Macro Morsels on bank buybacks

Thanks to a subscriber for this report from Maybank which may be of interest to subscribers. Here is a section on bank responses to the relaxing of controls following the Fed’s stress tests:

American Express Plans 9% Dividend Hike, $4.4b Share Buyback

Bank of America to Buy Back Up to $12b in Shares, Raise Dividend

Citi Plans Up to $15.6b Buyback, Dividend Boost to 32c/Share

Morgan Stanley Authorizes $5b Buyback; Lifts Dividend 25%

Fifth Third to Boost Dividend, Buy Back Up to $1.16b Shares

Huntington Bancshares Sets $308m Buyback, Boosts Dividend

KeyCorp Sets $800m Buyback, Raises Qtr. Div to 10.5c from 9.5c

Regions Financial Plans Up to $1.47b Buyback, Higher Dividend

SunTrust to Boost Div to 40c; Sets Up to $1.32b Buyback

State Street Sets $1.4b Buyback, Boosts Dividend

Here is a link to the full report.

Banks have been constrained in how they can reward their shareholders because they were forced to rebuild capital, withhold even more to allow for future disasters and repay government bailouts. The fact they have almost universally passed the Fed’s latest stress tests suggests the monetary authorities are satisfied the sector has recovered enough that it can now be allowed greater leeway to exercise they balance sheets in favour of investors.

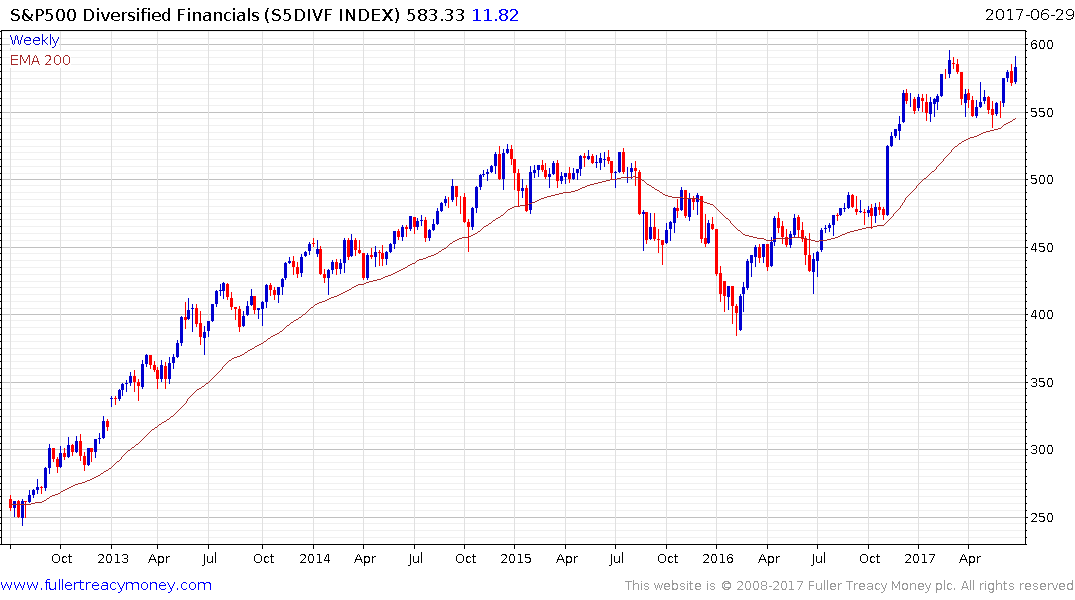

The more hawkish tone evident in central bank communications is an additional point in banks’ favour since they are likely to benefit from better margins in a higher interest rate environment. The S&P500 Banks Index continues to firm from the region of the trend mean and a sustained move below it would be required to question medium-term scope for additional upside.

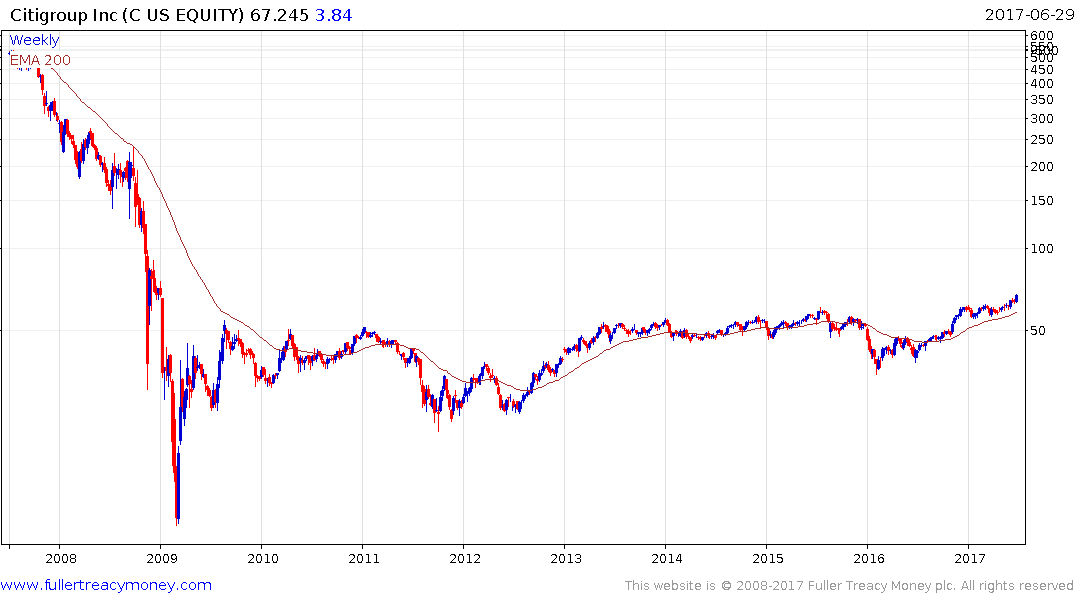

Citigroup, which has announced one of the largest buybacks, broke out today to new recovery highs as it pulls away from the $60 area to complete its almost 8-year base formation.

It will be a true measure of the sector’s return to outperformance to see how it holds up, or sustains breakouts, during the continuing rotation out of high momentum technology shares which has seen Nasdaq volatility increase substantially over the last couple of months and particularly today.