Looking for Leverage to Gold; Reviewing Common Metrics Used for Equity Selection

Thanks to a subscriber for this report from B Riley FBR which may be of interest. Here is a section:

As we wrote in our March 24 industry note, we see extreme monetary and fiscal stimulus leading to dollar deflation. In this environment, similar to the set up in 2008, we expect gold price to trade materially higher and we have raised our gold price forecast to $2,500/oz. With higher prices, gold miners stand to benefit from substantial margin growth, assuming that industry-specific cost inflation remains low. In our opinion, investors should be looking to build positions in gold-related equities that give them exposure to gold. In our experience, investors will gravitate to large-cap producers and select those with the largest annual production of gold. Investors will also look to published gold reserves (and resources) in the ground, and selecting those equities with the largest accumulation. While neither of these section methods is without its flaws, we have reviewed our coverage and aggregated this data. As we indicated in our January 30 gold industry note (“Strategies for Outperforming the Gold Miner ETFs”), we continue to recommend investors build a concentrated portfolio of our favorite names that offer gold leverage, but also minimize exposure to production interruptions and provide exposure to the M&A cycle that historically accompanies a gold bull market.

Here is a link to the full report.

“This is not the time to worry about deficits” are likely to prove fateful words 18 months from now. The measures being adopted by the world’s governments, in tandem with their respective central banks, are sowing the seeds for future inflation.

That’s not a short-term risk because the velocity of money is at an unprecedented low but stimulus often proves sticky and any improvement in economic conditions is going to result in a surfeit of money sloshing around.

The USA is currently leading the world in its willingness to do whatever is required to support the economy. That is now having a deleterious effect on the Dollar which has been subject to a great deal of volatility over the last six weeks. As investors begin to assess the ramifications of the extreme counter measures being deployed to counter economic contractions, the relative stability of a hard asset is becoming more attractive.

Gold is back testing the upper side Otis six-week range and remains in a medium-term uptrend.

Silver is rapidly unwinding its short-term oversold condition.

.png)

The gold/silver ratio briefly hit a high of 120 in March and is now unwinding that historic dislocation. Silver is dirt cheap on a relative basis.

Newmont broke higher today to high a new seven-year high.

Barrick Gold completed a seven-year base formation today.

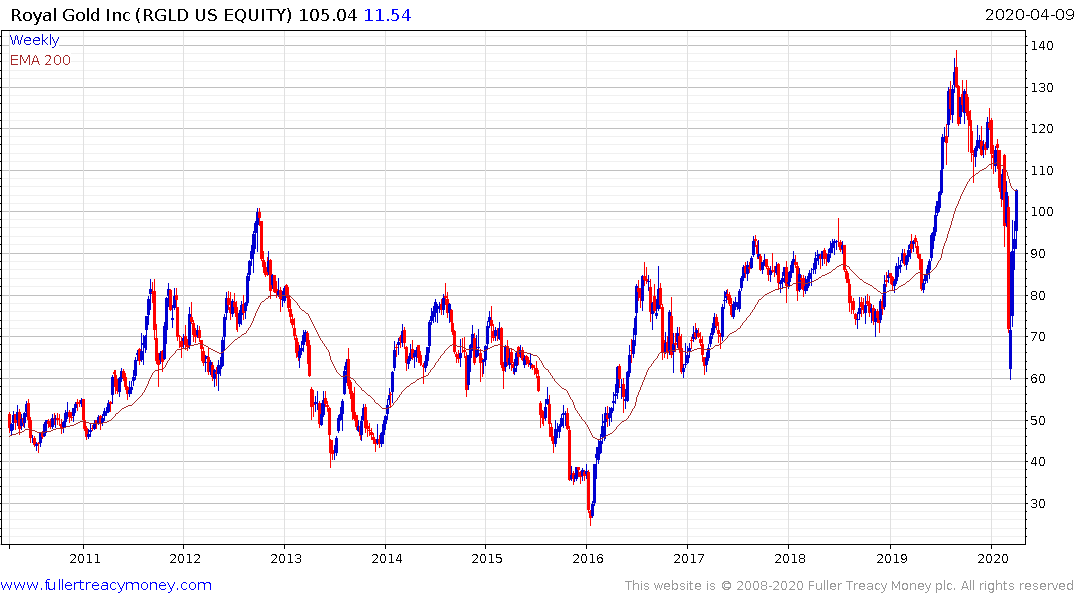

Royal Gold, a royalty streamer is unwinding a deep oversold condition but has the benefit of substantial in-ground resources.

Fresnillo has been trending lower for four years and is firming from the region of the trend mean as it pressures its sequence of lower rally highs.

.png)

Great Bear Resources, one of the highest-grade new mines in years, pulled back sharply in March but is now rebounding.

Coeur Mining is firming from the lower side of its long-term base formation.

SilverCrest Metals is unwinding an oversold condition but has previously been trending higher in a reasonably consistent manner.

Polymetal International spent the last few months ranging in the region of its all-time peak and broke on this upside this week.