Ma Says Alibaba Shareholders Should Feel Love After Coming Third

This article by William Mellor, Lulu Yilun Chen and Zijing Wu for Bloomberg may be of interest to subscribers. Here is a section:

And Alibaba is making money: Net profit tripled to $3.7 billion in the year ended on March 31. While net income fell 39 percent in the three months ended Sept. 30, in part as a result of the cost of integrating new businesses, revenue jumped 54 percent during the quarter -- beating analysts’ estimates.

“The growth potential of Internet companies in China is many multiples greater than in the U.S.,” says Shane Oliver, who helps manage $131 billion at AMP Capital Investors in Sydney. “Businesses which can take advantage of that, such as Alibaba, seem incredibly attractive.” In line with AMP policy, Oliver declined to say whether his firm bought the stock.

Ma isn’t the only billionaire tapping China’s Web-savvy consumers. Robin Li, 45, was China’s second-richest man as of Nov. 9, with a fortune of $17.2 billion, after founding search engine Baidu Inc. Ma Huateng, 43, who was worth $15.6 billion on that date, has expanded Tencent Holdings Ltd. into China’s top instant-messaging service.

The opening up of the Shanghai – Hong Kong Exchange link is a major event. It is tempting to think of it from the perspective of a Westerner gaining access to a new market but it is even more important for mainland Chinese who will for the first time have access to Hong Kong listed securities and by extension the wider global market.

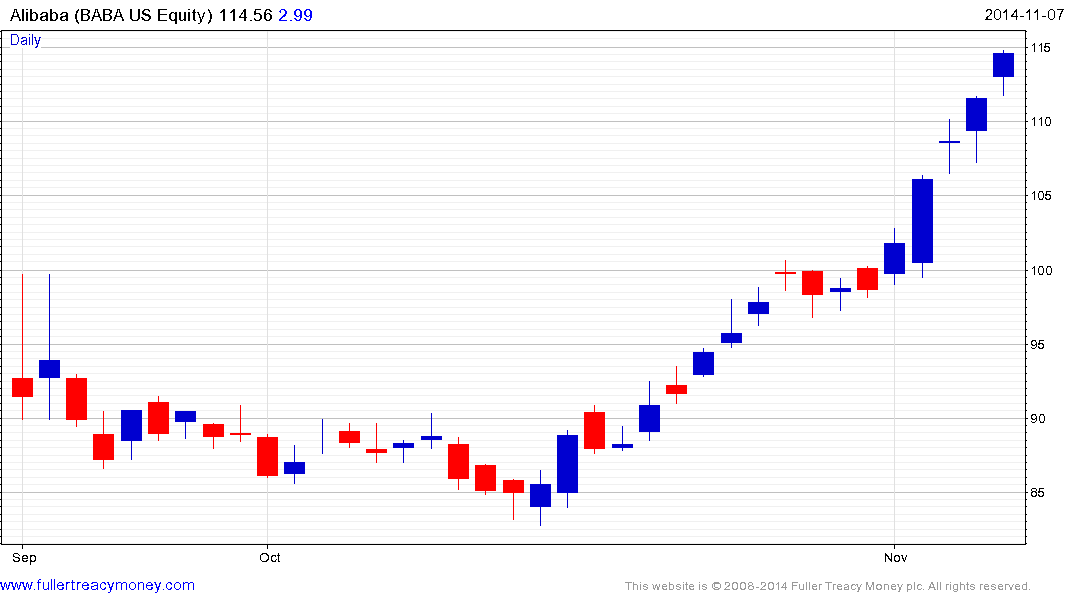

Alibaba has advanced on most days since its October 15th low near $83. It’s almost 20% advance in the last week has created a short-term overbought condition so the risk of at least a consolidation has increased. However a sustained move below $100 will be required to break the progression of higher reaction lows.

Baidu found support in the region of the 200-day MA from mid-October and a sustained move below $200 would be required to question medium-term scope for additional upside.

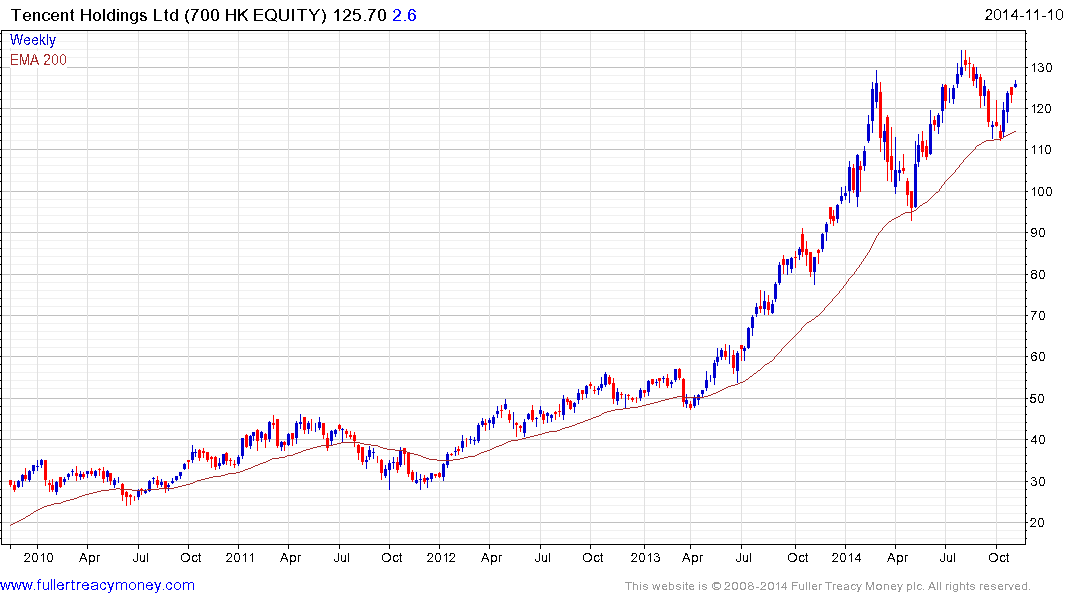

Tencent Holdings has lost momentum somewhat since hitting an accelerated peak in March but continues to find support in the region of the 200-day MA on pullbacks.