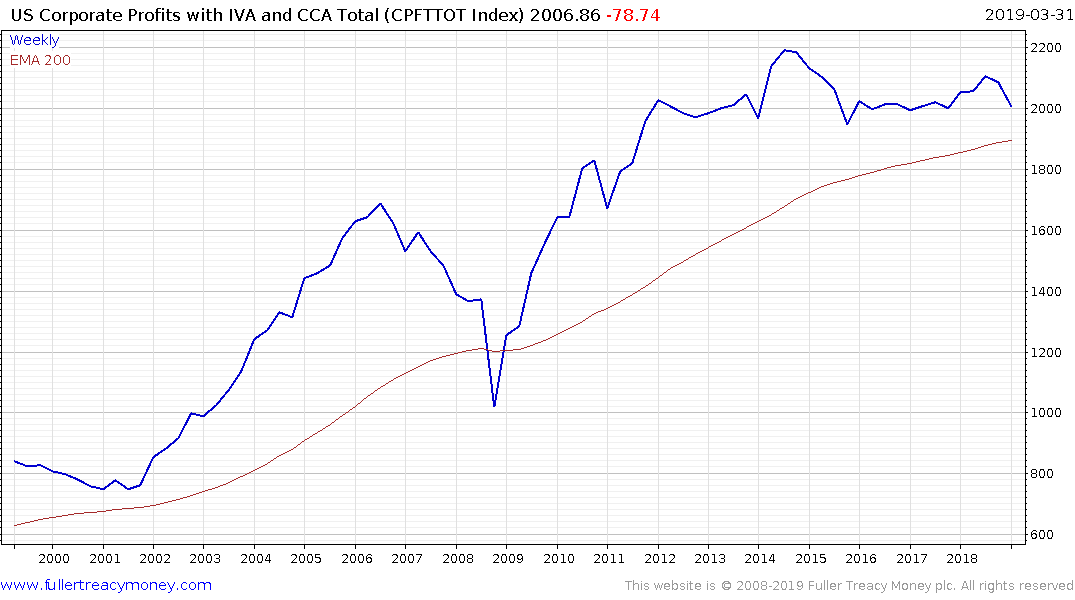

Jobless Claims, Unemployment and growth are all still favourable. One of the most important indices to monitor over the next six weeks will be next update of US Corporate Profits. It has generally peaked ahead of recessions but is reported with a quarterly lag and in arrears. The Index has been moving sideways for five years but a breakdown would lend credence to the recession argument.

Economic figures are deteriorating sharply in Europe and China and that has the scope to represent a headwind for the USA as well. That suggests now is the time to pay particular attention to the consistency of trends.

Back to top