Macro Morsels

Thanks to a subscriber for this edition of Maybank’s report which in this issue makes a number of bearish points. Here is a section on buybacks:

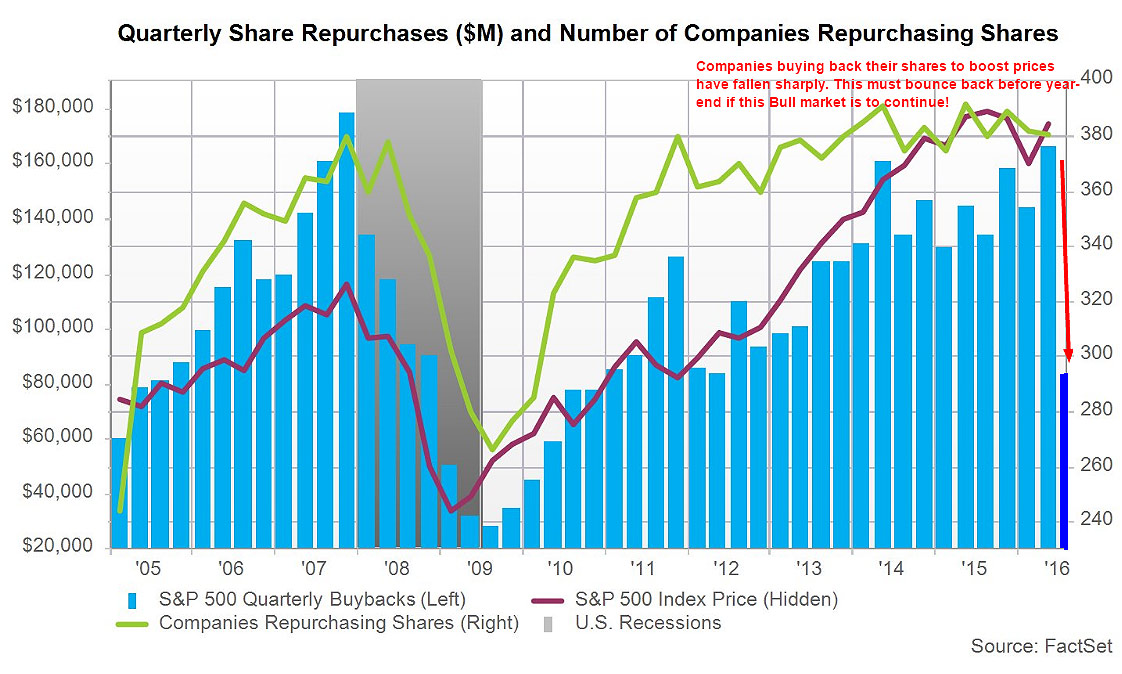

The new wrinkle is that Trim Tabs Investment Research indicates that corporate buybacks have suddenly plunged. We show the estimated repurchase levels below in dark blue that mirror the lowly levels of 2012. Share buybacks always rise during equity bull markets.

With paltry organic economic growth since the 2009 recovery, share buybacks become a critical source of buying power to maintain rising stock prices. When repurchases fall sharply, stock prices, in general, are more likely to fall as well.

We can theorize this drop is due to (1) anxiety over anti-business policies discussed by both Presidential candidates or (2) uncertainty over the Federal Reserve desire to raise rates making corporate debt issuance for stock buybacks more costly.

?Corporate debt issuance has receded about 8% from the record 2015 levels and is still quite high. We suspect that once we get past the November 8th US presidential election, share buybacks will normalize. However, if they remain weak, then expect stock prices to be valued with far more risk.

Federal Reserve Board Presidents have been very vocal these days that strong job growth warrants raising the Fed funds rate sooner rather than later. Sure, the labor market has grown as sharply as any strong economic recovery could and “official” U3 unemployment is low, but the sluggish economy hovering just above stall speed remains a fixture.U6 unemployment including marginal workers is well over 9%, wage inflation in this strong jobs market has remained below normal and Purchasing Managers Indices (PMI) have stalled. The composite PMI of services and manufacturing indicates a GDP that should be closer to 1% than the 2.5 to 3% many have expected during the 2nd half of 2016.

Here is a link to the full report.

I’ve argued for much of the last five years that buybacks represent one of the primary arteries for quantitative easing to influence the stock market. The logic is that with ultralow interest rates companies have an incentive to favour debt over equity financing and therefore issue bonds to fud buybacks. This has contributed to trillions of dollars being poured into the equity markets since 2009 and represents a major component of the liquidity that has fuelled the bull market.

This chart from the above report which appeared on financialsense.com is illuminating because if accurate it reflects a major shift in activity among corporations. This data will be worth watching going forward because if companies have lost their appetite for buybacks that represents a headwind for the wider market. What this chart doesn’t tell us is how buybacks have performed over the second quarter and perhaps more importantly in the third quarter when Treasury yields hit a new low. If buybacks are indeed declining then the incentive for fiscal stimulus to pick up some of the slack left by monetary policy is more even compelling.

