Losing AAA Matters for $1.2 Trillion Australian Mortgage Holders

This article by Ruth Liew and Narayanan Somasundaram for Bloomberg may be of interest to subscribers. Here is a section:

The biggest losers after Prime Minister Malcolm Turnbull scraped through to win Australia’s fractious elections could be homebuyers facing higher costs on their A$1.6 trillion ($1.2 trillion) in mortgages.

The price to protect bonds issued by the nation’s banks climbed seven basis points last week after S&P Global Ratings cut its outlook on Australia’s AAA grade to negative on concern government deficits will persist without “more forceful” decisions to rein in shortfalls. It also put the nation’s biggest lenders on notice. Moody’s Investors Service said Monday that it could be a “credit negative” if Turnbull can’t win agreement from the split upper house for plans to improve the government’s finances.

“An increase in funding costs relating to a ratings downgrade will impact bank margins, but banks may choose to offset this via loan pricing,” said Anthony Ip, a credit sector specialist at Citigroup Inc. in Sydney, adding that any increase in funding costs will be significant but manageable. “At the end of the day it’s still a competitive lending market.”

Australia’s largest lenders -- Australia & New Zealand Banking Group Ltd., Commonwealth Bank of Australia, National Australia Bank Ltd.and Westpac Banking Corp. -- rely on offshore bond markets for a fifth of their funding requirements, central bank data show. If their rankings were lowered after a sovereign downgrade, that would increase borrowing costs as much as 20 basis points, prompting them to slap mortgagees with higher interest rates, according to Citigroup.

Losing an AAA rating has not represented a challenge for either the USA or UK so it is questionable whether Australia will experience meaningful repercussions not least when its currency continues to enjoy a positive interest rate differential with that of other OECD countries.

The S&P/ASX 200 Index has held a progression of higher reaction lows since January and found support this week from the region of the trend mean. A sustained move below the 200-day MA would be required to question medium-term scope for continued higher to lateral ranging.

The S&P/ASX 200 Financials Index has been lagging and will need to sustain a move above 6000 to confirm a return to demand dominance beyond short-term steadying.

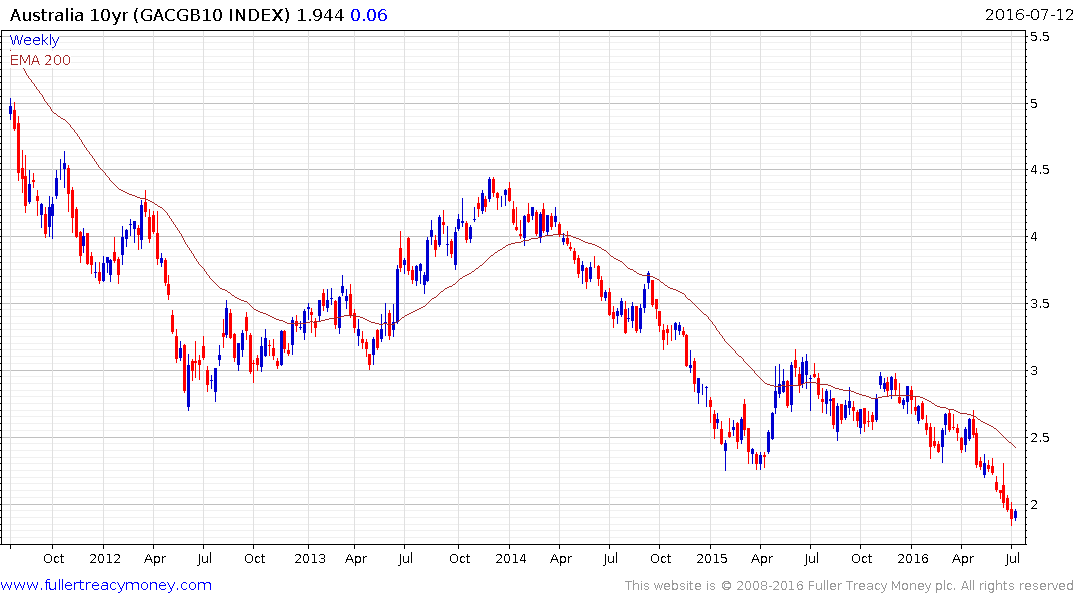

Australian 10-year yields dropped below 2% last week but are quite overextended relative to the trend mean and potential for a reversionary move has increased.

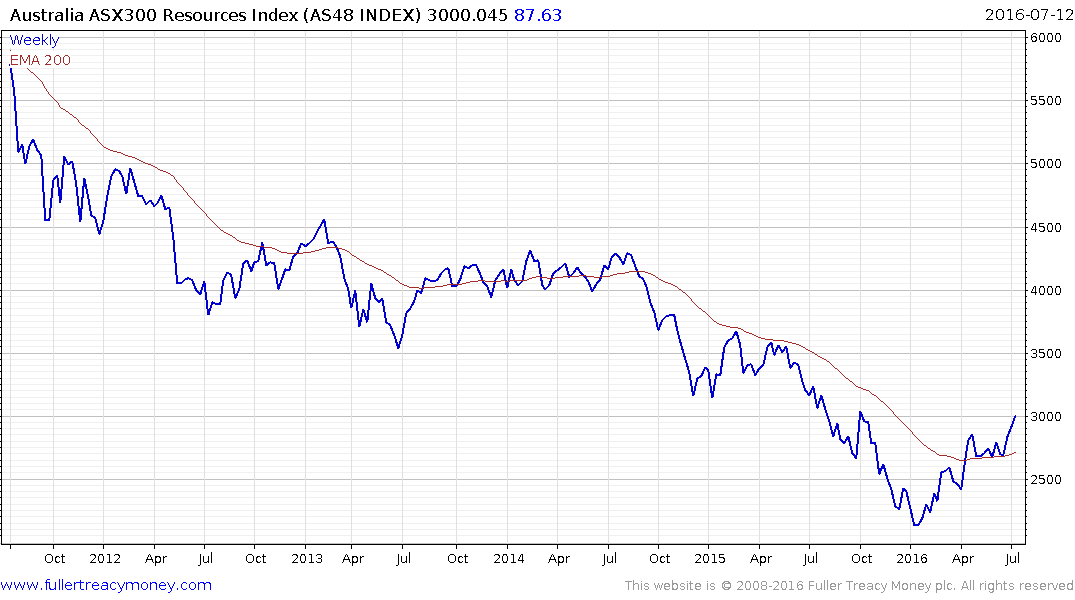

Meanwhile the S&P/ASX 300 Resources Index has broken a five-year downtrend and is now pulling away from the region of the trend mean.