Logic, Magic, And the Outlook For Retail Stocks

This article from Barron’s may be of interest to subscribers. Here is a section:

Investors are worried about a potential recession, but you have said that discretionary retail spending is already in a recession. How do you expect it to unfold?

It seems that in the past few months, we've seen a consumer-discretionary recession. The consumer still has money, but you don't need a new big-screen TV if you bought one during the Covid pandemic, or new outerwear if you bought a new coat last year as people started going out again.

We are seeing consumers return to prepandemic behaviors -- things we were talking about 10 years ago, such as shopping close to need, shopping during events, looking for promotions. The problem, which has been consistent but sequentially improving, is that inventories can't adjust that fast. Also, when stimulus dollars were flowing, consumers weren't that price-sensitive because they had money in their pockets. Now the sensitivity has increased.

Is inflation now semipermanent?

I think so. Prices will stick, and there might be disinflation, but there won't be deflation. We are at a new level because of labor; we will see some relief in freight and the average unit cost of some ingredients, but labor costs will be sticky. Apparel has been problematic, because the price of shirts basically has stayed the same for a decade. A little bit of inflation is healthy, but this level has been wreaking havoc in demand trends. Your food cost at Walmart was up by a midteens percentage [in recent months]. That's a good indicator of how the whole country is faring.

Penny pinching has arrived in the consumer sector and that is about the clearest sign of reduced spending power we can observe. Unemployment has not yet started to tick higher, so for now consumers do not have to make big spending adjustments. However, tightening monetary conditions continue to tighten the noose so caution is warranted.

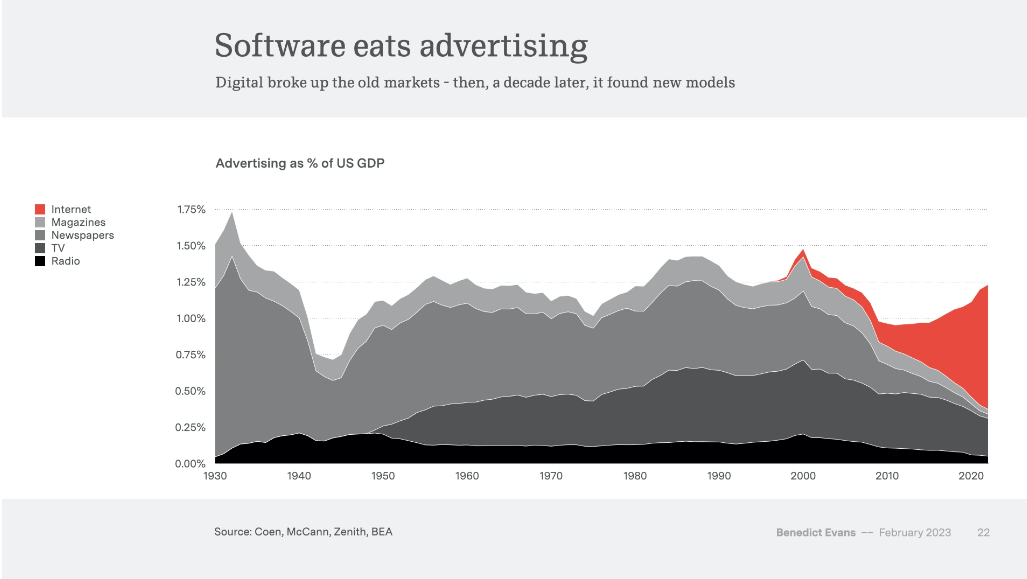

The response of retailers is to find additional income streams. Wal-Mart is boosting its income from advertising both on its ecommerce site and in-store. This graphic from Benedict Evans highlights how online advertising has grown to approximate the size of the pre-internet media market. That begs the question how much further advertising revenue can grow on aggregate?