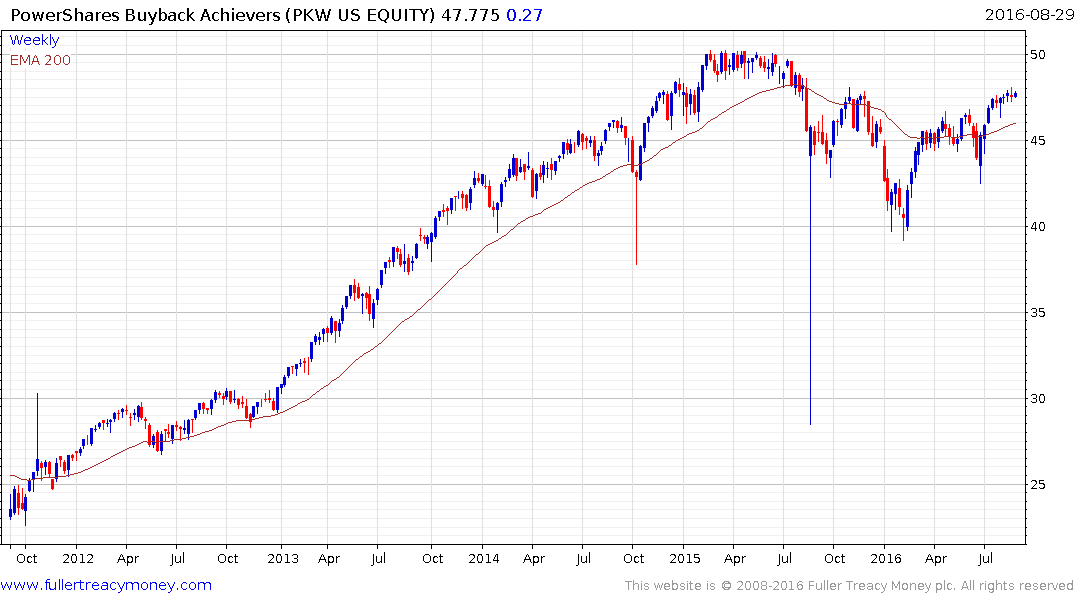

Meanwhile the PKW Buyback Achievers ETF has lagged the performance of the S&P500 and will need to continue to hold above the trend mean if potential for continued higher to lateral ranging is to be given the benefit of the doubt.

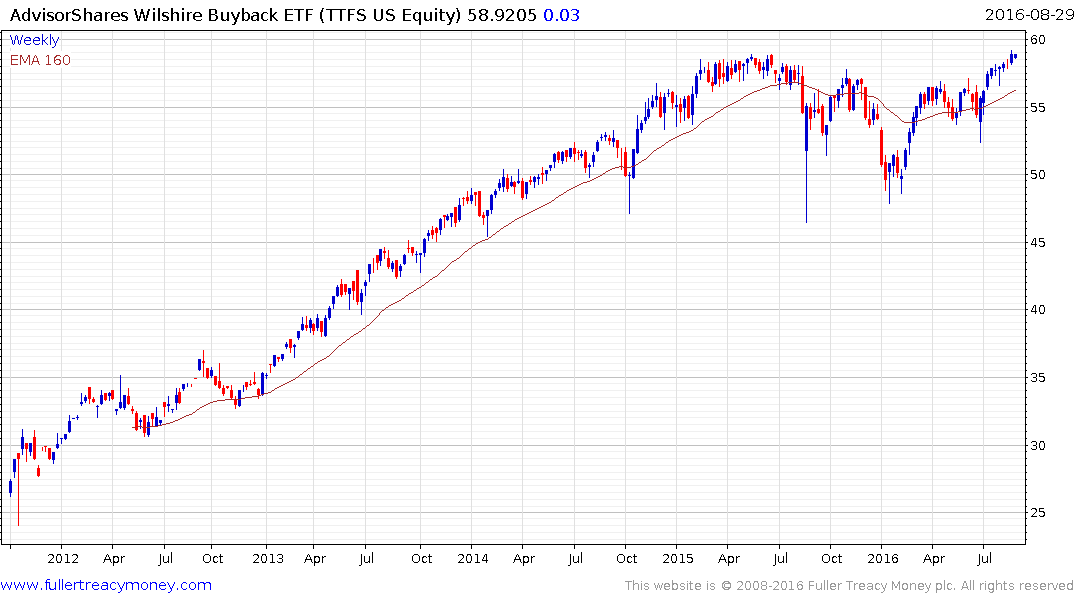

I’ve also added the TrimTabs Float Shrink ETF to the Library. It concentrates on shares where the free float is shrinking which is similar to a buyback focus but also takes cash flow into account. The fund hit a new closing high last week.