Lula-Central Bank Fight Intensifies as Traders Eye Rate Hike

This article from Bloomberg may be of interest to subscribers. Here is a section:

Lula tried to walk back prior comments on Monday, saying his criticism was not about whether or not the central bank was independent, but rather over the fact that the institution continues to keep borrowing costs high.

In Brazil, “the problem is that there is a culture of living with high interest rates and that doesn’t mix well with necessities and investment.” Lula said.

The president had publicly questioned the central bank in both January and earlier this month. Current Selic levels make it “impossible” to boost growth, Lula said previously, adding that he considered the bank’s autonomy law to be “nonsense” and suggesting a higher, 4.5% inflation goal.

Lula’s default mode is to spend. His first tenure as President of Brazil afforded him the luxury of spending during an historic commodity boom. This time around he has inflation to contend with and a central bank that appears ready to push back against profligate spending plans. The challenge is clear. If spending goes ahead without inflation coming down, the central bank will raise rates to levels that clearly depress economic activity.

The currency markets are now pricing in that eventuality with the Dollar rebounding from the region of the 1000-day MA.

The currency markets are now pricing in that eventuality with the Dollar rebounding from the region of the 1000-day MA.

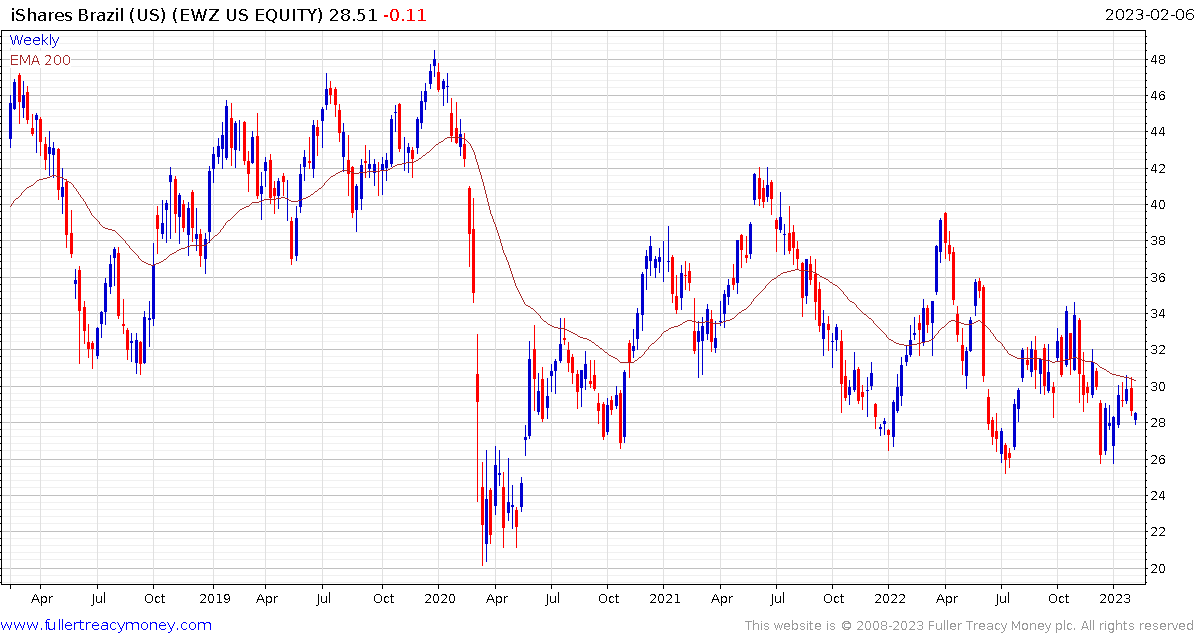

The iShares Brazil ETF is rolling over following it recent rebound. If the Brazil’s central bank is intent on continuing to raise rate recovery in the stock market will have to wait.

The iShares Brazil ETF is rolling over following it recent rebound. If the Brazil’s central bank is intent on continuing to raise rate recovery in the stock market will have to wait.