Today, every major internet venue has an advertising revenue generating engine. How long before Tesla begins selling advertising on those big in-car screens for example? The harsh reality is advertising spending is dependent on sufficient margins to support it. If companies are unable to pass along higher prices they cannot spend on advertising and decline. If they capture market share, competition is reduced and prices rise.

The necessity of competing for attention online creates an advertising rat race, but it has to be sustained with healthy margins. Without that it cannot continue to grow. Alibaba announced today that it is splitting up into six different companies. The race to capture food delivery market share has been inordinately expense for both Alibaba and Tencent. With a separate listing ele.me will have to find the ready cash to fund its loss making business independently. That’s an example of tighter liquidity conditions forcing companies to rethink their spending plans.

The share rebounded today on the argument the sum of the parts is worth more than the parent.

The share rebounded today on the argument the sum of the parts is worth more than the parent.

Wal-Mart is firming within its three-year range.

Wal-Mart is firming within its three-year range.

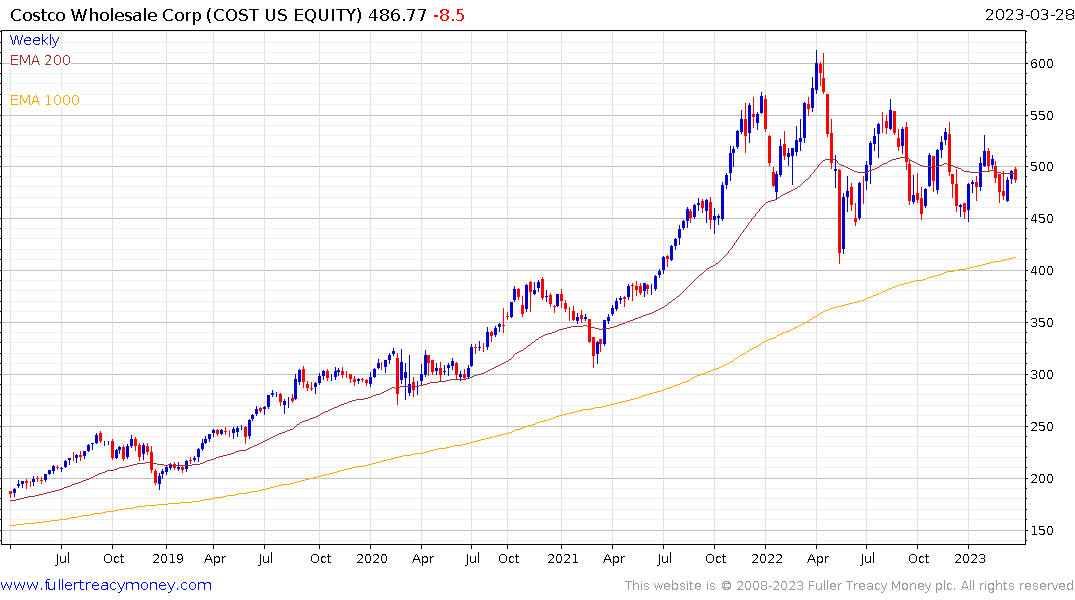

Costco, which conspicuously does not have an advertising model, continues to exhibit type-2 top formation characteristics with right hand extension.

Costco, which conspicuously does not have an advertising model, continues to exhibit type-2 top formation characteristics with right hand extension.

