Lucid Stock Is Falling as Reservations for Cars Drop

This article from Barron’s may be of interest to subscribers. Here it is in full:

The EV maker Lucid turned in respectable third-quarter earnings and stuck with its forecast for vehicle shipments this year, but the stock is dropping. Reservations are the issue.

Tuesday evening, Lucid (ticker: LCID) reported a per-share loss of 40 cents from $195 million in sales. Wall Street was looking for a 31-cent loss from $209 million in sales., but earnings and sales don't matter much at this point.

The company is just ramping up production of its first model, the Lucid Air. Importantly, the company didn't change its full-year guidance for vehicle shipments from the 6,000 to 7,000 cars it told investors to expect back in August. The prior guidance, given in May, was for 12,000 to 14,000 units.

What seems to be raising investors' eyebrows is that management says Lucid has 34,000 reservations for its vehicles. The number given in August was 37,000.

Shares were down 3% in after-hours trading.

Lucid delivered 1,398 vehicles in the third quarter, up from 679 in the second quarter of 2022. Lucid produced 2,282 vehicles in the third quarter, which was more than triple the second-quarter production, according to the company.

The company also ended the quarter with almost $4 billion in cash.

Management scheduled a conference call for 5:30 p.m. Eastern time to discuss the results. Investors and analysts will be interested in the reservation number and whatever management has to say about demand for Lucid vehicles.

Through Tuesday trading, Lucid stock was off more than 60% so far this year, while the S&P 500 and Dow Jones Industrial Average had dropped about 20% and 9%, respectively.

Lucid stock has been hit harder than most. The cut to the forecast for deliveries didn't help. Rising interest rates, which reduce the current, discounted value of earnings expected to arrive in coming years, are an additional problem.

Flashy ads and attentional grabbing statistics, like the longest range and best battery, encouraged consumers to pay trivial down payments to secure a spot in delivery queues. Now, the question whether one does in fact have the resources to spend six figures on a car are more pressing. For Lucid it represents a significant issue because they are quite a ways from delivering a more affordable model. The share continues to trend lower.

This issue is much more pressing for Tesla. The company has taken millions of orders for the Cybertruck. Media commentary has been all about Tesla’s ability to deliver. We really should be talking about the ability of millions of people to afford the truck and particularly in a higher rate environment. Meanwhile, Elon Musk is selling down his holding in the company and the share is extending its break below the psychological $200. The pattern continues to exhibit top formation completion characteristics.

Again, media appear to be missing the point with Elon Musk’s takeover of Twitter. This talk about charging $8 for a blue tick mark is a sideshow. The removal of the content moderation team has resulted in the volume of pornography on the platform multiplying over the last 48 hours. This possibility was discussed in passing a week ago but is now reality. It appears Musk aims to recoup the purchase price by turning Twitter into a souped up version of Onlyfans. https://www.thestreet.com/social-media/elon-musks-twitter-may-be-looking-to-compete-with-onlyfans

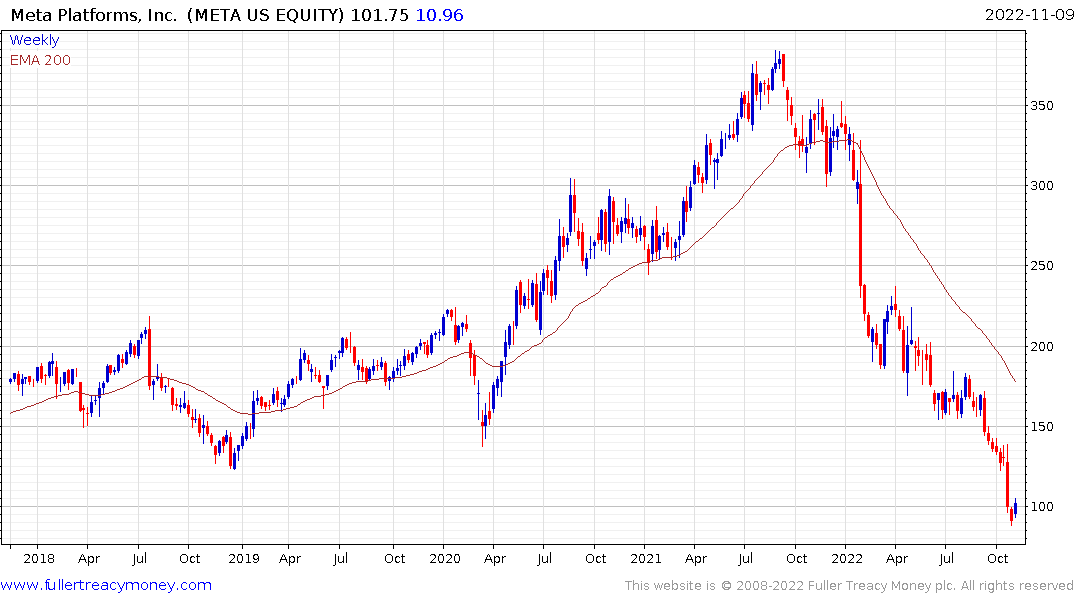

That must be music to Mark Zuckerberg’s ears. Meta Platforms is going through a painful reorganization but the company has not pulled back from content moderation. That’s a big plus for advertisers and investors generally react positively to cost saving measures.

The share is trading on single digit multiples and is rebounding from a deep oversold condition.

The share is trading on single digit multiples and is rebounding from a deep oversold condition.