LVMH's Value Nears $500 Billion, Enters World's Top 10

This article from Bloomberg may be of interest to subscribers. Here is a section:

LVMH, Europe’s largest company by market value, has now made it to the world’s top 10.

A first-quarter sales beat sparked a 5% increase in the share price Thursday, giving the luxury powerhouse a 29% rally for the year. That, along with a gain in the euro against the dollar, lifted LVMH’s market capitalization to $486 billion, briefly ranking it as the world’s 10th-biggest company. Should it reach $500 billion, it would become the first European company to achieve that milestone.

Luxury goods represent an interesting paradox which must be among the marketing profession’s greatest triumphs. They have created an aura of desirability, mystique and aspiration for items that are not in limited supply. Of course, companies like Hermes ensure their most desirable bags are very hard to purchase, but the entire sector rides on the coattails of that limited supply argument.

Luxury goods are intrinsically linked to the rise of the middle class. First generation upper middle-class people often seek to display their wealth in an effort to convince themselves they have arrived. The evolution of the well-heeled population in China, the fountain of cash given to US consumers during the pandemic and the potential rise of India and Africa represent the sectors big sales and future respectively.

The ability of an ever increasingly number of people to pay for luxury goods is also heavily dependent on liquidity. For now, the return of Chinese consumers after 3 years of lockdowns is a welcome development for the sector which has sheltered it from tightening liquidity elsewhere.

For now, at least, the most elite of the luxury goods companies are the best performers. LVMH, Hermes and Ferrari are all breaking out to new highs.

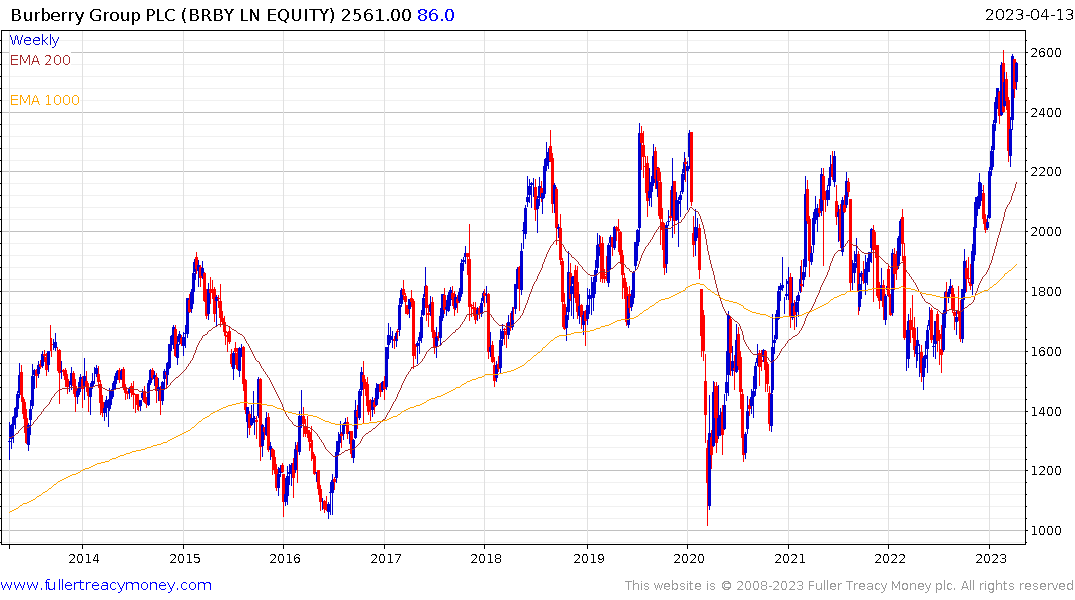

Burberry is also now breaking out to new all-time highs.

Burberry is also now breaking out to new all-time highs.

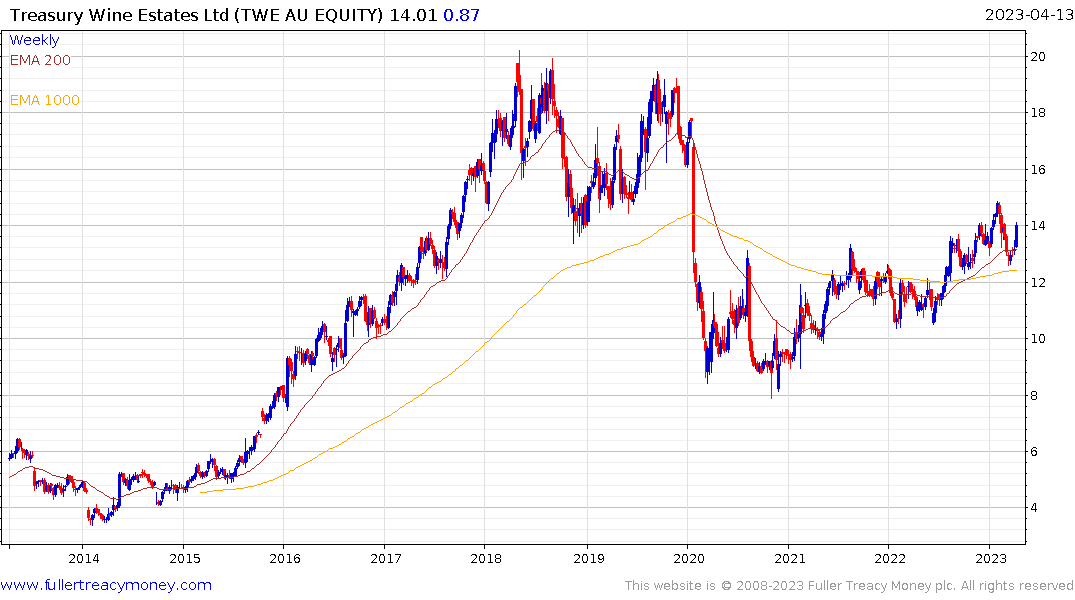

Treasury Wine Estates is firming from the upper side of a two-year base formation.