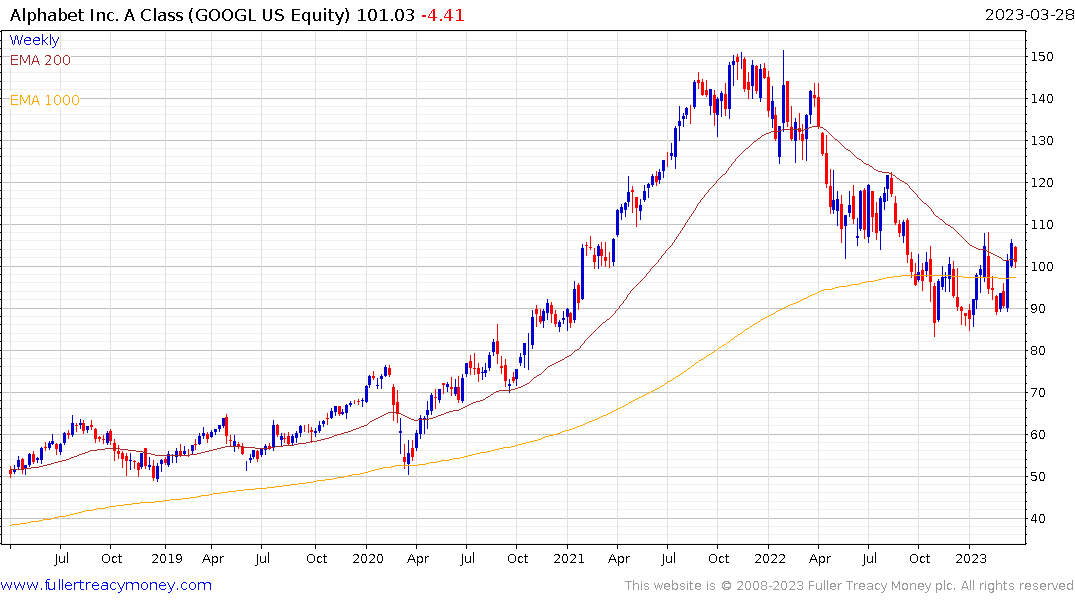

Alphabet encountered resistance this week in the region of the peaks over the last five months.

Alphabet encountered resistance this week in the region of the peaks over the last five months.

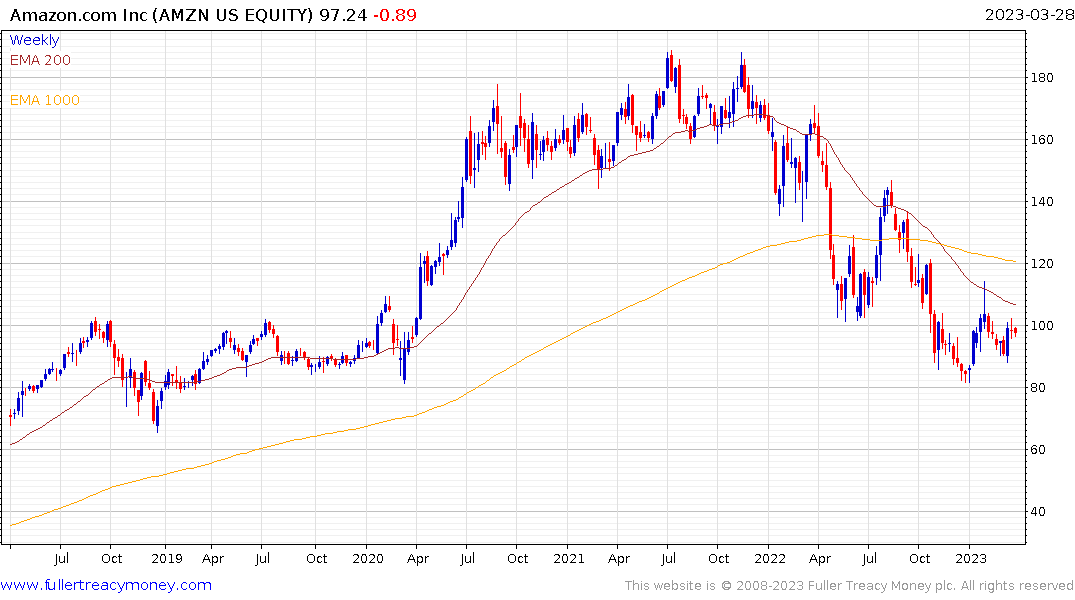

Amazon is still trending lower.

Amazon is still trending lower.